The heads of leading central banks of the world will be delivering their speeches today. The ECB President Mario Draghi is due to speak in Frankfurt at 14:00 CET. At 15:00 CET the Fed Chair Janet Yellen will testify before the US Senate Banking Committee. Investors expect that Draghi will confirm the dates and the amount of targeted longer-term refinancing operations (TLTRO) announced last year. Recall that it is planned to start this March in the monthly amount of 60 billion euro. Market participants expect Janet Yellen to shed light on the timing of the rate hike in the United States. Previously, it was supposed to happen in April 2015. However, FOMC Meeting Minutes released last Wednesday revealed that an early rate hike was doubtful: the world economy is being in a poor state for the first time since January 2013. In general, we consider the situation to be ambiguous. The US dollar index has been traded sideways for a month. As a rule, after leaving this trend, strong movement is expected further on. The statements made by the heads of the ECB and the Fed will probably guide the exchange rate in some direction. Unfortunately, the trend is difficult to predict in advance.

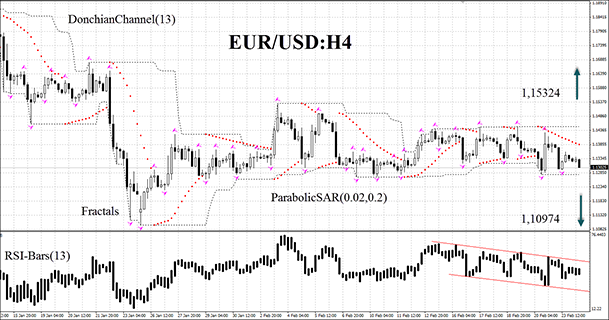

Let’s consider the EUR/USD currency pair on the H4 chart. It was traded sideways on January 26, 2015. The last bars of RSI-Bars are below 50 and form a downtrend. But as we noted above, the final price direction of this currency pair will depend on the monetary policy determined by the Fed and the ECB. We believe a new trend will appear after sideways trading is finished. Let the market choose the price direction. The most significant levels at 1.10974 and 1.15321 are confirmed by Bill Williams fractals and Donchian Channel boundaries. Two positions can be placed at the opposite levels: after one of the orders is opened, the second one can be deleted. It means the market has chosen the direction. After pending order activation, Stop loss is to be moved every four hours near the next fractal high (short position) or low (long position), following Parabolic values. Thus, we are changing the probable profit/loss ratio to the breakeven point.

- Position Sell

- Sell stop below 1.10974

- Stop loss above 1.15321

- Position Buy

- Buy stop above 1.15321

- Stop loss below 1.10974

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.