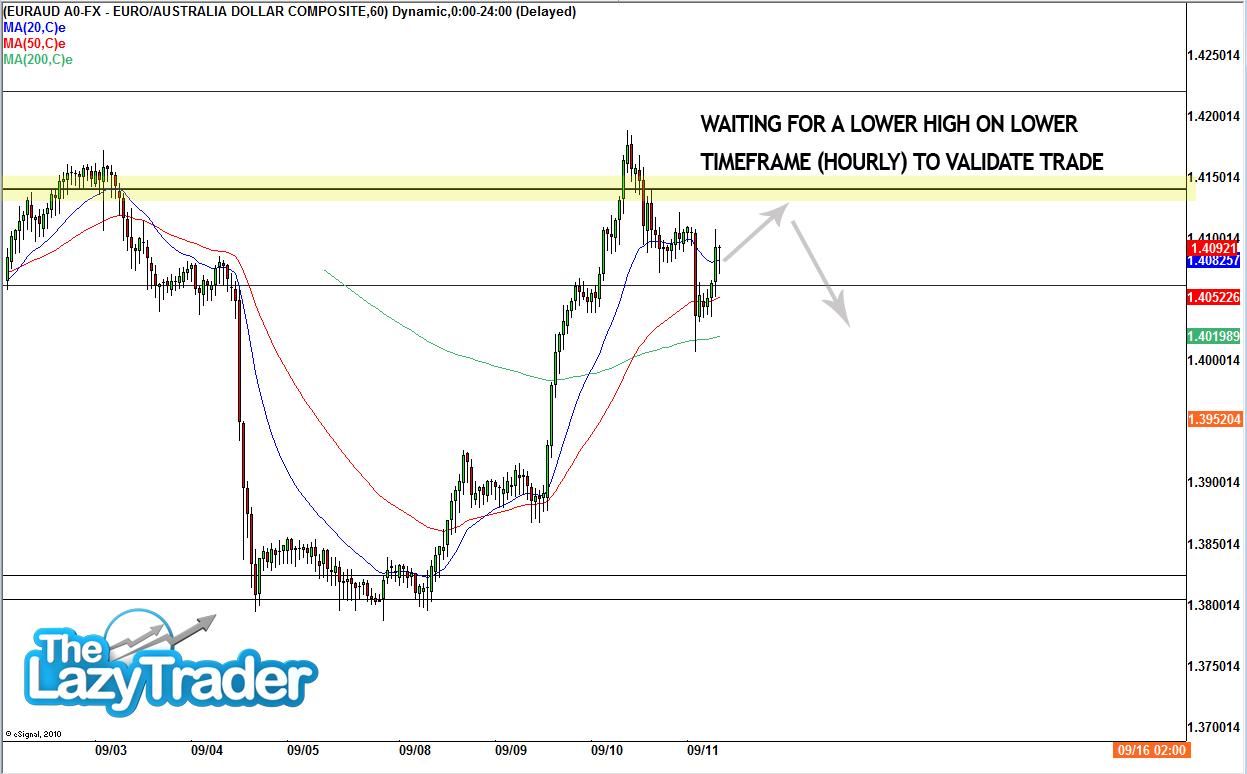

This behaviour is congruent with how downward trends typically ebb and flow, and it could give us a decent entry point for a sell (especially as we were able to bank profit and are now out of the EURNZD trade). Not only is this potential sell set-up congruent with the EURAUD’s downward trend, the level at 1.4138 also overlaps with the 50 Fibonacci Retracement level.

From a fundamental perspective, the disparity between Australia’s interest rates, held at 2.5%, compared to the 0.5% maintained by the ECB is cause for the inevitable weakening of the Euro and a strengthening Aussie Dollar, by comparison (as investors seek a better rate of return in the currency which corresponds with the most favourable interest rate).

So, how can we play this?

We are going to be slightly cautious when trading this. Not only do we not have bearish reversal divergence on the daily (RSI or Stochastic) to validate this trade, we do not have a reversal on the hourly timeframe to give us an indication that the medium term-buyers are being replaced by sellers. Ideally, we will have a double top/head and shoulders formation on the hourly to correspond with what is a bearish pin bar reversal on the daily – but we don’t! HOWEVER, this could form throughout today.But for now, the hourly continues to trend upwards, having spiked in those who unwittingly took the trade on the daily without waiting for the confirmations (that we looks for).

As EURAUD is currently moving upwards against the dominant trend, many traders will simply set things up so that if the “lower high” on the hourly is confirmed today, then they can catch the move on its way down...but without having to be in front of the screen to manually do it.

Many traders will use the break of yesterday’s low (Wednesday) as their entry point (below the low minus spread) with their stoploss above yesterday’s high (plus spread) for what could be a protracted short-term sell trade with the downtrend on the daily. They will do this under the proviso that they will only be triggered into the trade if the lower high is made on the hourly timeframe.

Target: A quick fire outcome will most likely be sought by many trading this (the previous swing low) at around: 1.3846. This target corresponds with a very strong level of support so, in our opinion, to take the money and exit (supposing we do get triggered and it goes in favour), for a high(er) probability, low(er) reward outcome.

Verdict: One for the brave.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.