Analysis for February 27th, 2015

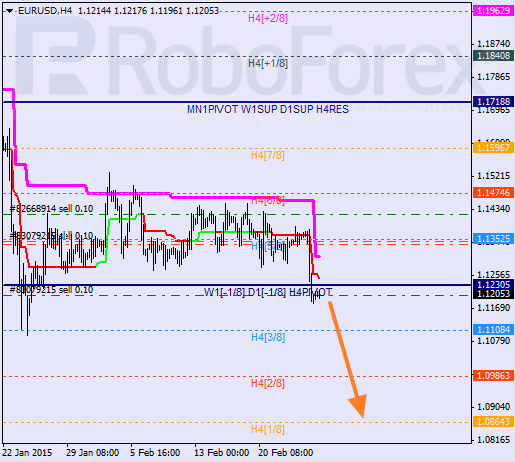

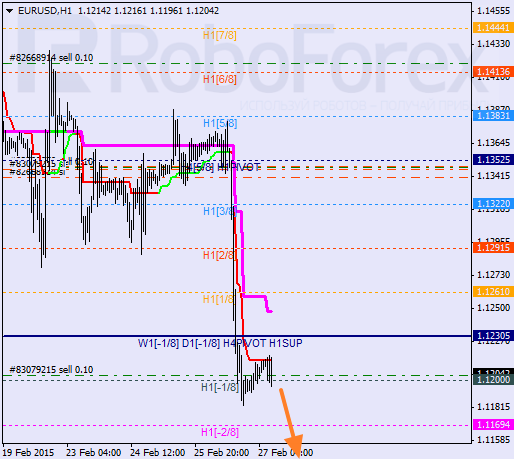

EUR USD, “Euro vs US Dollar”

Euro has left its month-long consolidation channel by making a fast descending movement. The price has broken the 4/8 level, and if later bears are able to stay below the 3/8 level, the market may continue falling towards the 1/8 one.

As we can see at the H1 chart, after breaking the 0/8 level, the pair is trying to stay inside “oversold zone”. During a local correction, I opened an additional sell order. In the future, the price may break the -2/8 level. In this case, the lines at the chart will be redrawn.

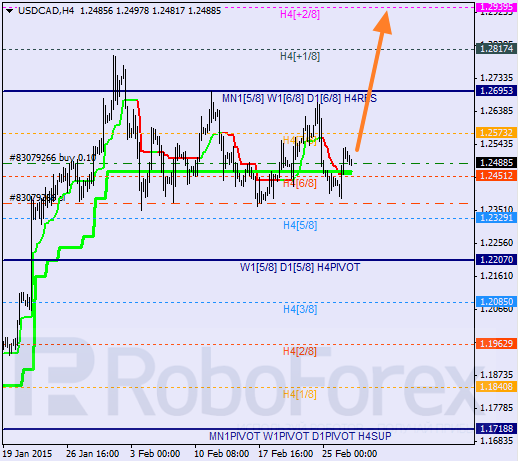

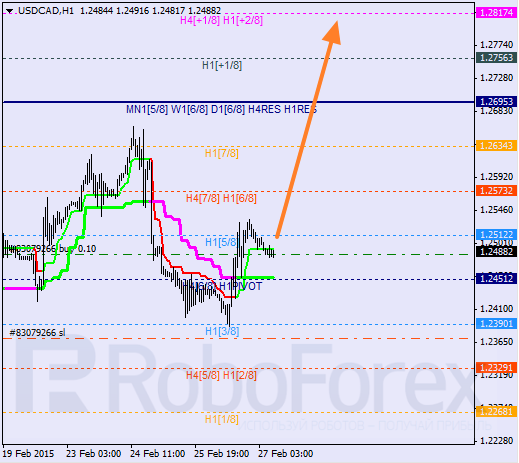

USD CAD, “US Dollar vs Canadian Dollar”

Canadian Dollar has rebounded from the 6/8 level several times, which means that the market may start another ascending movement. Probably, Super Trends may form “bullish cross” during the next several hours.

At the H1 chart, the price is moving in the middle. If the pair is able to stay above the 5/8 level during the day, it may continue growing towards the 8/8 one or even higher.

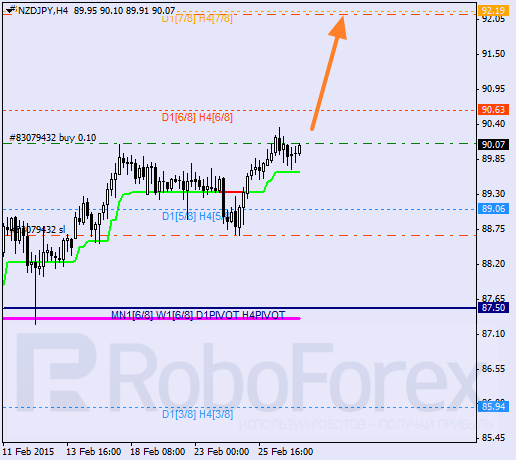

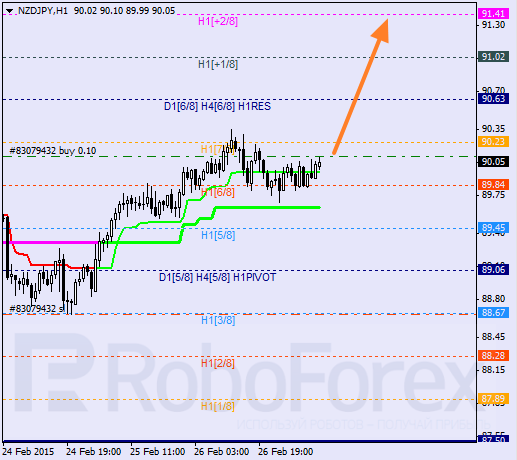

NZD JPY, “New Zealand Dollar vs Japanese Yen”

The pair s trying to rebounds from the H4 Super Trend. Earlier, the price was able to stay above the 5/8 level and continued growing towards the 8/8 one. Possibly, the market may reach a new local high during the day.

As we can see at the H1 chart, after rebounding from the 7/8 level, the pair was supported by the 6/8 level. Moreover, the price has rebounded from this level several times, which means that it may start a new ascending movement towards the 8/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.