Analysis for July 9th, 2014

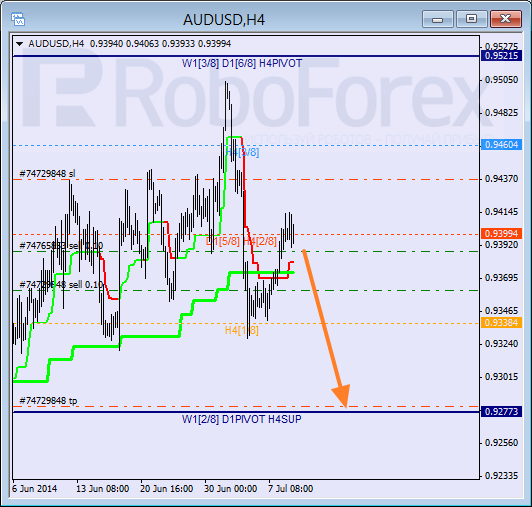

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar is still being corrected and trying to find support at the 2/8 level; main target is still at the 0/8 one. If later price breaks Super Trends downwards again, I’ll increase my short position.

Pair is moving in the middle of H1 chart. If later pair breaks Super Trends and the 3/8 level downwards, price will continue falling down towards the 0/8 one.

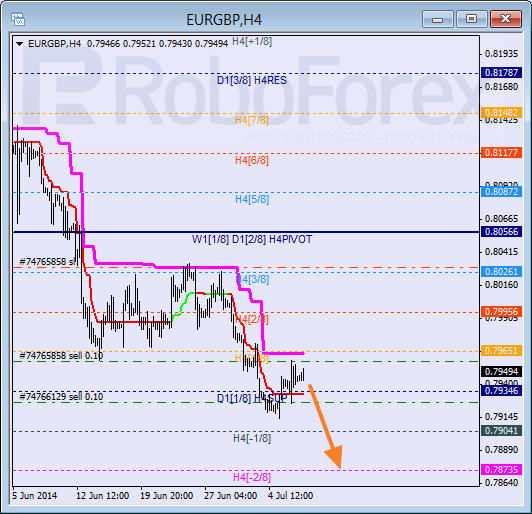

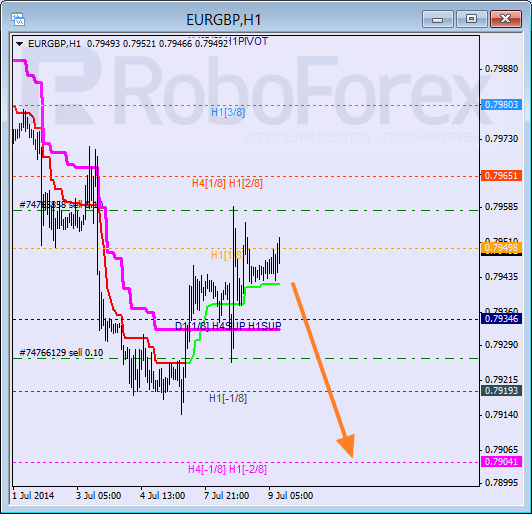

EUR GBP, “Euro vs Great Britain Pound”

Price is still being corrected between Super Trends. Possibly, during the day bears may try to break the 0/8 level downwards. If they succeed, instrument will continue falling down towards the -2/8 level.

As we can see at H1 chart, bears were supported by the 1/8 level, from which price rebounded several times. In the near term, instrument is expected to break the -2/8 level. In this case, lines at the chart will be redrawn.

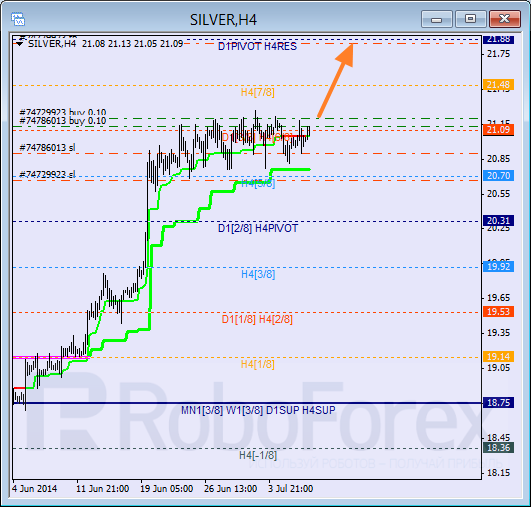

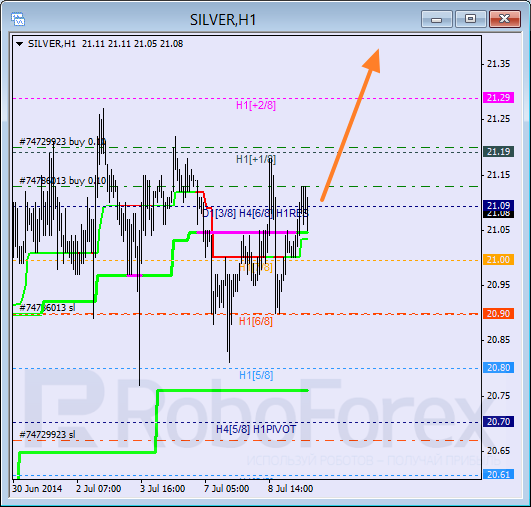

XAG USD, “Silver vs US Dollar”

Silver is still consolidating and supported by Super Trends; main target is at the 8/8 level. After reaching it, instrument may start more serious correction.

As we can see at H1 chart, Silver rebounded from the 6/8 level three times, which means that bulls may start new ascending movement. Possibly, in the nearest future Super Trends may form “bullish cross” and instrument will continue growing up to break the +2/8 level.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.