Analysis for April 24th, 2014

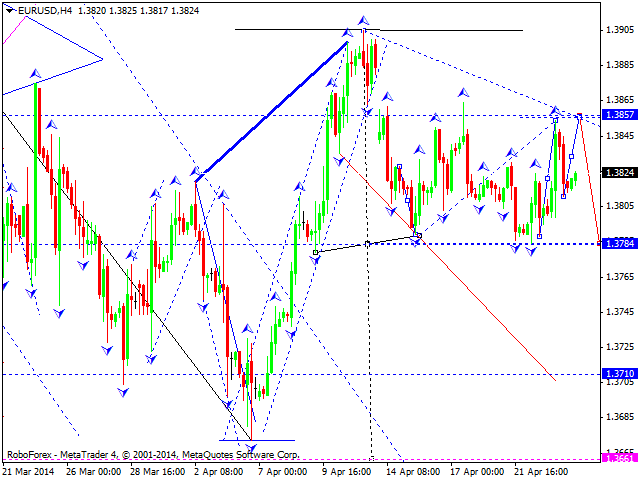

EUR USD, “Euro vs US Dollar”

Euro is trying to return to level of 1.3857. After reaching it, price may start forming another descending structure with predicted target at level of 1.3750. During this descending movement, pair is expected to form continuation pattern, which may help us to specify the target.

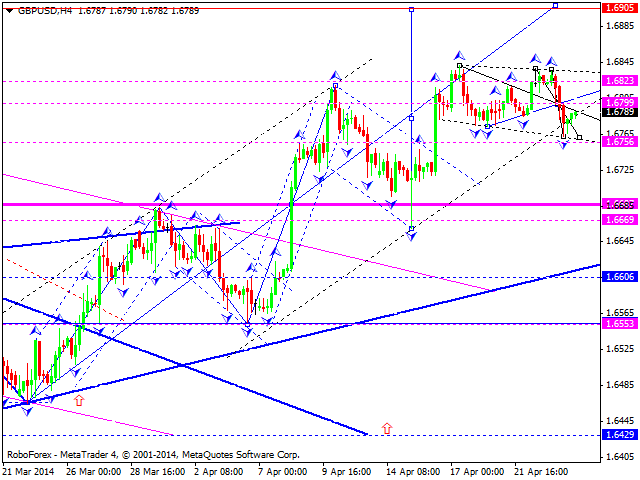

GBP USD, “Great Britain Pound vs US Dollar”

Pound is moving downwards to reach level of 1.6756. Later, in our opinion, instrument may start new ascending movement towards level of 1.6905 and then start more serious correction.

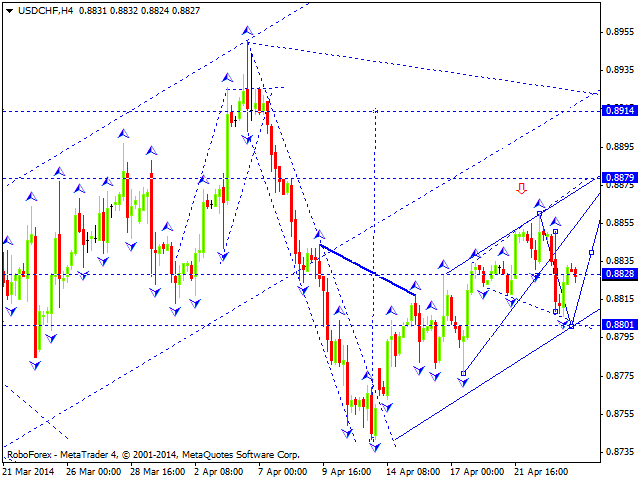

USD CHF, “US Dollar vs Swiss Franc”

Franc is falling down towards level of 0.8800. After reaching it, price may grow up to reach level of 0.8880 and then return to level of 0.8830.

