Analysis for June 13th, 2014

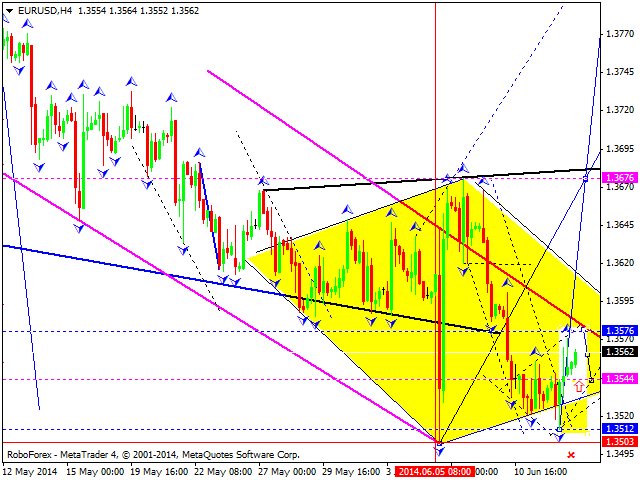

EUR USD, “Euro vs US Dollar”

Euro continues forming ascending impulse towards level of 1.3576. After reaching it, price may start new descending movement towards level of 1.3544 and form another ascending structure to break level of 1.3676.

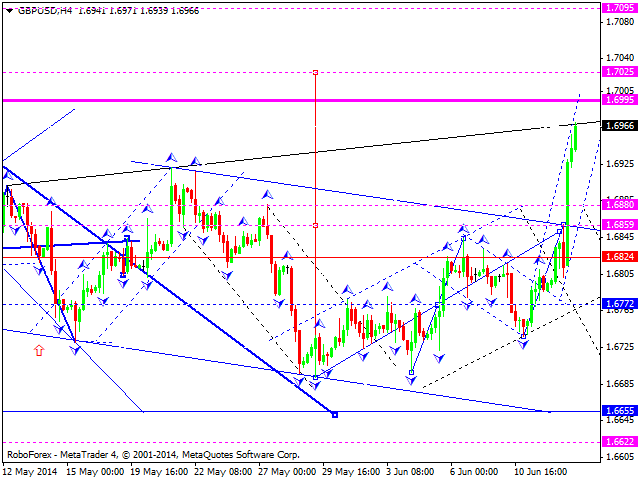

GBP USD, “Great Britain Pound vs US Dollar”

Pound is still extending its ascending wave. Possibly, price may reach level of 1.7025. Later, in our opinion, instrument may form another descending structure towards level of 1.6655.

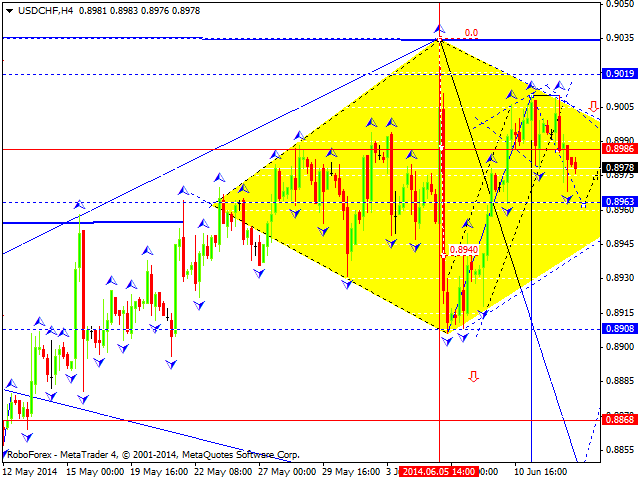

USD CHF, “US Dollar vs Swiss Franc”

Franc continues forming descending impulse towards level of 0.8963. Later, in our opinion, instrument may correct this impulse towards level of 0.8986 and then continue forming its descending wave.

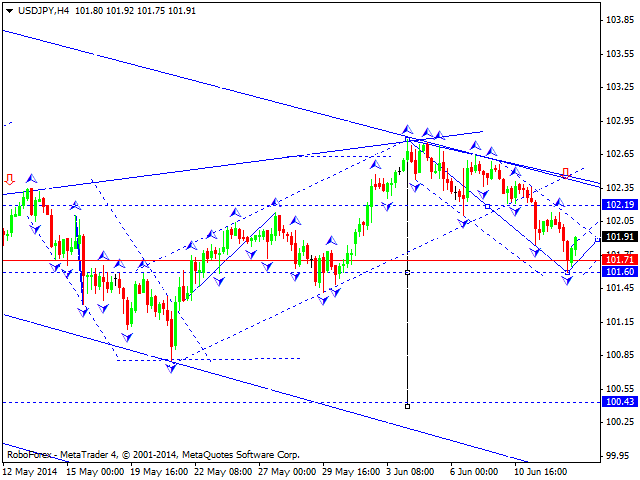

USD JPY, “US Dollar vs Japanese Yen”

Yen is still moving downwards and extending its descending structure. We think, today price may form correction towards level of 102.20 (at least) and then continue falling down. Next target is at level of 100.50.

