Today we would like to focus your attention to GBP/USD . The pound slid from the seven-year high against the euro, and is down from the eight-week high against the US dollar. It was caused by the decline in real estate prices in February for the first time in five months. Note that last week the pound soared to the six-year high against the basket of major currencies. Now investors believe that the Bank of England rate hike will occur no earlier than in 2016. Moreover, there is a hypothetical possibility that the UK may exit the European Union if the Conservative Party wins the parliamentary elections scheduled in May. We don’t rule out the possibility that the pound might continue rising after the technical pullback is over.

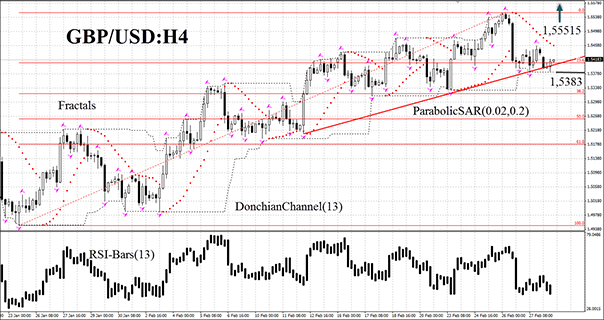

The GBP/USD currency pair shows a pullback on the H4 chart, but the uptrend price channel is still remained. RSI-Bars oscillator is now in a neutral range: the latest bars are located below 50. It might be a sign that it is too early to buy. We do not rule out the bullish momentum being developed after the fractal high breakout at 1.55515: this level can be used for placing a pending buy order. Stop loss is to be placed at the lower border of DonchianChannel, which can currently act as the support line at 1.5383. After pending order placing, Stop loss is to be moved every four hours near the next fractal low, following Parabolic signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets Stop loss level without reaching the order, we recommend cancelling the position: market sustains internal changes which were not considered.

- Position Buy

- Buy stop above 1.55515

- Stop loss below 1.5383

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Runes likely to have massive support after BRC-20 and Ordinals frenzy

With all eyes peeled on the halving, Bitcoin is the center of attention in the market. The pioneer cryptocurrency has had three narratives this year already, starting with the spot BTC exchange-traded funds, the recent all-time high of $73,777, and now the halving.

Billowing clouds of apprehension

Thursday marked the fifth consecutive session of decline for US stocks as optimism regarding multiple interest rate cuts by the Federal Reserve waned. The downturn in sentiment can be attributed to robust economic data releases, prompting traders to adjust their expectations for multiple rate cuts this year.