Analysis for March 18th, 2014

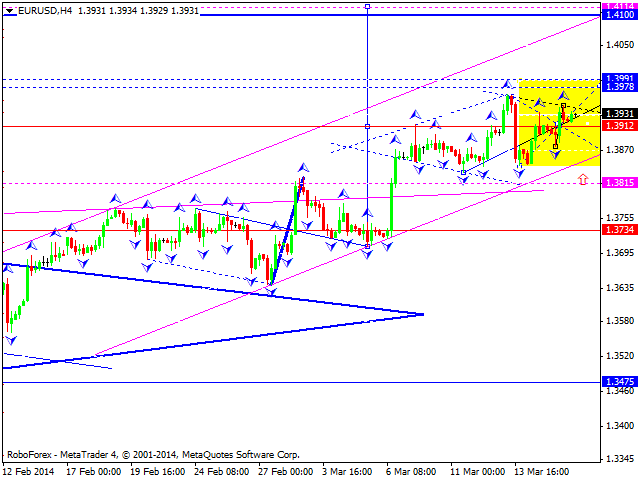

EUR USD, “Euro vs US Dollar”

Euro is still moving inside ascending structure. We think, today price may move upwards to reach level of 1.3980 and then fall down towards level of 1.3915. Later, in our opinion, instrument may grow up again towards level of 1.3990, return to level of 1.3900, and then continue its ascending movement towards main target at level of 1.4100.

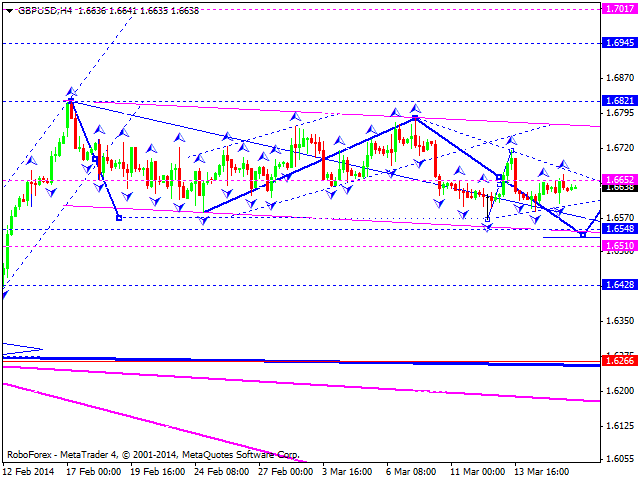

GBP USD, “Great Britain Pound vs US Dollar”

Pound is still moving inside consolidation channel; market is forming descending structure towards level of 1.6550. We think, today price may reach it and then complete flag pattern by falling down towards level of 1.6530. Later, in our opinion, instrument may continue growing up towards level of 1.7000.

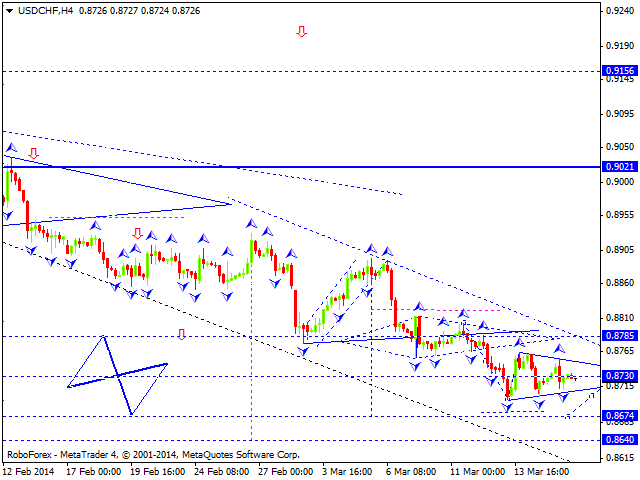

USD CHF, “US Dollar vs Swiss Franc”

Franc is still consolidating near level of 0.8730; market has formed triangle pattern. . We think, today price may continue falling down towards level of 0.8670, consolidate for a while, and then continue falling down towards main target at 0.8300.

