Today at 14:30 CET Core CPI m/m will be released in the United States. The index is published monthly by the Bureau of Labor Statistics. It measures the change in prices for goods and services, excluding the most volatile components: food and energy. The indicator measures inflation, which in turn affects the US monetary policy and base rates. Members of the Federal Open Market Committee (FOMC) take the inflation outlook into account to restrain its excessive growth pace due to tightening policy. Rate hike leads to an influx of investment funds in the economy. For this reason, CPI release may cause volatility momentum of the US dollar against the most liquid currencies.

Here we consider EUR/USD currency pair on the H4 chart. The Swiss National Bank (SNB) turned down the protection policy of the average exchange rate of two currencies (EUR,CHF) at 1.20 francs per euro. The regulator was forced to take this measure amid long-term euro depreciation. Floating exchange rate made the European currency soar even deeper and triggered a sell-off. We can observe the daily bearish trend, which proceeded after a slight retracement within the channel 1.16132-1.17252. Parabolic historical values are moving along the trend line, confirming its strength. You should also pay attention to the bullish divergence completion on the RSI-Bars oscillator chart and the trend reversal. Dashed line marks the preliminary trend line which will be confirmed only after the support level intersection at 18.4161%. We expect it will accompany the price level crossing at 1.15665, which can be used for placing a pending sell order. Stop Loss can be placed above the last strong support at 1.17252, which now acts as resistance line. After order opening, Stop Loss is to be moved after Parabolic values near the next fractal high. Thus, we are changing the probable profit/loss ratio to the breakeven point.

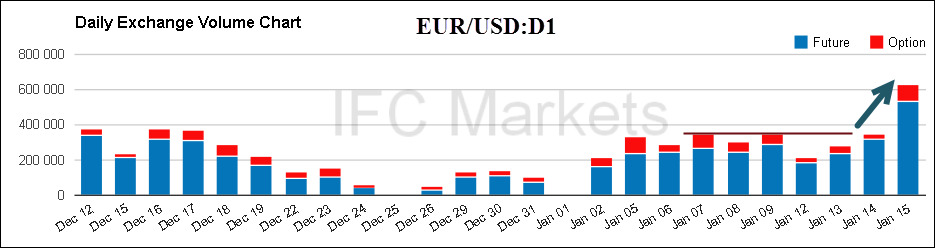

The volumes of futures and options on euro traded on the Chicago Mercantile Exchange has increased greatly after yesterday’s news. The number of contracts outperformed the local peak of 400 000 and has continued to grow as the trend is developing. The volume confirms the bearish sentiment and investor fears on the European currency.

- Position Sell

- Sell stop below 1.15665

- Stop loss above 1.17252

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.