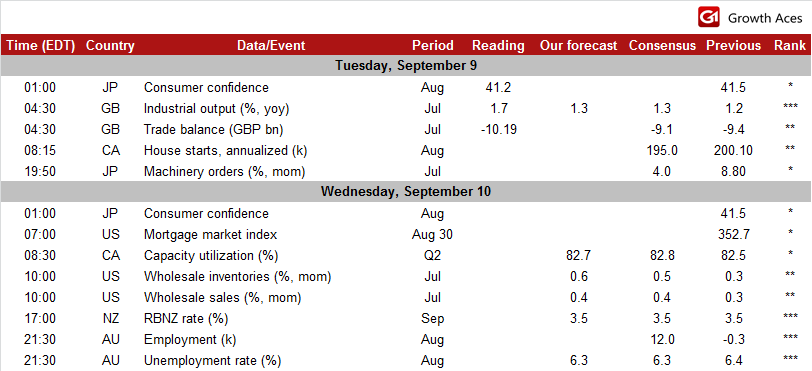

ECONOMIC CALENDAR

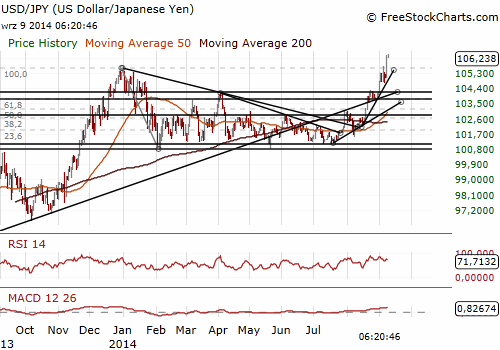

USD/JPY hit new 6-year high

(long at 104.90, target 107.50, stop-loss moved to 105.30 from 104.30 previously)

The central bank of Japan released minutes of August meeting. Some policymakers said that Japan's exports could be slow to respond to developments in overseas economies due to structural changes, such as a shift in production overseas. Members also agreed that inflation is likely to accelerate in the second half of this fiscal year as the output gap improves.

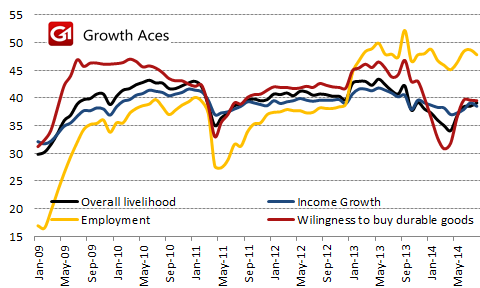

Japanese consumer confidence worsened for the first time in four months in August and amounted to 41.2, down from 41.5 in July. The index is a simple average of four components each gauging sentiment for prospects over the next six months: households’ willingness to buy, income growth, overall livelihood and employment. The ”overall livelihood” index grew to the highest level since late last year. Declines of the ”employment” and ”income growth” indexes indicate that the labour market is no longer improving. The “willingness to buy durable goods” component recovered slightly after sales tax hike in April but is still at lower levels than before the hike.

The USD/JPY grew to 6-year high at 106.39 on Tuesday. Further gains towards 108.04 (September 19, 2008 peak) are possible. Solid bids were noted on the dip back to 106.00. At GrowthAces.com we remain long but have raised out stop-loss to 105.30.

Japanese policymakers warned that rapid fluctuations in the JPY were undesirable for the economy. Economics Minister Akira Amari said “It's not good for Japan and the global economies for currencies to have big fluctuations, regardless of whether they move up or down.” Finance Minister Taro Aso said: “I've been saying that rapid currency fluctuations are undesirable. Gradual moves are desirable.”

The weak JPY increases competitiveness of Japanese exporters as their products became cheaper and more attractive in overseas markets. On the other hand, weaker JPY will increase import costs.

