Good afternoon, dear investors. Today we consider the example of unbalanced spread trading, a trading method effectively used within Personal Composite Instruments - PCI Technology. The basis of this method is the expression of the underlying asset in units of the quoted one, provided that both assets have a negative relation: the underlying asset price growth causes the price drop of the quoted asset and vice versa.

Today as such assets we consider the frozen beef and soybean commodity futures: #C-FCATTLE, #C-SOYB. It is quite natural to assume that soy is a cheap filler and a meat product substitute, and under certain conditions we can observe the demand substitution effect. Most apparently this effect appears at the vegetarian lifestyle macro trend expansion, or a drop in personal income. An opposite situation is possible to happen: the meat consumption growth in Asian countries (European influence) eventually leads to a drop in soy demand and increased meat demand, including beef. One of these trends immediately results in #C-FCATTLE and #C-SOYB reverse relation boost.

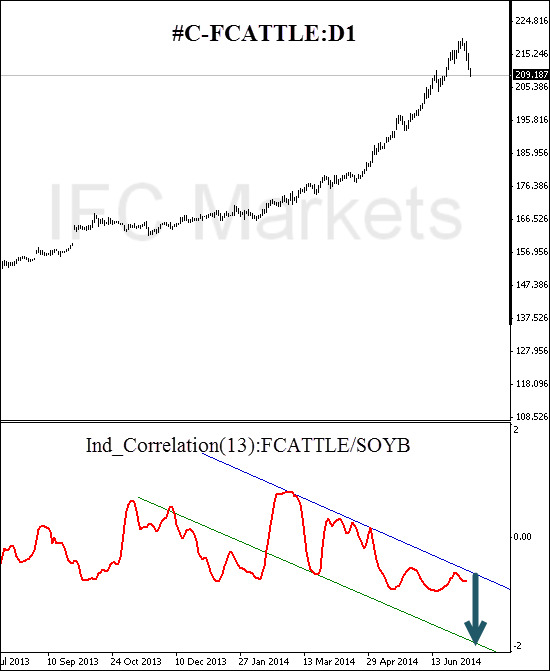

We draw your attention to the fact that since the reverse spread beginning (April 30) #C-FCATTLE futures price has increased by 15% while the PCI price of #C-FCATTLE/#C-SOYB rose by 57%. The reverse spread use multiplied 4 times the yield growth. At the same time we are safe from systematic risks such as falling food demand. We are interested only in the relative movement. The synthetic instrument allows hedging the order, while providing the instrument persistence, i.e. its trend behavior.

Recommended Content

Editors’ Picks

EUR/USD hovers around 1.0700, eyes on US first-quarter GDP data

EUR/USD hovers around the 1.0700 psychological level on Thursday during the early Thursday. The modest uptick of the major pair is supported by the softer US Dollar. Later in the day, Germany’s GfK Consumer Confidence Survey for April will be released.

USD/JPY finds its highest bids since 1990, near 155.50

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, testing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming Japanese intervention risks. Focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold price lacks firm intraday direction, holds steady above $2,300 ahead of US data

Gold price remains confined in a narrow band for the second straight day on Thursday. Reduced Fed rate cut bets and a positive risk tone cap the upside for the commodity. Traders now await key US macro data before positioning for the near-term trajectory.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price. Coupled with broader market gloom, INJ token’s doomed days may not be over yet.

Meta Platforms Earnings: META sinks 10% on lower Q2 revenue guidance Premium

This must be "opposites" week. While Doppelganger Tesla rode horrible misses on Tuesday to a double-digit rally, Meta Platforms produced impressive beats above Wall Street consensus after the close on Wednesday, only to watch the share price collapse by nearly 10%.