Good afternoon, dear traders. At the end of last week the market was in the state of expectation regarding the meeting of G7. Investors feared the appearance of signals of new sanctions by the U.S. and the EU to limit dealings with Russia. Specific measures could lead to new capital losses in developed markets, as well as the outflow of Russian investments.This problem would touch the EU the most acutely as a major trading partner. However, no economic results than the symbolic exclusion of Russia from the G8 and abstract declarations about the need for energy independence this meeting did not bring. So this week we are expecting the foreign exchange market to come out from the "frozen" state and a more sensitive response to the output of economic indicators.

For example, the Core Retail Sales are expected to be published today at 14:30 (CET) (Core Retail Sales). This indicator is released every month by Bureau of Statistics and shows the relative change in the volume of retail sales excluding the volatile transportation component. Core retail sales indicator determines the level of consumer confidence and domestic demand in the country. If the change of the indicator is above the predicted value of 0.5%, most probably the U.S. Dollar will strengthen.

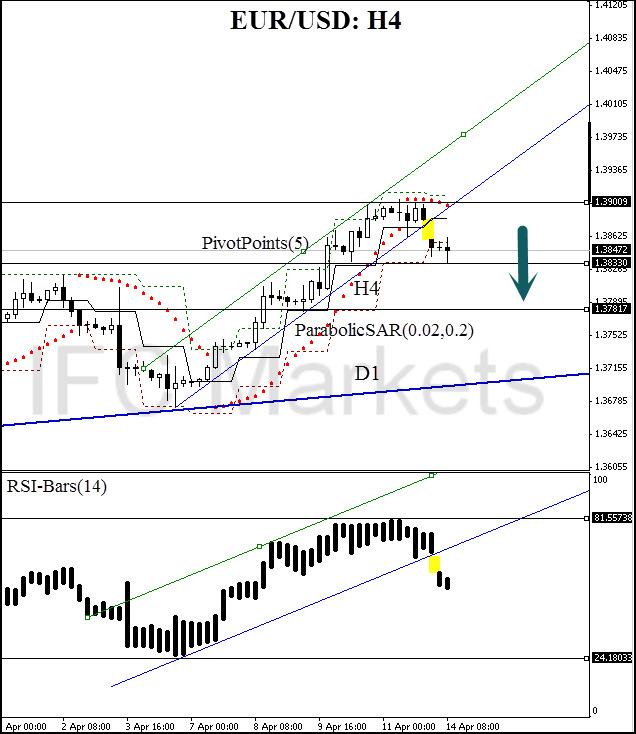

Today we will consider the EUR/USD on the H4 chart. During the European trading session, the market opened bearish gap down, which is repeated on the signal oscillator RSI-Bars. The signal coincides with the breakdown of the trend line H4 and the reversal of the trend indicator ParabolicSAR towards the trend reduction. The first Pivot resistance has been completely overcome. All signals show that we should expect the continuation of further decrease of price and the 1.38330 level breakdown. A pending sell order can be opened below this level.

Stop is selected according to the nearest maximum at 1.39009. This is a great position to limit the risk because the previous values of Parabolic SAR are located at this level, as well as Pivot resistance. The preliminary target is located above the historic low of 1.37817 and is also confirmed by both trend indicators. Stop is recommended to move after the values of ParabolicSAR , as soon as they cross the preliminary level of risk limitation. The pending order is to be opened 15 minutes before the publication of Core Retail Sales. We believe that the position should be closed immediately in case the indicator is below or equal to the forecast (0,5%).This would mean that the trend has reversed and the market experiences the fundamental changes which were not considered by us.

This overview has an informative character and is not financial advice or a recommendation. IFCMarkets. Corp. under any circumstances is not liable for any action taken by someone else after reading this article.

Recommended Content

Editors’ Picks

AUD/USD pressures as Fed officials hold firm on rate policy

The Australian Dollar is on the defensive against the US Dollar, as Friday’s Asian session commences. On Thursday, the antipodean clocked losses of 0.21% against its counterpart, driven by Fed officials emphasizing they’re in no rush to ease policy. The AUD/USD trades around 0.6419.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday during the early Asian session. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold price edges higher on risk-off mood hawkish Fed signals

Gold prices advanced late in the North American session on Thursday, underpinned by heightened geopolitical risks involving Iran and Israel. Federal Reserve officials delivered hawkish messages, triggering a jump in US Treasury yields, which boosted the Greenback.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Is the Biden administration trying to destroy the Dollar?

Confidence in Western financial markets has already been shaken enough by the 20% devaluation of the dollar over the last few years. But now the European Commission wants to hand Ukraine $300 billion seized from Russia.