Analysis for September 2nd, 2015

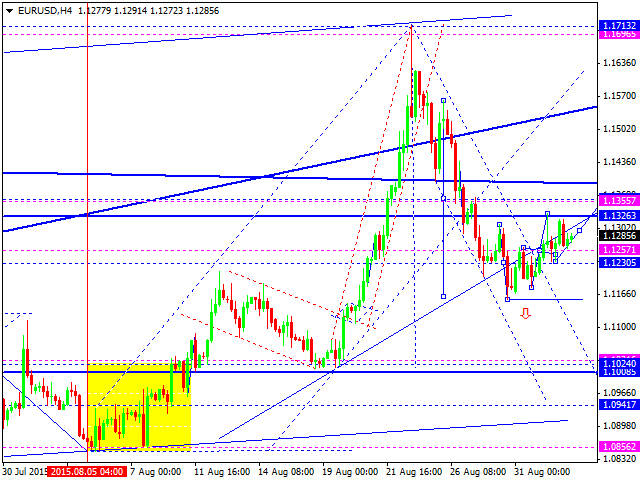

EUR USD, “Euro vs US Dollar”

Eurodollar is still being corrected with the target at 1.1355. After that, the pair may continue falling inside the downtrend. The target of this descending wave is at 1.1020. Later, in our opinion, the market may return to 1.1230.

GBP USD, “Great Britain Pound vs US Dollar”

Being under pressure, Pound is falling. We think, today, the price may reach 1.5240 (at least). The possible target of the last descending structure is at 1.4960. This decline without any corrections may be considered as the trend wave with the target at 1.4400.

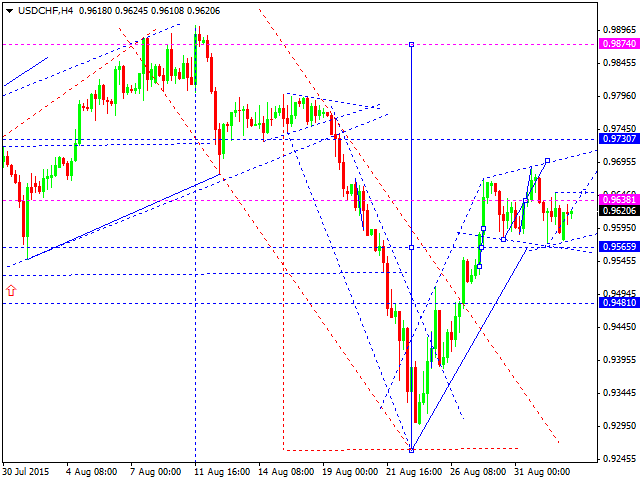

USD CHF, “US Dollar vs Swiss Franc”

Franc is still moving inside its consolidation channel without any particular direction. If the channel is broken upwards, the pair may grow to reach 0.9870; if downwards – we can expect only the correction towards 0.9481.

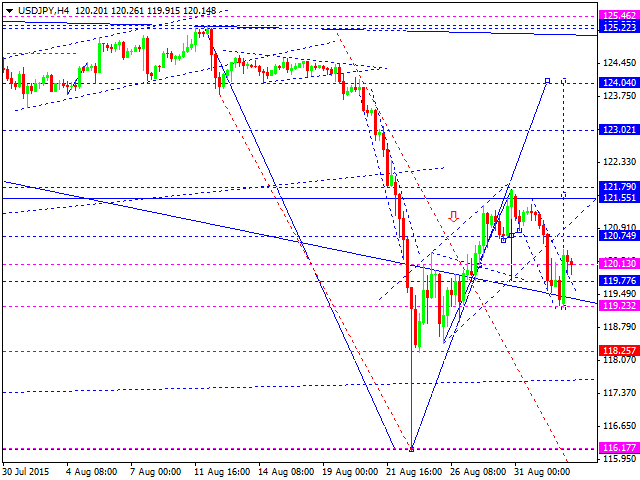

USD JPY, “US Dollar vs Japanese Yen”

Yen has reached the downside target and broken the descending channel. We think, today, the price may form another ascending structure towards the top of the wave at 121.80. After that, the pair may form a continuation pattern and reach 124.04.

