Analysis for April 26th, 2016

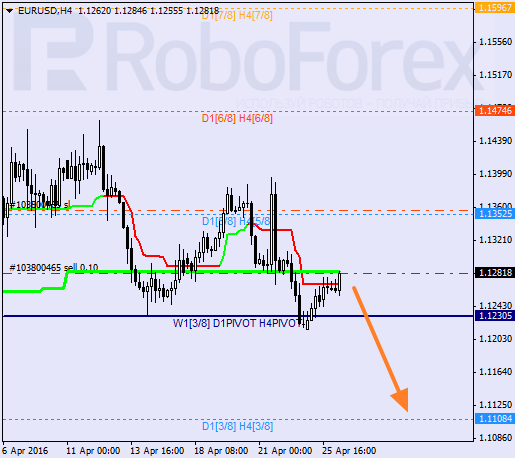

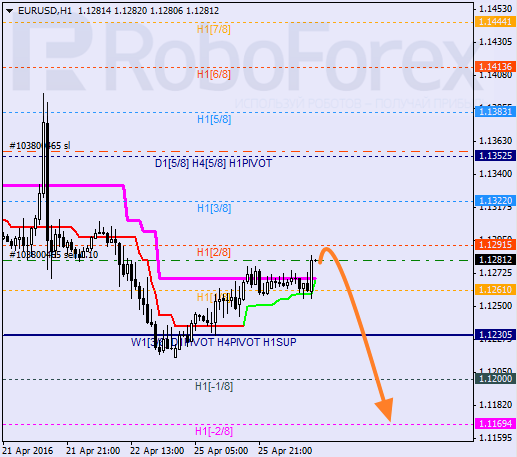

EURUSD, “Euro vs US Dollar”

Eurodollar is testing the daily Super Trend. If the price rebounds from it, the market may resume falling. If the pair stays under the 4/8 level, it will continue falling towards the 3/8 one.

At the H1 chart, the target of the current ascending correction is at the 2/8 level. If the price rebounds from it and later stays under Super Trends, the market may break the 0/8 level and return into the “oversold zone”.

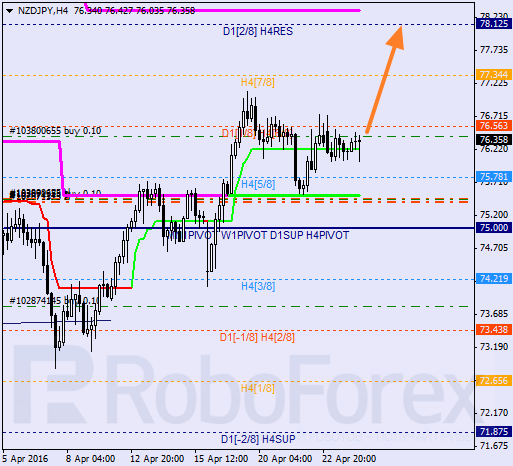

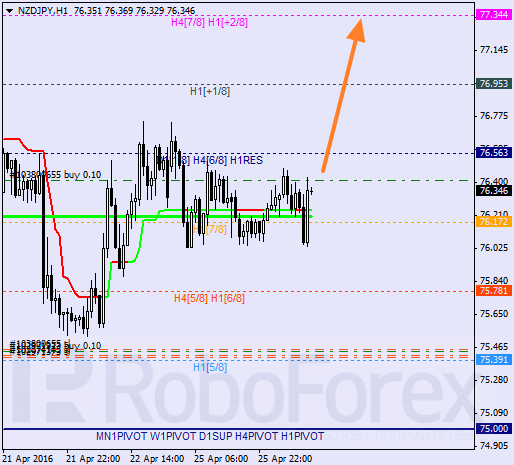

NZDJPY, “New Zealand Dollar vs Japanese Yen”

The pair is consolidating. Earlier, Super Trends formed “bullish cross”. If later the price is able to stay above the 6/8 level, it will continue growing towards 8/8 one.

At the H1 chart, the pair is moving very close to the “overbought zone”; bulls are supported by Super Trends. In the nearest future, the market may break the 8/8 level and continue moving upwards to reach the +2/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 after US data

EUR/USD stays in a consolidation phase below 1.0700 in the early American session on Wednesday. The data from the US showed a strong increase in Durable Goods Orders, supporting the USD and making it difficult for the pair to gain traction.

USD/JPY refreshes 34-year high, attacks 155.00 as intervention risks loom

USD/JPY is renewing a multi-decade high, closing in on 155.00. Traders turn cautious on heightened risks of Japan's FX intervention. Broad US Dollar rebound aids the upside in the major. US Durable Goods data are next on tap.

Gold trades on the back foot, manages to hold above $2,300

Gold struggles to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to reverse its direction.

Worldcoin looks set for comeback despite Nvidia’s 22% crash Premium

Worldcoin price is in a better position than last week's and shows signs of a potential comeback. This development occurs amid the sharp decline in the valuation of the popular GPU manufacturer Nvidia.

Three fundamentals for the week: US GDP, BoJ and the Fed's favorite inflation gauge stand out Premium

While it is hard to predict when geopolitical news erupts, the level of tension is lower – allowing for key data to have its say. This week's US figures are set to shape the Federal Reserve's decision next week – and the Bank of Japan may struggle to halt the Yen's deterioration.