We would like to draw your attention to the CORN futures H4 chart. In the previous overview we pointed out that increase and decrease were equally probable. Eventually, due to the strengthening dollar, corn quotes declined but now they start growing again. We are considering buying the futures. This decision may be confirmed by the dropping dollar and estimated drought in the US. Grain crops may show a sharp growth in the future because of the potential onset of El Niño this year. Competent weather agencies haven't released forecasts yet but anything is possible. We remind that El Niño was last seen in 2010. The natural phenomenon boosted food prices back then. On March, 26 US Department of Agriculture (USDA) will publish a weekly report on food export. It may dramatically affect corn, wheat, soy, cotton and beef quotes.

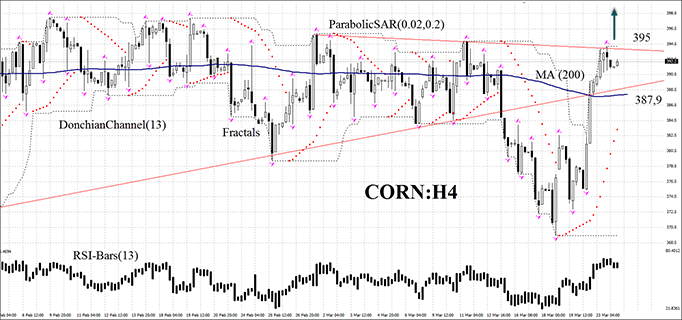

Let us consider the CORN futures on the H4 time frame. It is traded in a mid-term range. The graph has recently shaped a triangle figure and continued moving down. However, there were no significant drop and corn returned into the neutral trend rather fast. RSI-Bars latest signals rebounded from the overbuy zone which is located above 70. At the same time the oscillator didn't breach 50. Donchian Channel expanded and the curve reached its upper boundary. The Donchian upper level is above 200-day moving average (MA 200). We do not rule out further bullish momentum if the latest bar of the CORN futures closes above the “old triangle” - 395. A pending buy order may be placed there. Stop loss may be placed at MA 200 level which can be considered as a support line – 387.9 mark. After pending order activation, Stop loss is to be moved every four hours near the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes which were not considered.

- Position Buy

- Buy stop above 395

- Stop loss below 387,9

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.