Analysis for July 30th, 2014

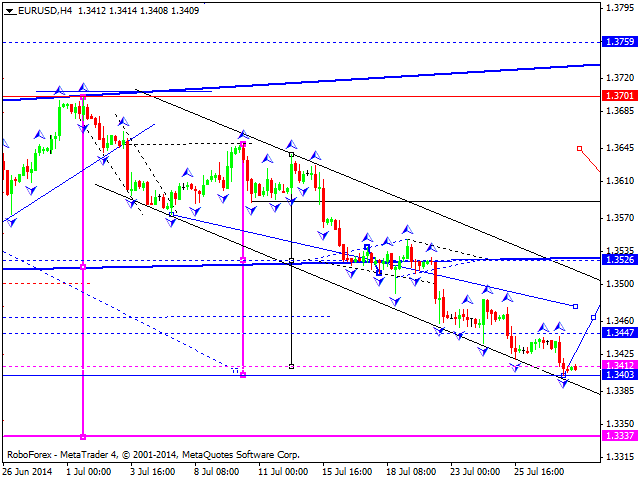

EURUSD, “Euro vs US Dollar”

Pair is still moving in the descending channel, extending descending structure. Price formed spiral wave without any considerable corrections. Price is expected to return back to level of 1.3525. Then, one more descending structure may be formed towards level of 1.3340.

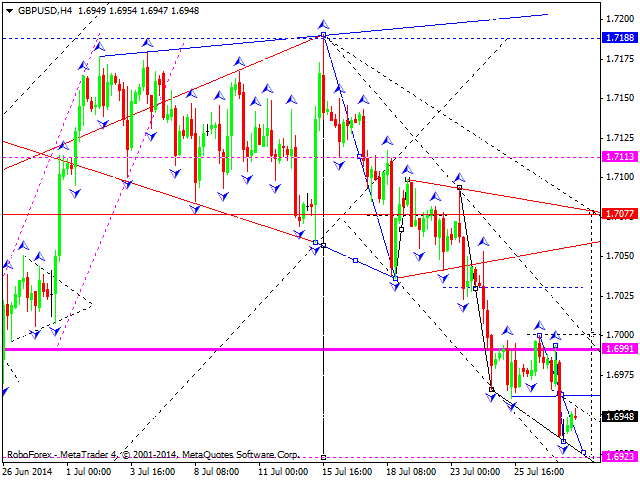

GBPUSD, “Great Britain Pound vs US Dollar”

Pound broke consolidation downwards. Price may reach level of 1.6925 and, then, rebound to level of 1.7080. After it, new minimums may be reached.

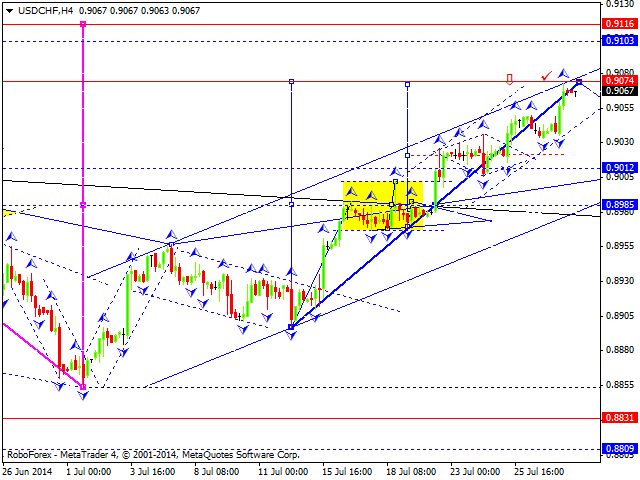

USDCHF, “US Dollar vs Swiss Franc”

Pair continues ascending movement. Price tests the middle of the downtrend pattern. Price may start falling down at any level. The first target, in our opinion, is level of 0.8985.

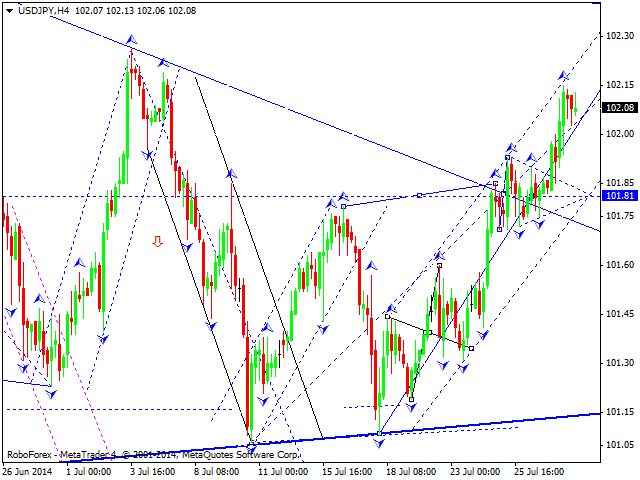

USDJPY, “US Dollar vs Japanese Yen”

Yen continues ascending movement towards level of 102.50, then, it may return back to level of 101.70. After it, we expect the formation of new ascending structure. Price may reach new maximum. We think price may try to test the upper triangle border.

