Welcome to my "Ranking, Rating and Score" article for the coming week.

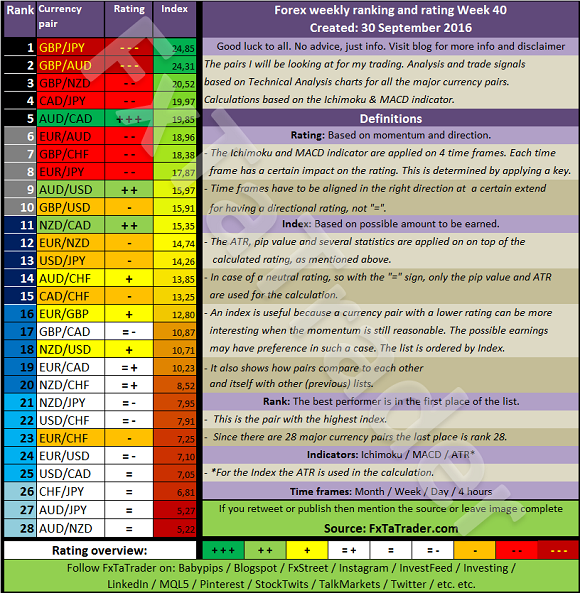

When looking at the Top 10 in the Weekly Ranking and Rating list we can see that for the coming week the following stronger currencies are well represented for going long: AUD(4X) followed by the JPY(3X). The weaker currencies are the GBP(5X) followed by the CAD(2X) and the EUR(2X).

A nice combination for coming week may be e.g:

- AUD/CAD with the EUR/JPY

- GBP/AUD with the CAD/JPY

- GBP/JPY with the EUR/AUD

Some of the pairs in the Top 10 comply for a longer term trade based on the Technical Analysis (TA) of the Daily and Weekly chart. For the coming week these seem to be:

GBP/AUD, GBP/NZD and AUD/CAD.

These are just a few examples and many other combinations are possible. The mentioned pair combinations can be traded at the same time according to the rules of the FxTaTrader strategy because these are all different currencies. Generally speaking, by not trading the same currency in the same direction more than once in the same Time Frame you may have better chances with lower risk. In any case it always seems better to spread risk and this can be done in many different ways.

When trading with more than 2 micro lots it is a good idea to have a diversification and depending on your bias it may offer opportunities by going long or short on a specific currency trading it against other currencies.

______________________________________

Ranking and Rating list

Analysis based on TA charts for all the major currency pairs. Good luck to all. No advice, just info. Every week the Forex ranking rating list will be prepared in the weekend. All the relevant Time Frames will be analyzed and the ATR and Pip value will be set.

______________________________________

For analyzing the best pairs to trade looking from a longer term perspective the last 13 weeks Currency Classification can be used in support.

This was updated on 25 September 2016 and is provided here for reference purposes:

Strong: USD, JPY, NZD. The preferred range is from 6 to 8.

Average: CHF, AUD. The preferred range is from 4 to 5.

Weak: EUR, GBP, CAD. The preferred range is from 1 to 3.

When comparing the 13 weeks Currency Classification with the pairs mentioned in the Ranking List above some would then become less interesting. On the other hand these pairs are at the top of the list partly also because of their volatility. It seems best to take positions for a short period then and take advantage of the high price movements.

With the FxTaTrader Strategy these pairs are not traded because these would be trades in the 4 Hour chart or in a lower Time Frame. Nevertheless they may offer good chances for the short term trader.

______________________________________

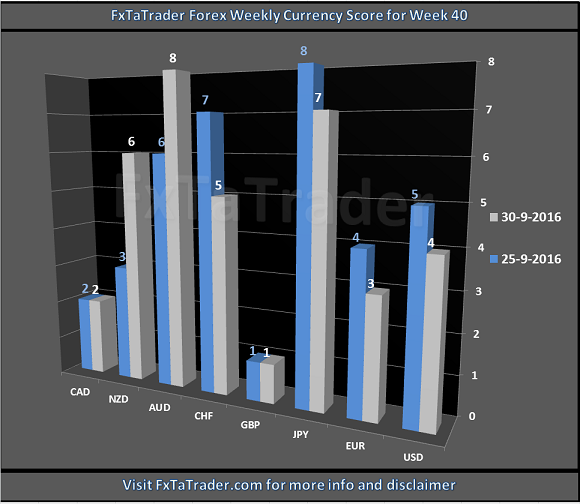

Currency Score Chart

The Currency Score analysis is one of the parameters used for the Ranking and Rating list which is published also in this article. The Currency Score is my analysis on the 8 major currencies based on the technical analysis charts using the MACD and Ichimoku indicator on 4 Time Frames: the monthly, weekly, daily and 4 hours. The result of the technical analysis is the screenshot here below.

When comparing the 13 weeks Currency Classification with the recent Currency Score, as provided in the image above, we can determine the deviations. In the article "Forex Strength and Comparison" this is analyzed in more detail. Currencies with a high deviation seem less interesting to trade because they are less predictable. A good example at the moment is e.g. theAUD and USD. Unless these currencies show a clear opportunity based on the longer term it seems best to avoid them.

The articles are my personal opinion, not recommendations, FX trading is risky and not suitable for everyone.The content is for educational purposes only and is aimed solely for the use by ‘experienced’ traders in the FOREX market as the contents are intended to be understood by professional users who are fully aware of the inherent risks in forex trading. The content is for 'Forex Trading Journal' purpose only. Nothing should be construed as recommendation to purchase any financial instruments. The choice and risk is always yours. Thank you.

Recommended Content

Editors’ Picks

EUR/USD climbs to 10-day highs above 1.0700

EUR/USD gained traction and rose to its highest level in over a week above 1.0700 in the American session on Tuesday. The renewed US Dollar weakness following the disappointing PMI data helps the pair stretch higher.

GBP/USD extends recovery beyond 1.2400 on broad USD weakness

GBP/USD gathered bullish momentum and extended its daily rebound toward 1.2450 in the second half of the day. The US Dollar came under heavy selling pressure after weaker-than-forecast PMI data and fueled the pair's rally.

Gold struggles around $2,325 despite broad US Dollar’s weakness

Gold reversed its direction and rose to the $2,320 area, erasing a large portion of its daily losses in the process. The benchmark 10-year US Treasury bond yield stays in the red below 4.6% following the weak US PMI data and supports XAU/USD.

Here’s why Ondo price hit new ATH amid bearish market outlook Premium

Ondo price shows no signs of slowing down after setting up an all-time high (ATH) at $1.05 on March 31. This development is likely to be followed by a correction and ATH but not necessarily in that order.

Germany’s economic come back

Germany is the sick man of Europe no more. Thanks to its service sector, it now appears that it will exit recession, and the economic future could be bright. The PMI data for April surprised on the upside for Germany, led by the service sector.