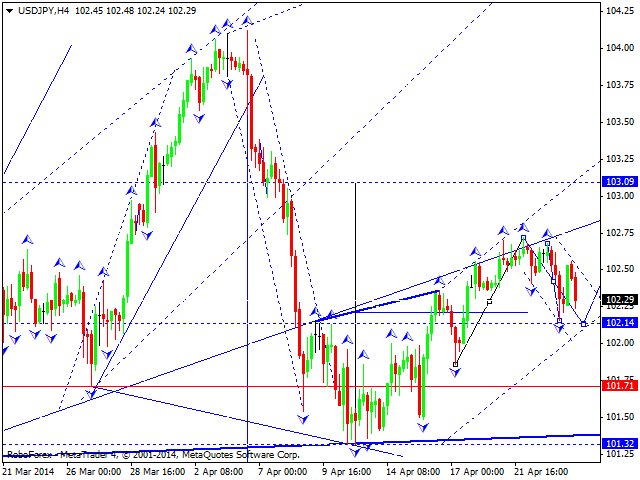

USD JPY, “US Dollar vs Japanese Yen”

Yen is forming descending structure with target at level of 102.15. Later, in our opinion, instrument may move upwards to reach level of 103.10and then continue falling down towards level of 100.00.

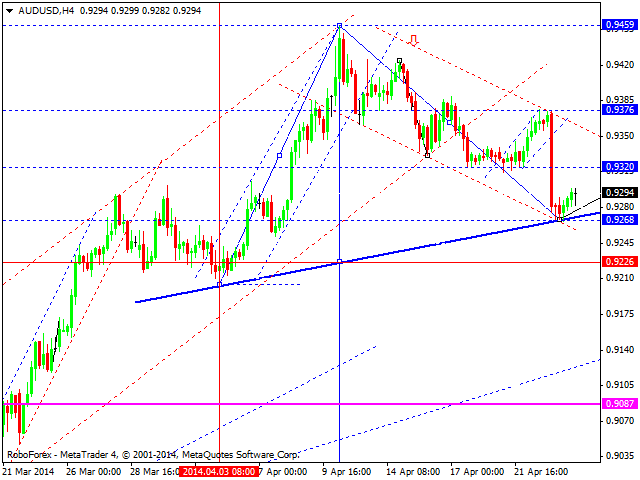

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is forming ascending structure to return to level of 0.9375; market is expected to form five-wave bearish flag pattern. Later, in our opinion, instrument may continue moving inside descending trend towards level of 0.8400.

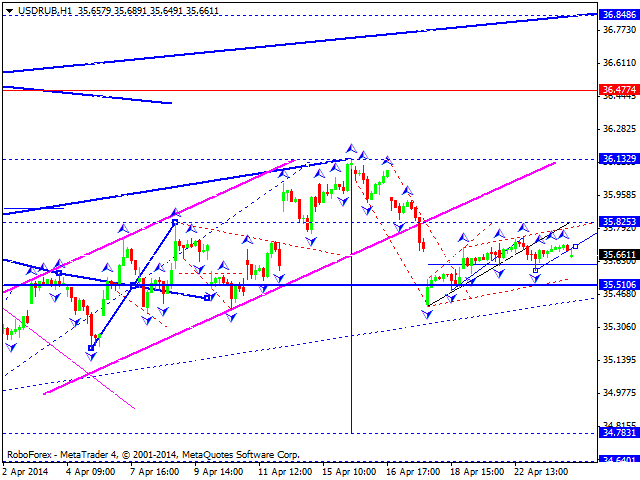

USD RUB, “US Dollar vs Russian Ruble”

Ruble continues moving upwards to reach level of 35.82. Later, in our opinion, instrument may form another descending structure towards level of 34.78 and then continue growing up to reach level of 36.60.

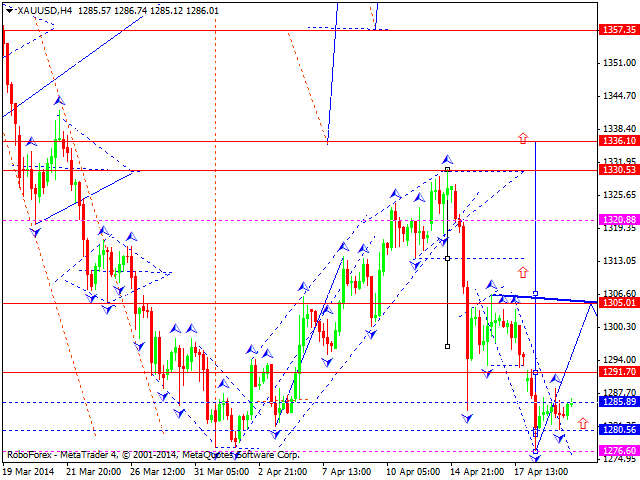

XAU USD, “Gold vs US Dollar”

Gold completed the first ascending impulse and corrected it. We think, today price may grow up to reach level of 1300 and then continue forming this ascending wave with target at level of 1357.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.