GROWTHACES.COM Trading Positions

EUR/USD: short at 1.2480, target 1.2330, stop-loss 1.2550

USD/JPY: long at 117.50, target 119.80, stop-loss 116.60

USD/CHF: long at 0.9600, target 0.9760, stop-loss 0.9580

EUR/CHF: long at 1.2025, target 1.2095, stop-loss 1.1995

EUR/GBP: short at 0.7990, target 0.7840, stop-loss 0.7980

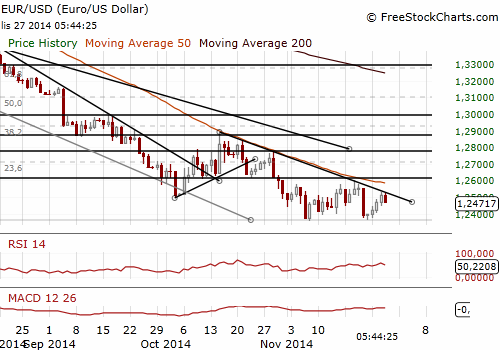

EUR/USD: No Details On Quantitative Easing From Draghi

(we stay short, the target is 1.2330)

Wednesday brought us some weaker-than-expected U.S. macroeconomic releases.

Initial claims for state unemployment benefits increased 21k to a seasonally adjusted 313k for the week ended November 22, the Labor Department said on Wednesday.

Sales of new U.S. single-family homes gained 0.7% to a seasonally adjusted annual rate of 458k units. The median forecast amounted to 472k. September's sales pace was revised down to 455k units from 467k units. The National Association of Realtors said its Pending Home Sales Index, based on contracts signed last month, fell 1.1% mom vs. the median forecast of a rise of 0.5% mom.

University of Michigan's final November reading on the overall index on consumer sentiment came in at 88.8, its highest reading since July 2007 on a final basis. The reading was up from the 86.9 the month before but slightly below the preliminary reading of 89.4. The survey's barometer of current economic conditions rose to 102.7 from 98.3. The survey's gauge of consumer expectations edged up to 79.9 from the 79.6 in October.

Chicago PMI index fell 5.4 pts to 60.8 in November. A major negative contribution came from new orders and employment components. The Chicago region still appears to have been outperforming many others recently.

Durable goods orders increased 0.4% mom in October after a fall of 1.3% mom I September. However, non-defense capital goods orders excluding aircraft, a closely watched proxy for business spending plans, declined 1.3% mom last month vs. an expected rise by 1.0% mom.

U.S. markets are closed today for the Thanksgiving holiday.

Investors were waiting for today’s speech of the ECB President Mario Draghi, a day after Vice President Vitor Constancio said the ECB could make a decision on government bond-buying in the first quarter if the economy did not improve. Mario Draghi disappointed the EUR/USD bears and did not add any further details on the status of the ECB's discussions on quantitative easing.

The EUR/USD rose on Wednesday after poor macroeconomic releases reaching a day’s high at 1.2532. The recovery in the EUR/USD was short-lived, expectations for further steps of monetary easing in the Euro zone still play key role for traders’ decisions.

At GrowthAces.com we stay EUR/USD short with the target at 1.2330.

Significant technical analysis' levels:

Resistance: 1.2532 (highNov 26), 1.2550 (30-dma), 1.2569 (high Nov 21)

Support: 1.2443 (low Nov 26), 1.2402 (low Nov 25), 1.2358 (low Nov 7)

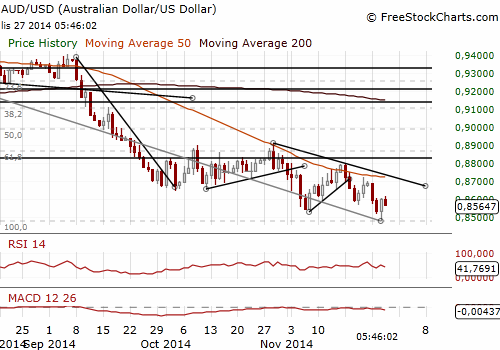

AUD/USD Recovered After Strong Capital Spending Data

(we stay sideways)

The Australian Bureau of Statistics reported capital spending edged up by 0.2% in the third quarter. The reading was much better than the median forecast of a fall by 1.5%. Spending on equipment jumped 4.4% for the biggest rise in three years.

The data herald a good GDP reading that is due next week and expected to show growth of 3.1% (a very good result among developed economies).

The AUD bounced off four-year lows against the USD Thursday after an upbeat report on business spending. The AUD/USD touched a four-year trough of 0.8480 on Wednesday. In our opinion the short-term outlook for the AUD/USD is mixed. In the opinion of GrowthAces.com no positions on the AUD/USD are justified from the risk/reward perspective at the moment.

Significant technical analysis' levels:

Resistance: 0.8619 (high Nov 25), 0.8635 (10-dma), 0.8663 (21-dma)

Support: 0.8480 (low Nov 26), 0.8450 (low Jul 7, 2010), 0.8315 (low Jul 1, 2010)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

US economy grows at an annual rate of 1.6% in Q1 – LIVE

The US' real GDP expanded at an annual rate of 1.6% in the first quarter, the US Bureau of Economic Analysis' first estimate showed on Thursday. This reading came in worse than the market expectation for a growth of 2.5%.

EUR/USD retreats to 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated to the 1.0700 area. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 with first reaction to US data

GBP/USD declined below 1.2500 and erased a portion of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold falls below $2,330 as US yields push higher

Gold came under modest bearish pressure and declined below $2,330. The benchmark 10-year US Treasury bond yield is up more than 1% on the day after US GDP report, making it difficult for XAU/USD to extend its daily recovery.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.