Analysis for October 2nd, 2014

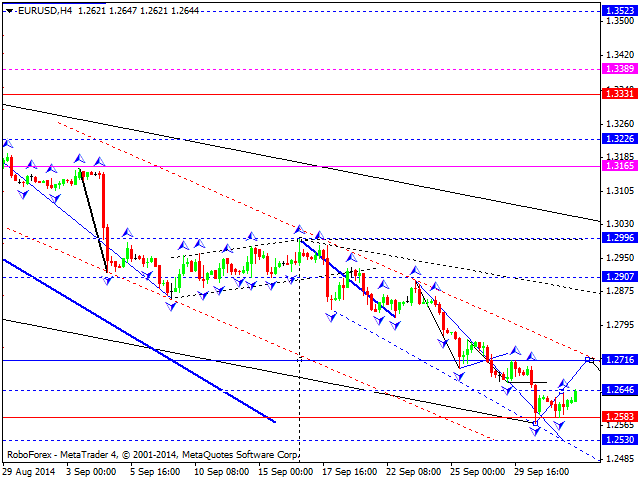

EUR USD, “Euro vs US Dollar”

Euro has started forming an ascending impulse to return to level of 1.2716. After reaching it, the pair may test level of 1.2646 from above. After such structure, we’ll estimate whether the market has a potential to form another ascending wave towards level of 1.2900.

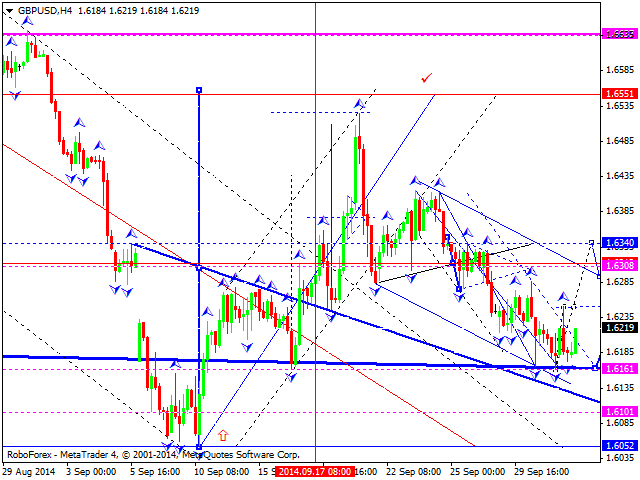

GBP USD, “Great Britain Pound vs US Dollar”

Pound has formed another consolidation channel and right now is breaking it upwards. We think, today the price may continue growing to return to level of 1.6340; this structure may be considered as another ascending wave with the target at level of 1.6550. An alternative scenario suggests that the market may fall to reach a new low of this wave and then to start moving towards the above-mentioned target.

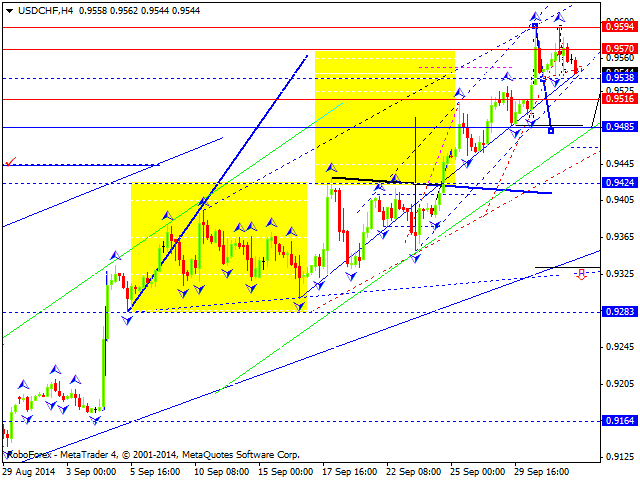

USD CHF, “US Dollar vs Swiss Franc”

Franc is forming another descending structure towards the target at level of 0.9485. Later, in our opinion, the market may start a correction towards level of 0.955 to test it from below and then continue forming this wave. The next target is at 0.9400.

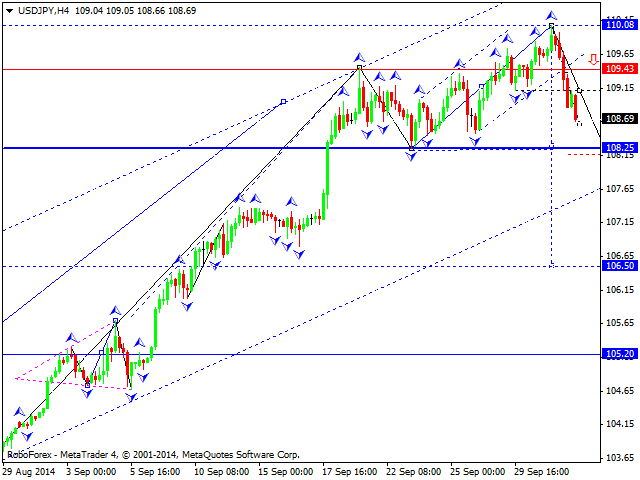

USD JPY, “US Dollar vs Japanese Yen”

Yen continues forming a descending wave with the target at 108.25. Later, in our opinion, the market may return to level of 109.10. Thus, the pair is forming head & shoulders reversal pattern to start a new downtrend. The next target is at level of 106.50.

