US oil reserves growth

Let us consider the WTI CFD. In theNetTradeX trading platform it is marked as OIL. On Wednesday Energy InformationAdministration reported that crude oil reserves increased last week by 2.4mlnbarrels. It happened for the first time since this April. For this reason WTIfutures dropped 3% to its 2-week low. We do not exclude the further bearish movement,which can be driven by a number of factors. The dollar is strengthening aheadof the probable Greek default and the weak euro. The sanctions against Iran aregoing to be lifted, so the oil export from the country may rise 60% within ayear. Meanwhile, the production may increase from 2.8mln to 3.6mln barrels perday. The overall oil extraction by OPEC countries in July grew to its 3-yearstrongest – 31.6mln barrels daily.

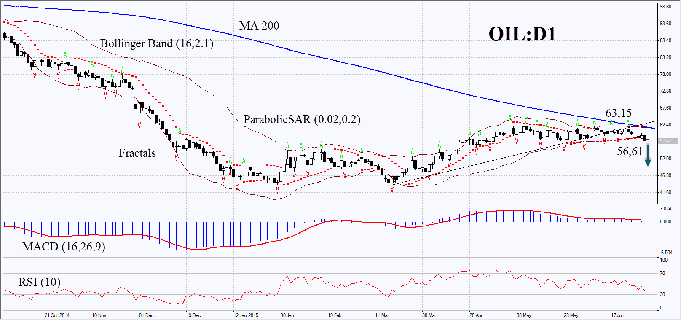

On the daily time frame the OIL futuresdid not manage to cross the 200-day Moving Average upwards. Last week itbreached the support line of the uptrend, which had been in effect for over 2months. The Parabolic indicator shaped a sell signal. Bollinger Bands narrowed,probably indicating low volatility. They have a negative slope as well. Thelatest daily bar has gone below the indicator's lower boundary. MACD has beengiving a rather weak sell signal, since its bars are too close to the zerolevel. RSI has been descending but has not yet reached the oversold zone. Thebearish momentum may continue, when the latest OIL bar closes under the fractallow at 56.61. A stop loss may be placed at 62.21 mark, supported by the latestParabolic signal, Bollinger Bands, the 200-day Moving Average and the fractal.It can also be set above the latest local low at 63.15. After pending orderplacing, the stop loss is supposed to be moved every four hours near the nextfractal high, following Parabolic and Bollinger signals. Thus, we are changingthe probable profit/loss ratio to the breakeven point. The most cautioustraders are recommended to switch to the H4 time frame and place a stop loss,moving it after the trend. If the price reaches the stop level withouttriggering the order we recommend to cancel the position: the market sustainsinternal changes that were not considered.

Position

Sell

Sell stop

below 56.61

Stop loss

above 62.21 or 63.15

Recommended Content

Editors’ Picks

EUR/USD consolidates recovery below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery but remains below 1.0700 in early Europe on Thursday. The US Dollar holds its corrective decline amid a stabilizing market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD advances toward 1.2500 on weaker US Dollar

GBP/USD is extending recovery gains toward 1.2500 in the European morning on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.