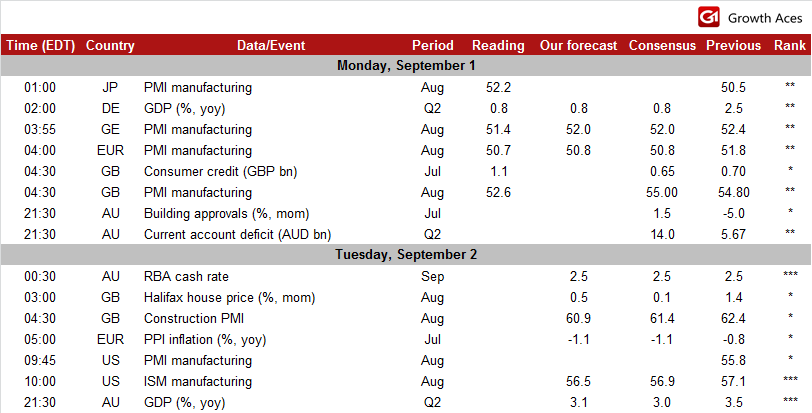

ECONOMIC CALENDAR

EUR/USD hurt ahead the ECB by Ukraine turmoil.

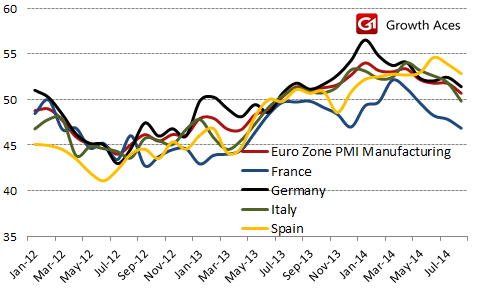

The final seasonally adjusted manufacturing PMI posted 50.7 in August, down from 51.8 in July, its lowest reading since July last year. The reading was also below its earlier flash estimate of 50.8.

PMI data signalled a broad easing in the manufacturing recoveries in the euro zone. Ireland was a noticeable exception, with its PMI at the highest level since the end of 1999. Greek PMI also went surprisingly up above the 50.0 mark in August. France remained the laggard, with its PMI signalling the sharpest rate of decline since May 2013.

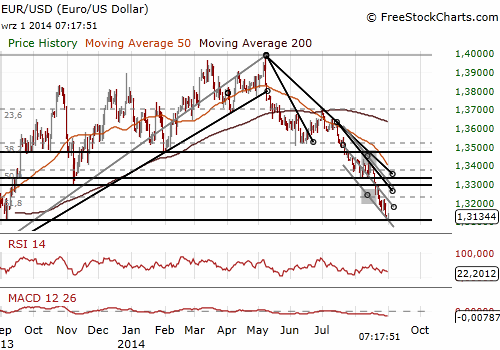

The EUR/USD hit a year-low 1.3119 on Monday mainly because of worries about the crisis in Ukraine. The European Union threatened Russia with new trade sanctions if Moscow fails to start reversing its action in Ukraine. German Chancellor Angela Merkel noted measures would be ready within a week.

In the opinion of GrowthAces.com the outlook for the EUR/USD remains bearish. The EUR is being used as a funding currency for carry trades, as Euro zone short-term yields continue to fall. There is still strong uncertainty because of the crisis in Ukraine. Investors are focused on the ECB’s meeting this week. We do not expect extraordinary dovish statement from the ECB. The disappointment after the decision of the central bank could push the EUR/USD higher that could be used to go short.

Significant technical analysis' levels:

Resistance: 1.3196 (high Aug 29), 1.3222 (high Aug 28), 1.3297 (high Aug 22)

Support: 1.3105 (low Sep 6), 1.3089 (low Jul 19), 1.3051 (low Jul 16)

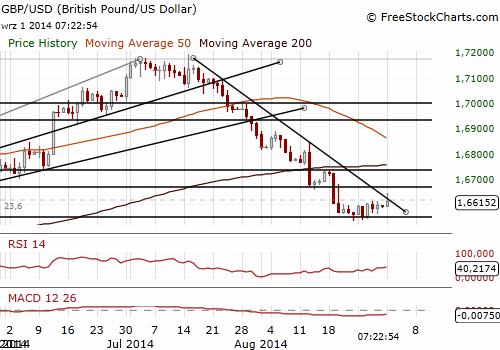

GBP/USD retreats after weaker UK manufacturing PMI.

