EURUSD: Diverging monetary policies in the US and the Eurozone support stronger Dollar

EURJPY: Yen: weakening slightly in the wake of weak GDP data

EURCHF: SNB adjusts its inflation forecast downwards and reaffirms minimum exchange rate

USD - Additional monetary easing by the ECB weakened euro

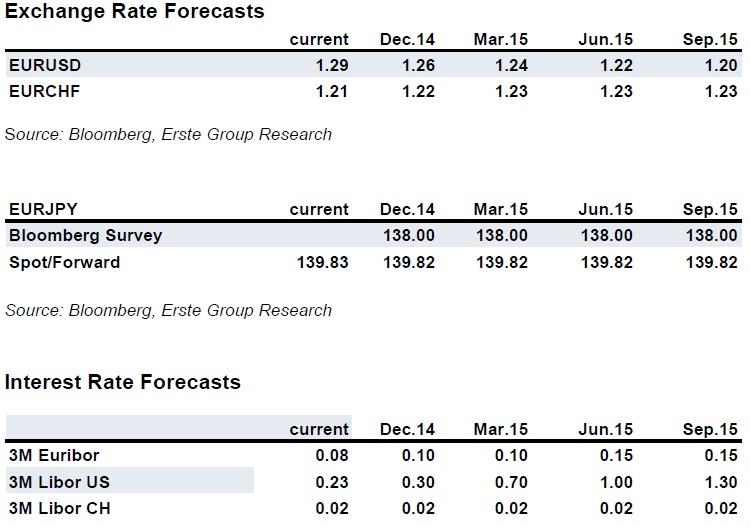

Over the last several weeks, the euro has experienced a considerable downslide vs. the dollar. Crucial to this were the recent decisions taken by the ECB’s monetary council. In addition to surprising further interest rate cuts, President Draghi announced new asset purchase programs. The details will only be released after the next meeting of the monetary council at the beginning of October, but it is clear that additional liquidity will come onto the markets and thus weigh on the euro. Economic conditions – low inflation and weak growth – will continue to support speculation regarding the further easing of monetary conditions and the additional liquidity provided by the ECB going forward will put downward pressure on the euro. At the same time, the first interest rate hike in the US is approaching. Economic data in the US show a continued upswing, which is not in line with short-term interest rates at current levels. In fact, we think that the labor market is already considerably tighter than the Fed and the majority of the market thinks, and we expect the first rate hike by the Fed earlier than the March 2015 date expected by the market. An earlier than expected start to monetary tightening should give additional support to dollar firming/euro weakening. Monetary policy in the US and the Eurozone will diverge for a considerable time, in our view. Accordingly, we expect continued weakening of the euro vs. the dollar.

JPY – weakening slightly in the wake of weak GDP data in the 2nd quarter

After a strong 1st quarter, Japan's economy has slumped significantly in the 2nd quarter (-1.8% q/q). As expected, household consumption especially (- 5.3% q/q) has declined markedly as a result of the sales tax hike (in force as of April). However, investment has also suffered a strong setback in the 2nd quarter (-4.5% q/q). External demand was weak as well (-0.5% q/q). Improving consumer sentiment in July and August (+9% vs. Q2) and an increase in new machinery orders in July (+1.4% vs. Q2) however point to a return to growth in the 3rd quarter.

Inflation at 3.3% in July remains far above the price stability target of 2%. Adjusted for the effects of the sales tax hike, the inflation rate has however remained stable at an unchanged 1.3% (thus remaining below the price stability target of 2%). Given that 10-year JGBs currently yield approx. 0.5%, investors are at present earning negative real returns in these securities. If this state of affairs continues, it seems possible that investors will increasingly look for alternative investments not denominated in yen. This in turn could create downside pressure on the yen.

The Bank of Japan expects that “inflation, adjusted for the direct effects of the sales tax hike, is likely to remain at around 1.3% for some time”. With the aim of achieving its price stability target of 2%, the Bank of Japan has confirmed in August that it will continue to implement its quantitative (increase in the monetary base by Yen 60-70 trillion per year) and qualitative measures at an unchanged pace. In view of the economy's strong slump in the 2nd quarter in conjunction with the government's plan to hike the sales tax in 2015 once again, central bank governor Kuroda has raised the prospect that further measures could be taken in the event that the price stability target of 2% seems jeopardized. In the wake of this, the yen weakened somewhat against the euro, and traded most recently around EURJPY 140. From a technical perspective, a sideways move should be anticipated for now, as prices have moved back above the 200 day moving average again (which is flattening out). According to the Bloomberg consensus forecast, analysts currently continue to expect a largely stable trend over a one-year time horizon at around EURJPY 138 (see table, page 4).

EURCHF: SNB adjusts its inflation forecast further downwards and reaffirms the minimum exchange rate of EURCHF 1.2

At an annualized rate of -0.2%, GDP growth in the second quarter of 2014 in Switzerland was distinctly lower than previously expected. Therefore, the SNB changed this year’s growth projection from around 2% in June to just below 1.5%. The recovery is likely to be delayed on the labor market and production capacities will remain underutilized for longer than previously assumed.

Due to the worsened global economic outlook and slower than expected growth in Switzerland, the SNB has adjusted its medium-term conditional inflation forecast downwards by 0.1 percentage points in 2015 (to 0.2%) and by 0.4 percentage points in 2016 (to 0.5%) compared to the one from June. For the current year, the inflation forecast of 0.1% remains unchanged. The forecast is based on the assumption that the Swiss franc will weaken over the forecast period. According to the SNB, ’the risk of deflation for Switzerland has thus increased again’.

The SNB has confirmed that, with the three-month Libor close to zero, ‘the minimum exchange rate remains the key instrument’ to avoid an undesirable tightening of monetary conditions. The SNB is prepared to ‘take further measures immediately’ if necessary. Should economic or inflation expectations decline further, the SNB could (at an interest rate close to zero) use other instruments to expand liquidity on the money markets (to lower interest rates on money and capital markets). Although this was not explicitly mentioned in the latest Monetary Policy Assessment, the likelihood of further monetary accommodation has increased, in our view. If the SNB used the purchase of foreign currencies as an instrument, this could in the mid-term result in a slight weakening of the Swiss franc against the euro. For the time being, we maintain our forecast for the EURCHF exchange rate to move within the bandwidth of 1.20-1.25, the yearly forecasted rate remains for the moment in the middle of this range, at about 1.23.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.