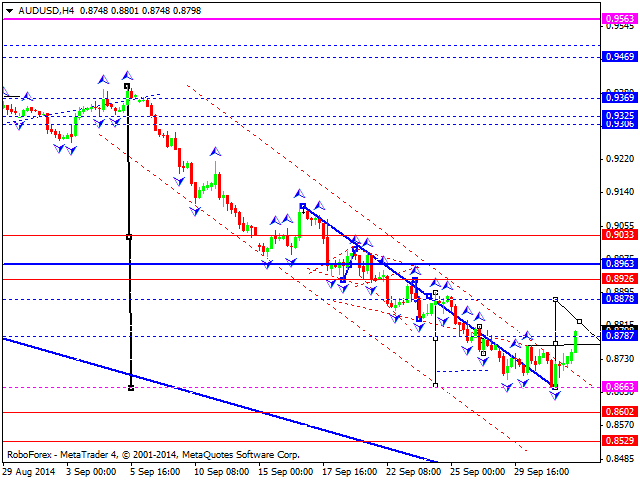

AUD USD, “Australian Dollar vs US Dollar”

Australian has started forming a structure to return to level of 0.8800. Later, in our opinion, the market may test level of 0.8770 from above and then start another ascending movement to reach the target at 0.8970.

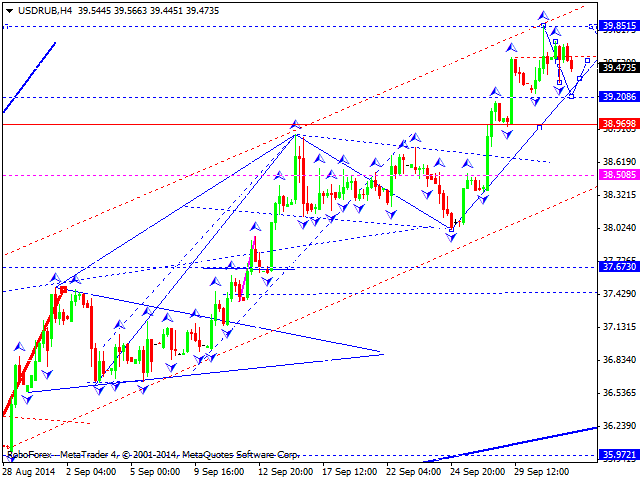

USD RUB, “US Dollar vs Russian Ruble”

Ruble has started forming the first descending wave. We think, today the price may reach level of 39.20 and then test level of 39.51. Later, in our opinion, the pair may start falling towards level of 38.50.

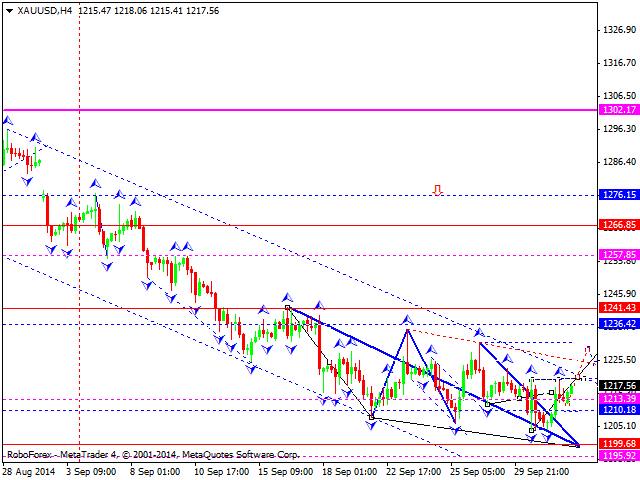

XAU USD, “Gold vs US Dollar”

Gold is forming another ascending structure to break a descending channel. We think, today the price may grow towards 1236 and then fall to reach 1220. After that, we’ll estimate if such pattern has a potential to continue moving upwards to reach level of 1266.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD posts gain, yet dive below 0.6500 amid Aussie CPI, ahead of US GDP

The Aussie Dollar finished Wednesday’s session with decent gains of 0.15% against the US Dollar, yet it retreated from weekly highs of 0.6529, which it hit after a hotter-than-expected inflation report. As the Asian session begins, the AUD/USD trades around 0.6495.

USD/JPY finds its highest bids since 1990, approaches 156.00

USD/JPY broke into its highest chart territory since June of 1990 on Wednesday, peaking near 155.40 for the first time in 34 years as the Japanese Yen continues to tumble across the broad FX market.

Gold stays firm amid higher US yields as traders await US GDP data

Gold recovers from recent losses, buoyed by market interest despite a stronger US Dollar and higher US Treasury yields. De-escalation of Middle East tensions contributed to increased market stability, denting the appetite for Gold buying.

Ethereum suffers slight pullback, Hong Kong spot ETH ETFs to begin trading on April 30

Ethereum suffered a brief decline on Wednesday afternoon despite increased accumulation from whales. This follows Ethereum restaking protocol Renzo restaked ETH crashing from its 1:1 peg with ETH and increased activities surrounding spot Ethereum ETFs.

Dow Jones Industrial Average hesitates on Wednesday as markets wait for key US data

The DJIA stumbled on Wednesday, falling from recent highs near 38,550.00 as investors ease off of Tuesday’s risk appetite. The index recovered as US data continues to vex financial markets that remain overwhelmingly focused on rate cuts from the US Fed.