Good afternoon, dear traders. Today at 14:30 CET we expect the release of the UK Current Account. This indicator includes the difference between imports and exports of goods, services, income flows, and unilateral transfers. The first two categories are included in the Balance of Trade; so therefore, the main suspense is the publication of the balance of net financial flows. Certainly, this event can have a significant impact on the British currency behavior.

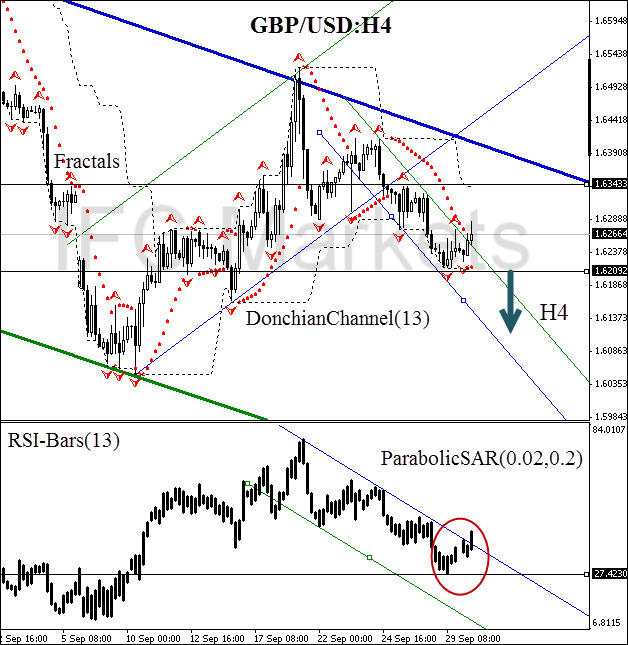

Here we consider the GBP/USD behavior on the H4 chart. Currently, the price broke the H4 trend line. However, we suggest the possible return to the downtrend corridor as the daily trend is influenced by bears. Donchian Channel confirms that investors are being pessimistic about the British currency. The key support breach at 1.62092 will lead to Parabolic SAR reversal in the direction towards the red zone, and we will get the necessary bearish confirmation. At this moment it is necessary to get an additional signal on the part of the RSI-Bars oscillator: the level at 27.4230%. For opening a conservative position we suggest limiting the risks by the last fractal resistance at 1.63433. This level is strengthened by ParabolicSAR historical values and the upper boundary of Donchian Channel.

After position opening, Trailing Stop is to be moved after the Parabolic values, near the next fractal peak. Updating is enough to be done every day. Thus, we are changing the probable profit/loss ratio to the breakeven point.

Recommended Content

Editors’ Picks

EUR/USD holds gains near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.