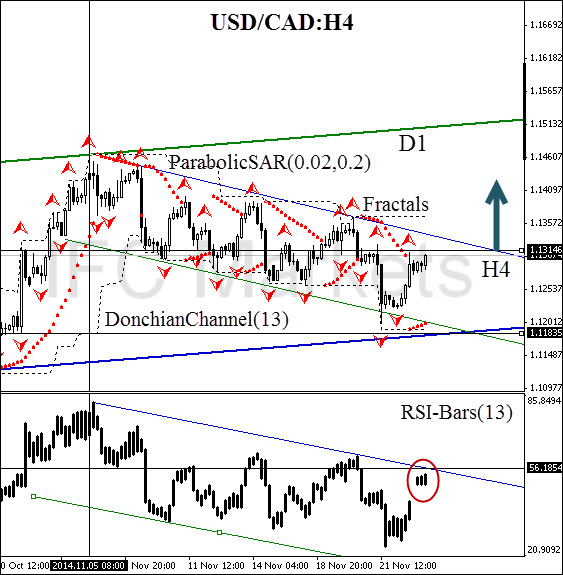

Today at 14:30 (CET) we expect the release of two economic indicators: Core retail sales, CRS in Canada and the preliminary Q3 GDP in the US. CRS is released monthly by Statistics Canada and shows a relative change in the total value of sales at the retail level, excluding automobiles, which account for 20% of the total volume. CRS is a monthly measurement of all goods sold by retailers, based on the sampling of different types of retail stores. The index defines long-term trends in consumer activity. The quarterly US GDP is also of interest primarily for long-term investors. Let us remind you that GDP expresses the cost of manufactured goods and services and adjusted for inflation. The GDP indicator shows the change in values of the previous quarter (%).In our opinion, the greatest volatility is expected today from the US currency relative to other liquid instruments.

After position opening, Stop Loss is to be moved after the Parabolic values, near the next fractal low. Updating is enough to be done every day after a new Bill Williams fractal formation (5 candlesticks). Thus, we are changing the probable profit/loss ratio to the breakeven point.

- Position Buy

- Buy stop above 1.13146

- Stop loss below 1.11835

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.