Today we would like to focus your attention to Personal Composite Instrument (PCI) &BRENT_RUB, i.e. Brent crude oil to Russian ruble on the H4 chart. They are highly interconnected because Russia is the third largest oil producer after Saudi Arabia and the United States. The share of hydrocarbons in the country’s exports is 73%. When Brent crude oil price (denominated in USD) advances, as a rule, Russian ruble is sagging on the USD/RUB chart. This means that it is strengthening against the US dollar. You can implement the &BRENT_RUB PCI downloaded from our website in NetTradeX.

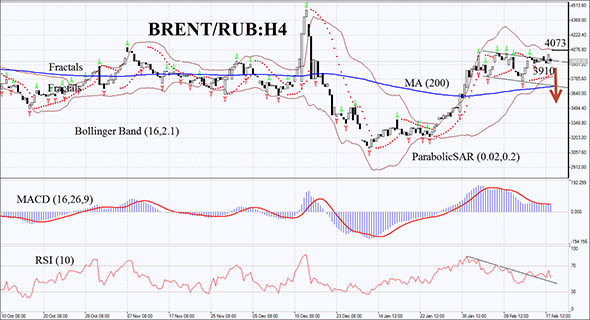

BRENT/RUB has formed the graphic pattern called “flag” on the H4 chart, and the price is currently located next to its upper boundary. Since the two assets of this PCI are highly correlated, they are mainly traded sideways. Therefore, we don’t expect a strong bullish momentum. BRENT/RUB will most likely return to its long-term moving average (200). There is a decline in volatility on the MACD chart. The histogram is below the signal line, which can be considered a bearish signal. There is a timid bearish divergence on the RSI chart. Bollinger Bands indicator shows narrowing. Further development of the bearish momentum is not ruled out after the fractal resistance breakout at 3910. This mark can be used for placing a pending sell order. Stop loss may be placed at the top line of Bollinger Bands indicator, which can currently act as a resistance line – 4073. After pending order placing, Stop loss is to be moved every four hours near the next fractal high, following Parabolic and Bollinger signals. Thus, we are changing the probable profit/loss ratio to the breakeven point. If the price meets Stop loss level without reaching the order, we recommend canceling the position: market sustains internal changes that were not considered.

- Position Sell

- Sell stop below 3910

- Stop loss above 4073

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.