The upturn in the UK manufacturing slowed further in August. The seasonally adjusted manufacturing PMI posted 52.5, down from 54.8 in July, to record its lowest reading since June last year.

The fall in the headline index was driven by the new orders component, which dropped to its lowest since April 2013 down from 56.8 in July in its biggest one-month drop in two years. The rate of growth in payroll numbers slowed, hitting a 14-month low.

The survey showed there was no inflation pressure in the manufacturing sector. Purchase price inflation ticked higher in August, reaching a seven-month peak, but remained low by the historical standards of the survey.

The PMI data hurt the GBP. The GBP/USD reached the level of 1.6645 before the release but then the rate fell below 1.6620. The beginning of the week was, however, encouraging for long position of GrowthAces.com. We maintain our target at the level of 1.6690 (slightly below 200-dma).

Significant technical analysis' levels:

Resistance: 1.6680 (high Aug 20), 1.6695 (200-dma), 1.6728 (high Aug 19)

Support: 1.6587 (hourly low Sep 1), 1.6564 (low Aug 29), 1.6537 (low Aug 27)

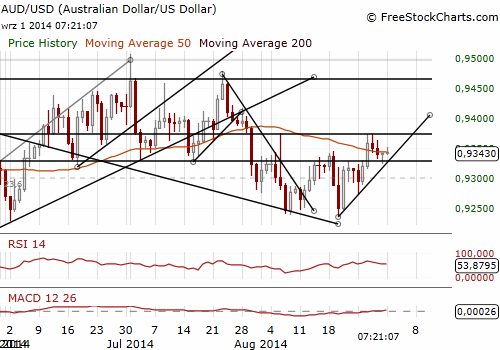

AUD/USD: All eyes on the RBA and GDP this week.

The AUD/USD has not reacted to slightly lower-than-expected Chinese PMI data (51.1 in August vs. median forecast of 51.2 and 51.7 in July).

Monday brought mixed data from Australian economy. The value of stocks held by Australian private businesses in the second quarter increased by 0.8% qoq (in seasonally adjusted chain volume terms) vs. market consensus of 0.2% qoq. The reading is a good sign before Wednesday’s (GMT) Q2 GDP release. Higher data on inventories reduce the risk of a weak GDP figure. On the other hand, Australian company gross operating profits for the second quarter fell by 6.9% qoq vs. expectations of fall by 1.8%.

The RBA is expected to keep its cash rate unchanged at 2.50% on Tuesday. The tone of its statement will play key role. However, in the opinion of GrowthAces.com much more important event for the AUD/USD remains Wednesday’s (GMT) Q2 GDP release.

Today’s rally was encouraging for our long position on the AUD/USD. The nearest strong resistance level is 0.9359 (50-dma).

Significant technical analysis' levels:

Resistance: 0.9359 (50-dma), 0.9374 (high Aug 28), 0.9389 (high Jul 30)

Support: 0.9333 (low Aug 28), 0.9300 (low Aug 27), 0.9272 (low Aug 26)

Our research is based on information obtained from or are based upon public information sources. We consider them to be reliable but we assume no liability of their completeness and accuracy. All analyses and opinions found in our reports are the independent judgment of their authors at the time of writing. The opinions are for information purposes only and are neither an offer nor a recommendation to purchase or sell securities. By reading our research you fully agree we are not liable for any decisions you make regarding any information provided in our reports. Investing, trading and speculation in any financial markets may involve high risk of loss. We strongly advise you to contact a certified investment advisor and we encourage you to do your own research before making any investment decision.

Recommended Content

Editors’ Picks

EUR/USD fluctuates near 1.0700 after US data

EUR/USD stays in a consolidation phase at around 1.0700 in the American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.