Significant technical analysis' levels:

Resistance: 107.03 (high Sep 25, 2008), 107.25 (high Sep 22, 2008), 108.04 (high Sep 19, 2008)

Support: 105.95 (session low Sep 9), 105.37 (hourly low Sep 8), 104.87 (low Sep 8)

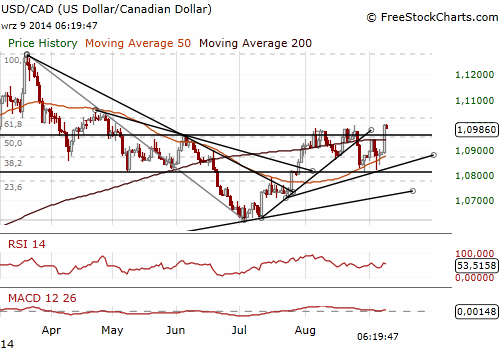

USD/CAD: Profit taken, looking to get long again on dip

(profit taken at 1.1000, looking to get long at 1.0930)

The CAD weakened against the USD yesterday on weaker oil prices. The CAD also suffered from disappointing labor market data last Friday that showed the Canadian economy unexpectedly shed jobs in August.

Canadian building permits unexpectedly jumped by 11.8% mom in July (seasonally adjusted). The reading was much higher than the median forecast of a drop of 6.8% mom. The value of permits for multifamily dwellings went up by 43.4% on the back of higher construction intentions for apartment and condominium projects. The Canadian finance ministry said it was closely watching the booming condo market but has so far played down talk of a potential bubble. The data did, however, little to stem the weakness of the CAD.

We have taken profit on our long trading position (taken at 1.0850) on the USD/CAD. The USD/CAD reached its target at 1.1000. In the opinion of GrowthAces.com the level of 1.1000 is a big hurdle for the USD/CAD. We maintain our bullish bias and are looking to get long again on dip at 1.0930.

Significant technical analysis' levels:

Resistance: 1.1007 (high May 2), 1.1027 (61.8% of 1.279-1.0620), 1.1053 (high Apr 23)

Support: 1.0920 (30-dma), 1.0900 (10-dma), 1.0881 (low Sep 8)

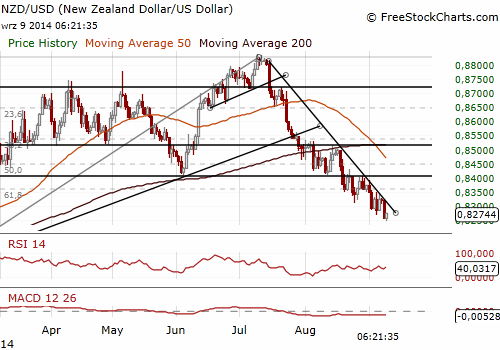

NZD/USD: RBNZ meeting ahead

(no trading position currently)

The Reserve Bank of New Zealand will meet tomorrow (EDT) to decide on its further monetary policy. The central bank is expected to hold its benchmark rate steady at its policy review and possibly signal a pause in its tightening cycle until early next year as cooling economic growth tempers inflation pressures. The bank raised its rates by 100 bps since March.

Consumer inflation increased 1.6% in the second quarter but growth of consumer prices is likely to slow in the second half of the year. Prices for dairy products (a major export sector) have fallen much more than expected. As a result, the RBNZ is likely to downgrade its forecasts for inflation and GDP. Another reason for keeping monetary policy unchanged is a slowing activity in the house market.

The central bank is also likely to continue its verbal intervention weakening the NZD. The RBNZ will keep the rhetoric saying that its strength is unjustified even as the currency has depreciated strongly since July.

We have currently no trading position on the NZD/USD. We have changed our bias on this pair towards bearish and see a room for further depreciation of the NZD if the RBNZ prolongs its current period of recent hikes’ assessment.

Significant technical analysis' levels:

Resistance: 0.8329(high Sep 8), 0.8348 (high Sep 5), 0.8391 (high Sep 2)

Support: 0.8262 (low Sep 8), 0.8259 (low Feb 24), 0.8212 (low Feb 7)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.