Analysis for April 23rd, 2014

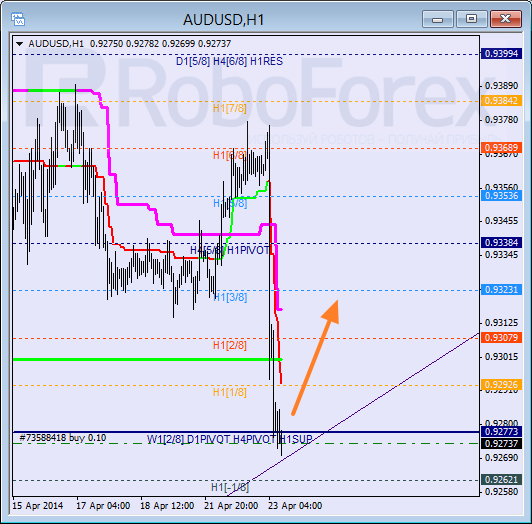

AUDUSD, “Australian Dollar vs US Dollar”

Australian Dollar is still being corrected; right now pair is testing the 4/8 level. In addition to that, we can see that market is moving close to lower border of ascending channel. That’s why I opened buy order, in case price rebounds from current levels and starts growing up again.

As we can see at H1 chart, bears are testing the 0/8 level. Possibly, they may rebound from it and if they do, I’ll move stop on my buy order into the black. If later pair breaks Super Trends upwards, I’ll increase my long position.

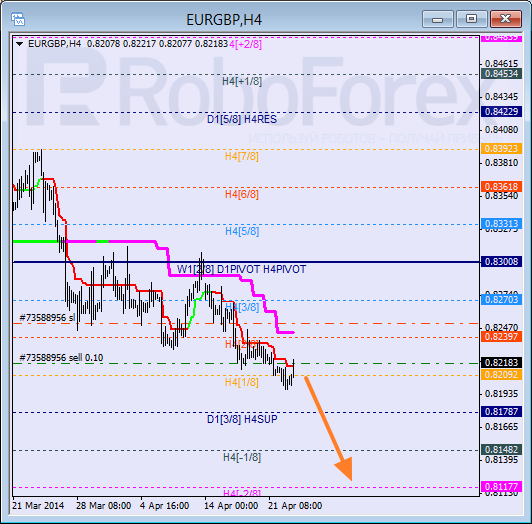

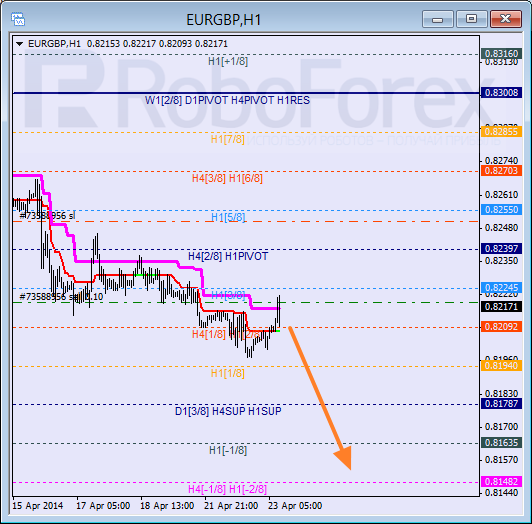

EURGBP, “Euro vs Great Britain Pound”

Pair is being corrected again. Possibly, bears may find support from H4 Super Trend one more time. If market breaks H4 Super Trend, price may break the 0/8 level and enter “oversold zone”.

At H1 chart, Super Trends are still influenced by “bearish cross”. Possibly, price may try to test the 3/8 level. If bears rebound from it, market will move towards the 0/8 one and break it.

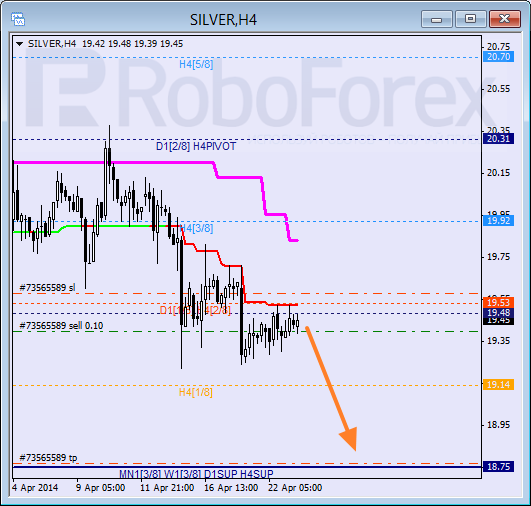

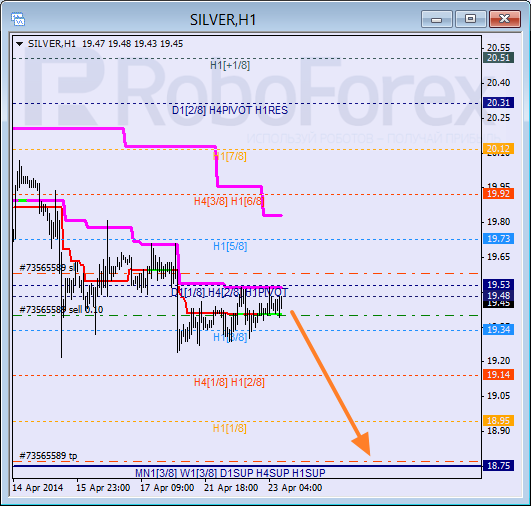

XAGUSD, “Silver vs US Dollar”

Silver is still being corrected. Earlier price rebounded from H4 Super Trends several times. In the near term, instrument is expected to break local minimum and continue moving downwards to reach the 0/8 level.

As we can see at H1 chart, Silver may try to test Super Trend and the 4/8 level. If Silver rebounds from these levels and then is able to stay below the 3/8 level, instrument may start new descending movement towards the 0/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD consolidates gains below 1.0700 amid upbeat mood

EUR/USD is consolidating its recovery below 1.0700 in the European session on Thursday. The US Dollar holds its corrective decline amid improving market mood, despite looming Middle East geopolitical risks. Speeches from ECB and Fed officials remain on tap.

GBP/USD clings to moderate gains above 1.2450 on US Dollar weakness

GBP/USD is clinging to recovery gains above 1.2450 in European trading on Thursday. The pair stays supported by a sustained US Dollar weakness alongside the US Treasury bond yields. Risk appetite also underpins the higher-yielding currency pair. ahead of mid-tier US data and Fedspeak.

Gold appears a ‘buy-the-dips’ trade on simmering Israel-Iran tensions

Gold price attempts another run to reclaim $2,400 amid looming geopolitical risks. US Dollar pulls back with Treasury yields despite hawkish Fedspeak, as risk appetite returns.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.