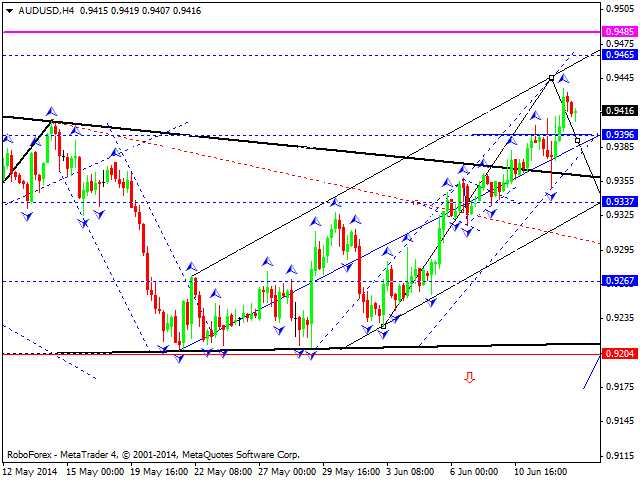

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar continues forming ascending wave towards level of 0.9465, which may be considered as the third wave inside this ascending structure. Later, in our opinion, instrument may start fall down towards level of 0.9279 and then start new ascending movement to reach level of 0.9465.

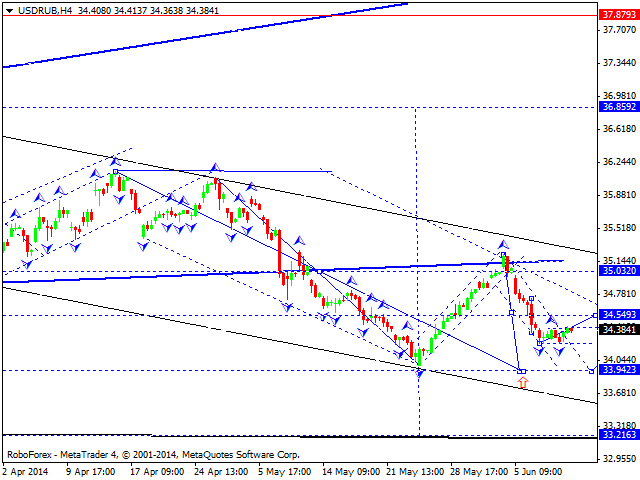

USD RUB, “US Dollar vs Russian Ruble”

Ruble is consolidating. After the market opening, price may leave this channel downwards and continue falling down reach level of 33.94. After reaching it, price may start new ascending structure to return to level of 35.00.

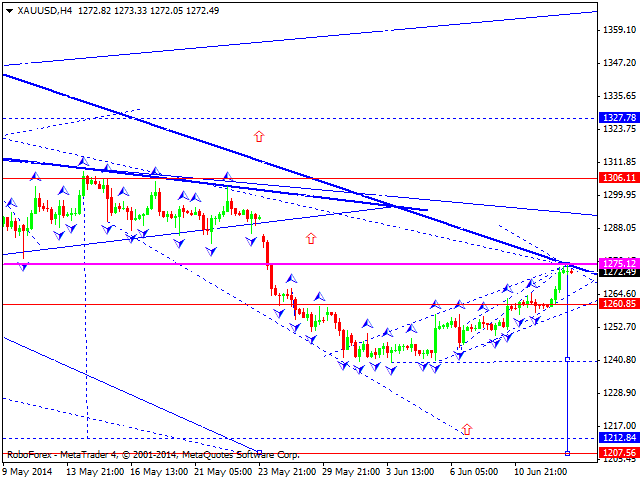

XAU USD, “Gold vs US Dollar”

Gold is falling down. We think, today price may continue forming descending wave to reach level of 1213. Later, in our opinion, instrument may return to level of 1260 and then start another descending movement towards level of 1208.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold rebounds to $2,320 as US yields turn south

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.