Dollar: ECB enters stage

Yen continues its depreciation against the euro

Minimum exchange rate remains ‘very important’ for SNB

US dollar

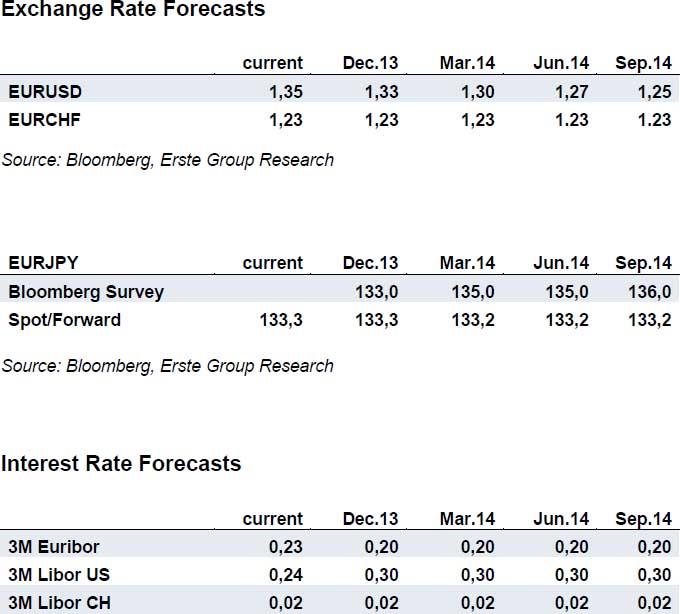

After the EURUSD exchange rate had reached 1.38, speculation about a potential ECB rate cut led to a countermovement. Eurozone inflation decreased to 0.7%, well below expectations, while the unemployment rate has been revised upwards, such that the likelihood for further action by the ECB has increased significantly. A rate cut would lower the euro’s attractiveness for short-term investments and thus weaken the currency. At the same time, the Fed’s monetary policy remains important. If the next US labor market reports were to disappoint, a slowdown of asset purchases would definitely be postponed until March (see Week Ahead). The larger balance sheet expansion (more liquidity) would in turn continue to weigh on the dollar. Overall, we have slightly revised our forecast, but the medium-term trend for a stronger dollar remains unchanged.

Yen continues its depreciation against the euro

In the course of the previous weeks the yen continued its depreciation against the euro and is currently at levels close to a four-year low. In the meantime, the economic and monetary measures in Japan seem to continue to unfold their effects. The core inflation rate (excluding energy and food) left negative territory in September for the first time since 2008. Indicators like the purchasing managers index and the Tankan index also reached levels which have not been observed for years. The Bank of Japan continues with its expansive monetary policy, which supports the development of the economy and price levels. However, the increase of sales taxes which is planned for April 2014 might have negative effects for the economy and inflation and could lead to new measures by the BoJ. This would tend to weaken the yen.

According to analysts, inflation rates in Japan should increase in the quarters ahead ant the BoJ should stick to its expansive monetary policy. Increasing differences in yields and in money supply (Fed vs. BoJ) would then tend to contribute to a weakening of the yen against the dollar. Surveys among analysts indicate that in the year ahead the yen should continue to depreciate, with the depreciation expected to be more distinct against the USD than against the EUR (cf. table on p. 4).

Minimum exchange rate remains ‘very important’ for SNB

In the previous weeks the Swiss franc proved its status as a safe haven and appreciated slightly in the course of the political tensions in Italy. Overall, it remains on levels around 1.23 EURCHF. The Swiss National Bank continues to emphasize that the enforcement of the minimum exchange rate remains important. According to President Thomas Jordan, the policy of the SNB remains the right one and the SNB will maintain the lower bound in the foreseeable future. There was thus ‘no reason at all for adjustments‘.

With its assessment the SNB confirms our view that while the situation on financial markets has stabilized, there remain risks for Switzerland. The SNB should continue to defend its minimum exchange rate, in particular to be able counteract a fast and distinct appreciation of the franc if tensions in the international environment emerge. The Swiss economy is developing well, however inflation rates are still on very low levels (-0.1% as of September). A flight into francs could thus increase deflationary pressure in Switzerland and increase economic risks. We continue to expect an exchange rate at levels around 1.23 EURCHF in the medium term.

Depending on the news flow larger fluctuations might occur.

This document is intended as an additional information source, aimed towards our customers. It is based on the best resources available to the authors at press time. The information and data sources utilised are deemed reliable, however, Erste Bank Sparkassen (CR) and affiliates do not take any responsibility for accuracy nor completeness of the information contained herein. This document is neither an offer nor an invitation to buy or sell any securities.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.