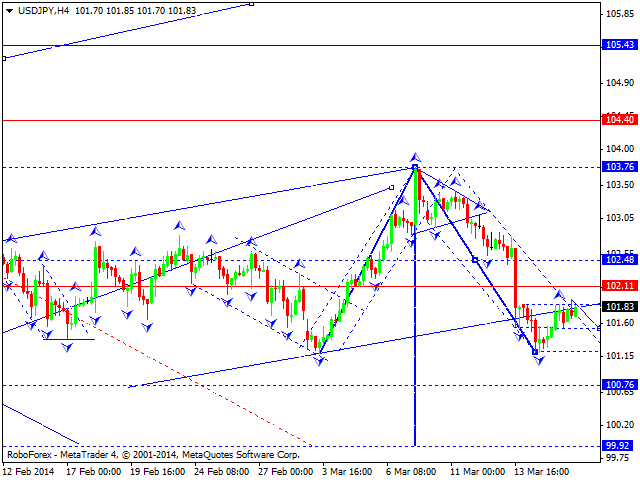

USD JPY, “US Dollar vs Japanese Yen”

Yen continues forming ascending structure; it looks like market is going to break descending channel. We think, today price break it, consolidate for a while, and then continue growing up towards level of 102.48. Later, in our opinion, instrument may start forming another descending structure to reach level of 100.00.

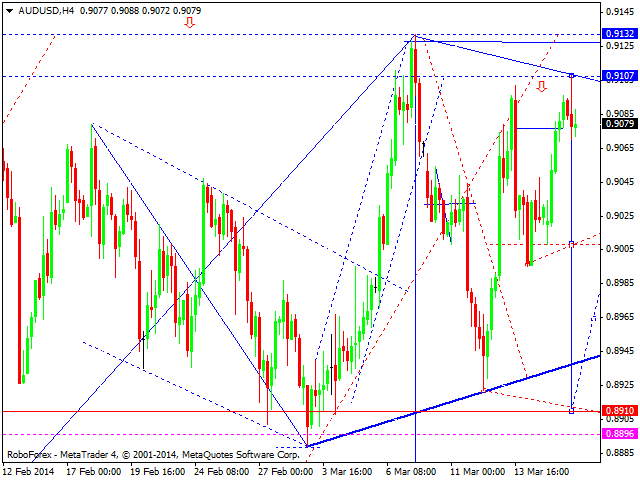

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar tried to continue its ascending movement, but market started falling down instead and right now is forming another descending impulse. We think, today price may reach level of 0.9000, form another consolidation channel, and then continue falling down to reach level of 0.8900.

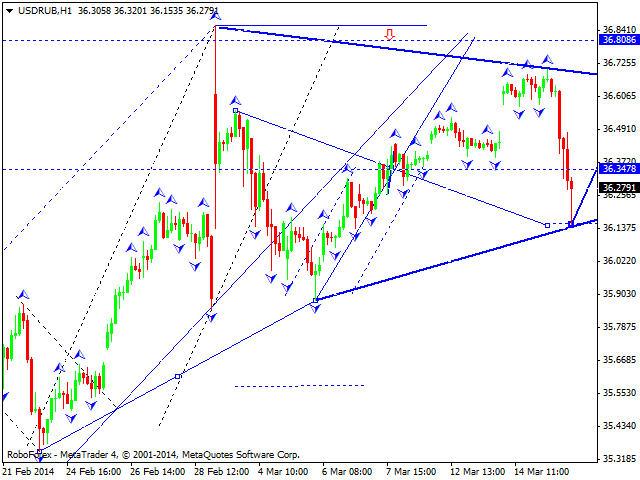

USD RUB, “US Dollar vs Russian Ruble”

Ruble is consolidating inside triangle pattern and forming descending structure to return to level of 36.30. We think, today price may move upwards to break pattern’s upper border and reach level of 36.80. Later, in our opinion, instrument may fall down towards level of 36.35 and then form new ascending structure to reach level of 37.50.

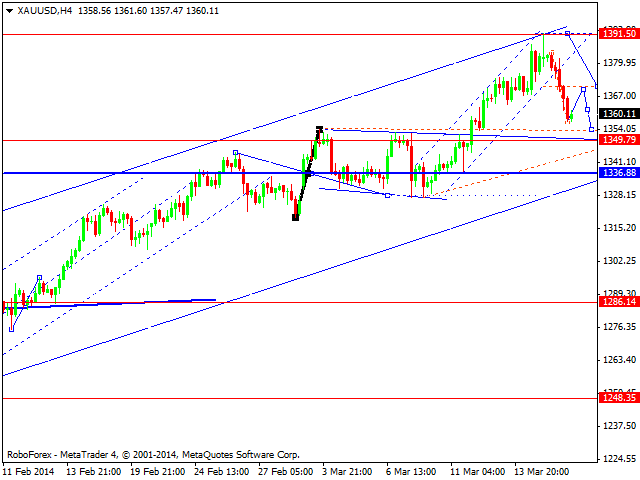

XAU USD, “Gold vs US Dollar”

Gold is forming ascending structure towards level of 1350. This structure may be considered as part of continuation pattern. Later, in our opinion, instrument may continue moving inside ascending channel with target at level of 1490.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'