Analysis for April 10th, 2015

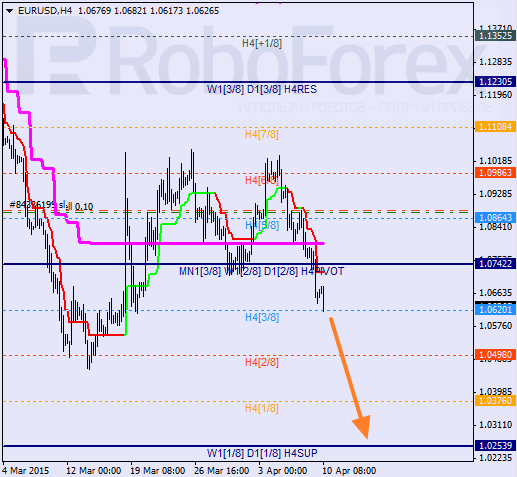

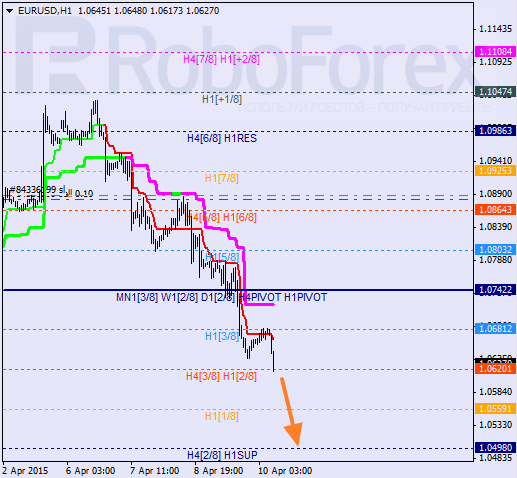

EURUSD, “Euro vs US Dollar”

Yesterday, Super Trends formed “bearish cross”. By now, Eurodollar has broken the 4/8 level, and if later it is able to stay below the 3/8 level, the market will continue falling to reach the 0/8 one. After reaching it, the pair may start a more serious correction.

As we can see at the H1 chart, the local target is at the 0/8 level. After reaching it, the price may start a short-term correction. Super Trends provide support. Most likely, in the nearest future, the pair will continue falling.

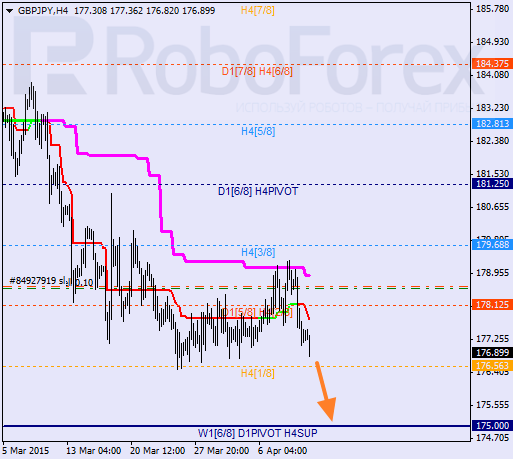

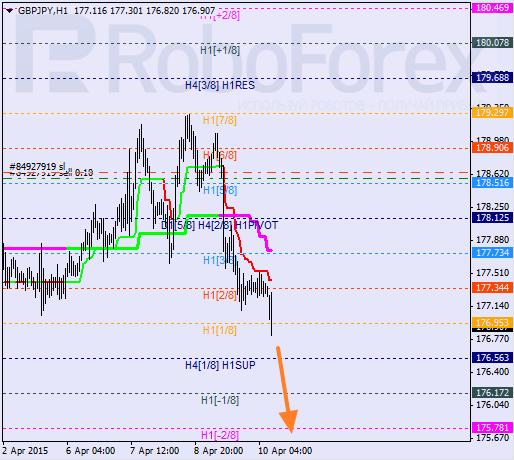

GBPJPY, “Great Britain Pound vs Japanese Yen”

The price has rebounded from the daily Super Trend several times and resumed falling. I’m holding a sell order with the stop loss in breakeven. The closest target is at the 0/8 level. After reaching it, the market may start a new correction.

At the H1 chart, the pair is moving at the bottom. Super Trends have formed “bearish cross”, which means that the pair may continue moving downwards. Possibly, the market may soon break the -2/8 level. In this case, the lines at the chart will be redrawn.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.