Let us consider the GBP/USD pair on the daily timeframe. On June 3 the Bank of England decided to keep the interest rate unchanged at 0.5% and to leave the monetary stimulus program unchanged at GBP 375 billion. June 30 final report indicated the UK economy grew 0.4% in the first quarter due to growing domestic demand as the current account deficit of 20.6 billion pounds, or 5.8% of GDP, subtracted 0.6 percentage point from growth. The economic outlook of UK is uncertain as the winning Conservative party plans to hold a referendum on Britain’s membership in European Union by the end of 2017 and possibly as early as 2016. The conservative party has also pledged to close the budget deficit in five years and Chancellor George Osborne is going to announce the austerity measures on July 8 when he presents the government’s budget for the next four years. The fiscal tightening will likely act as a drag on growth. The political and economic uncertainty from the possible Greek exit form euro-zone in turn increase the downside risks for UK economy. On this backdrop US economy appears to be on track of firm recovery, with solid June jobs report increasing the likelihood of September rate hike. The British pound will likely weaken against the US dollar in near term given the divergent growth prospects and monetary policies of the Federal Reserve and Bank of England.

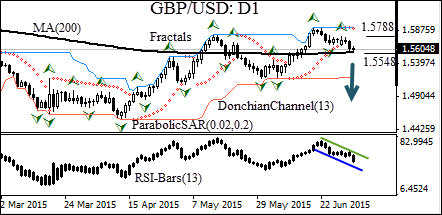

The GBP/USD has been trading with a downward bias since the Greek negotiators failed to reach an agreement on bailout extension with Eurogroup finance ministers on June 19. The Parabolic indicator gives a sell signal. The RSI-Bars oscillator moves in a downtrend channel. The Donchian channel is flat. The pair has crossed below the last fractal low at 1.56672 and is falling toward the 200-day moving average. We believe the bearish momentum will be confirmed after the pair closes below the 200-day moving average at 1.55485. A pending order to sell can be placed below that level. The stop loss can be placed above the last fractal high at 1.57886. After placing the order, the stop loss is to be moved every day to the next fractal high, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets the stop loss level without reaching the order, we recommend cancelling the position: the market sustains internal changes which were not taken into account.

PositionSellSell stopbelow 1.55485Stop lossabove 1.57886

Recommended Content

Editors’ Picks

AUD/USD hovers around 0.6500 amid light trading, ahead of US GDP

AUD/USD is trading close to 0.6500 in Asian trading on Thursday, lacking a clear directional impetus amid an Anzac Day holiday in Australia. Meanwhile, traders stay cautious due ti risk-aversion and ahead of the key US Q1 GDP release.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price treads water near $2,320, awaits US GDP data

Gold price recovers losses but keeps its range near $2,320 early Thursday. Renewed weakness in the US Dollar and the US Treasury yields allow Gold buyers to breathe a sigh of relief. Gold price stays vulnerable amid Middle East de-escalation, awaiting US Q1 GDP data.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.