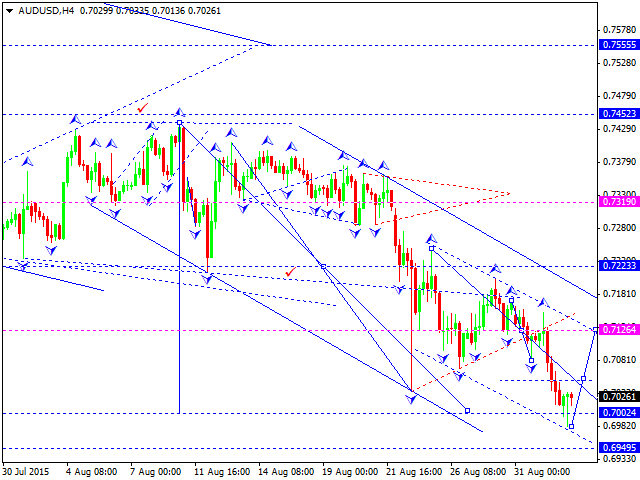

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar has reached the target of another descending structure and right now is forming an ascending impulse. We think, today, the price may return to 0.7126 and then continue falling to reach 0.7050.

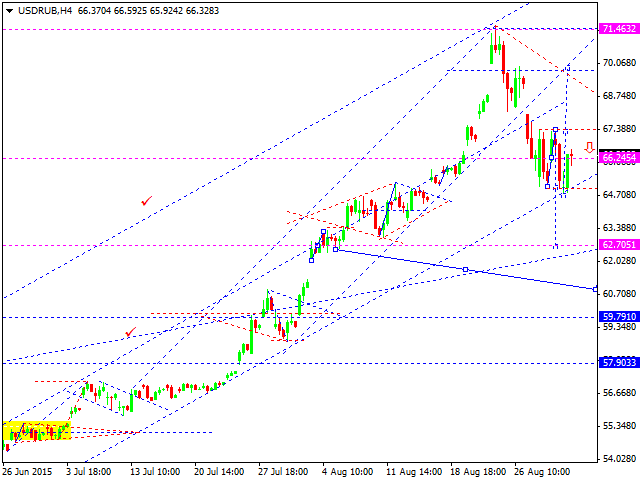

USD RUB, “US Dollar vs Russian Ruble”

Ruble is still consolidating without any particular direction. We think, today, the price may grow towards 67.30. If the pair breaks this level, it may expand the consolidation channel up to 69.00. If the channel is broken downwards, the market may start falling to reach 62.00.

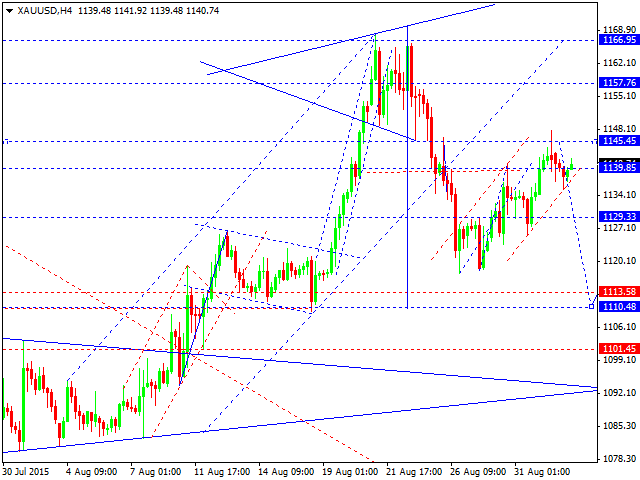

XAU USD, “Gold vs US Dollar”

Gold is moving inside an ascending channel and has already reached the target of the wave. We think, today, the price may fall towards 1131 and then return to 1139. Later, in our opinion, the market may continue falling to reach 1110, thu8s completing the correction. After that, the instrument is expected to start another ascending wave with the target at 1215.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns. Gold confirmed a symmetrical triangle breakdown on 4H but defends 50-SMA support.

Manta Network price braces for volatility as $44 million worth of MANTA is due to flood markets

Manta Network price was not spared from the broader market crash instigated by a weakness in the Bitcoin market. While analysts call a bottoming out in the BTC price, the Web3 modular ecosystem token could suffer further impact.

Investors hunkering down

Amidst a relentless cautionary deluge of commentary from global financial leaders gathered at the International Monetary Fund and World Bank Spring meetings in Washington, investors appear to be taking a hiatus after witnessing significant market movements in recent weeks.