Good afternoon, dear traders.

Today at 14:30 CET we expect the release of two macroeconomic indicators: Building Permits, USA and Core CPI, Canada. The first index expresses the number of new housing building permits issued by the government last month. It allows assessing the real estate potential growth, and also secondary demand goods and technology sector. Positive data permits expecting a momentum for domestic consumption and production in the USA. The second indicator shows the change in prices of goods and services in Canada with the exception of the most volatile components: food and energy. The Core CPI defines inflation rate which affects the Bank of Canada monetary policy. The CPI release may lead to a significant boost of the Canadian dollar against its most liquid competitors, including the US dollar. Both indices are expressed on a monthly basis and influence considerably the investment expectations.

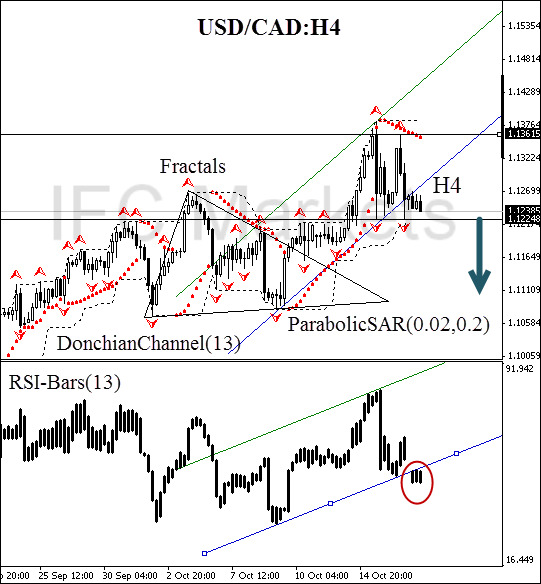

After position opening, Trailing Stop is to be moved after the Parabolic values, near the next fractal peak. Updating is enough to be done every day after the formation of 5 new H4 candlesticks, needed for the Bill Williams fractal formation. Thus, we are changing the probable profit/loss ratio to the breakeven point.

- Position Sell

- Sell stop below 1.12248

- Stop loss above 1.13615

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.