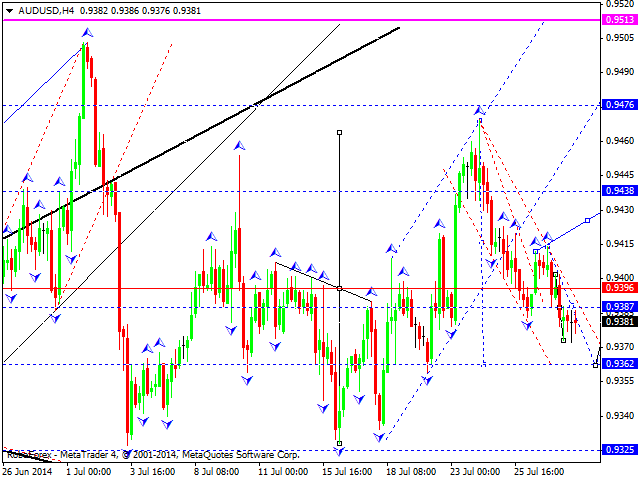

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is still moving inside descending structure as correction. Today descending wave may be formed towards level of 0.9362. After it, we expect new ascending wave towards level of 0.9510.

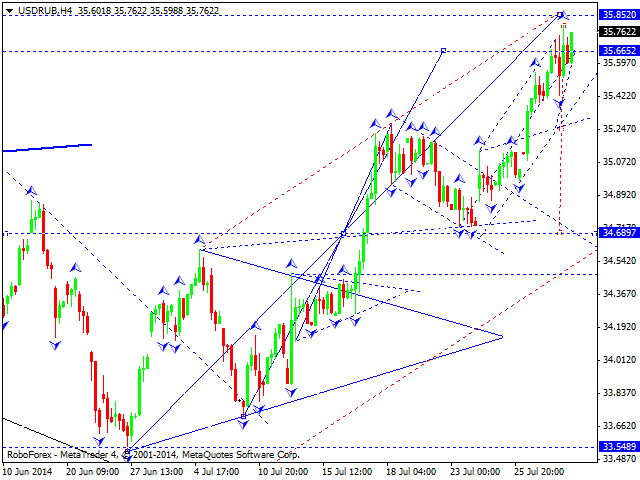

USDRUB, “US Dollar vs Russian Ruble”

Ruble reached the target of the third wave. Descending structure may be formed towards level of 34.60. However, price may try to reach level of 35.85 and, thus, complete the ascending structure. After completing the ascending structure, price may return, in our opinion, back to level of 33.20.

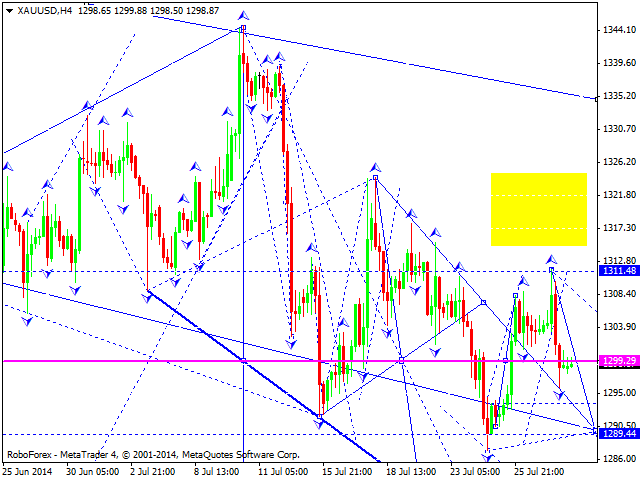

XAUUSD, “Gold vs US Dollar”

Gold continues its descending movement. We expect consolidation with breakout to the downside. The target is level of 1275.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD stands firm above 0.6500 with markets bracing for Aussie PPI, US inflation

The Aussie Dollar begins Friday’s Asian session on the right foot against the Greenback after posting gains of 0.33% on Thursday. The AUD/USD advance was sponsored by a United States report showing the economy is growing below estimates while inflation picked up. The pair traded at 0.6518.

EUR/USD mired near 1.0730 after choppy Thursday market session

EUR/USD whipsawed somewhat on Thursday, and the pair is heading into Friday's early session near 1.0730 after a back-and-forth session and complicated US data that vexed rate cut hopes.

Gold soars as US economic woes and inflation fears grip investors

Gold prices advanced modestly during Thursday’s North American session, gaining more than 0.5% following the release of crucial economic data from the United States. GDP figures for the first quarter of 2024 missed estimates, increasing speculation that the US Fed could lower borrowing costs.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

Bank of Japan expected to keep interest rates on hold after landmark hike

The Bank of Japan is set to leave its short-term rate target unchanged in the range between 0% and 0.1% on Friday, following the conclusion of its two-day monetary policy review meeting for April. The BoJ will announce its decision on Friday at around 3:00 GMT.