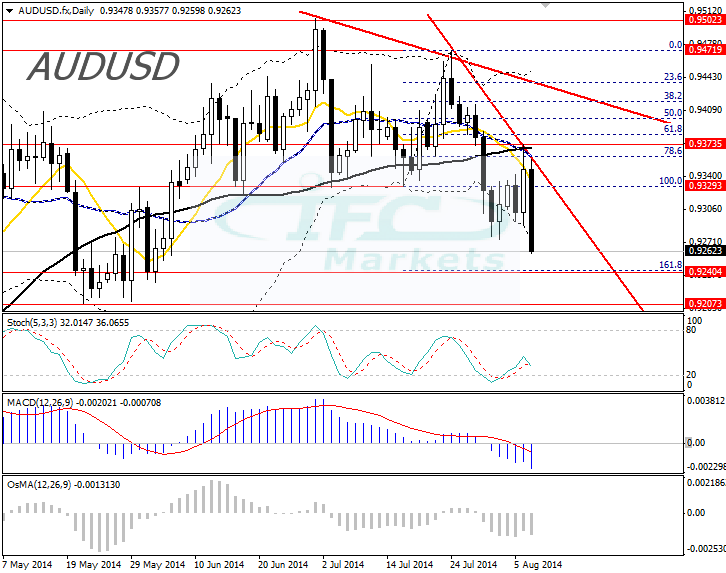

Hello, dear traders. Today we are going to analyze the Aussie against the US dollar chart. The currency pair comes from a long term uptrend but a reversal pattern is created in the daily timeframe with prices falling to 2-month low. Currently the forex pair is below the both of the tentative falling trend lines and as we can see there is a likely bearish formation establishment. Moreover, the Moving Averages are creating negative triple cross which increases bearish expectations. The current candle of the currency pair is a bearish engulfing and has made a substantial down move in the current daily trading session also it has breached the lower Bollinger Band. However, the candle is not yet finished and therefore its signal is not valid, we have to wait to see the close of the day to make the appropriate conclusions. Towards the next support which is the 161.8% Fibonacci extension of 0.9329 to 0.9471, at 0.9240 there are not any obstacles blocking the way. Thus, based on the price analysis we would expect the currency couple to move lower at 0.9240.

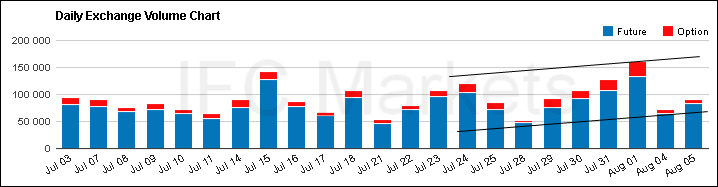

At the below chart we can see the daily volumes of futures and options traded on the Chicago Mercantile Exchange. We can see that on the 28th, 29th and 30th of July volume has been increasing and on the 30th of July, at the highest of volume, prices breached support at 0.9329. Then a slight bounce up took place in the AUDUSD with volumes of trading remaining the same or even falling. Eventually leading to today’s bearish trading and we would be expecting the CME release of today’s volume of trading to confirm the validity of the bearish candle.

Looking at the oscillators, MACD is gradually declining and has room for lower levels suggesting that downside could continue. The Stochastic crossed its signal line from above and OsMA is mostly neutral. In our opinion, the downside would most likely continue towards 0.9240 and if the current candle close as a big bearish engulfing then chances are for succeeding 0.9207 as well. Moreover, should the volumes of trading increase then our downside expectations would be confirmed by another analysis tool. Lastly, trading below 0.9207 there will be a double top long term reversal pattern which would signify falling structure.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.