Analysis for April 22nd, 2014

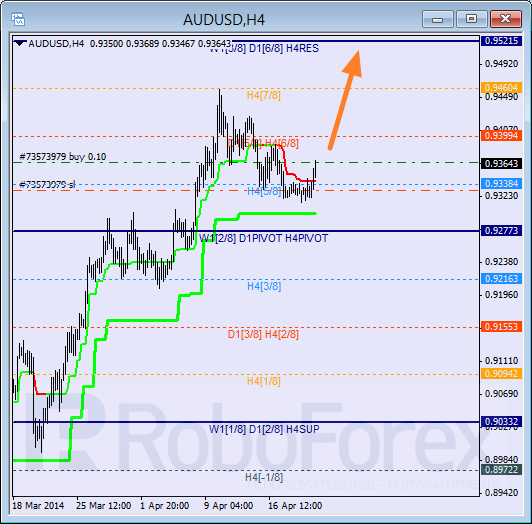

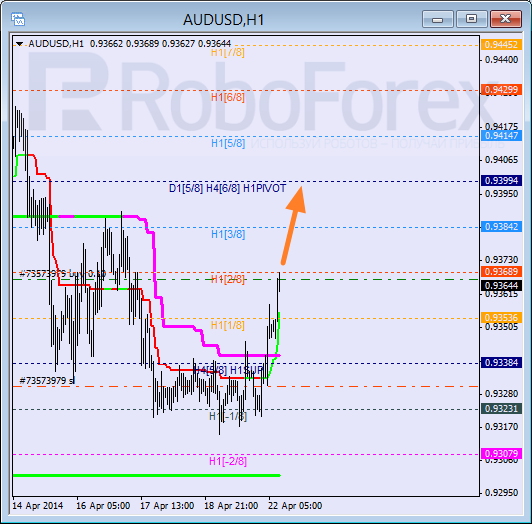

AUD USD, “Australian Dollar vs US Dollar”

Australian Dollar broke H4 Super Trend upwards, and I decided to close my sell order and opened bought one. Target for bulls is at the 8/8 level. Possibly, instrument may break local maximum during the next several days.

As we can see at H1 chart, Super Trends formed “bullish cross”. Most likely, market will reach the 4/8 level during the day, break it, and continue growing up. I’ll move stop on my order into the black as soon as instrument continues moving upwards.

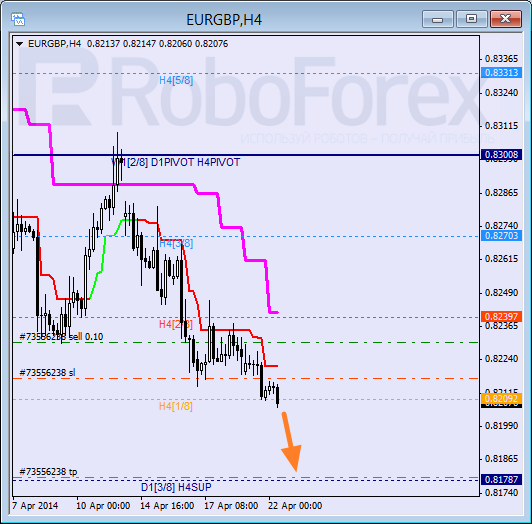

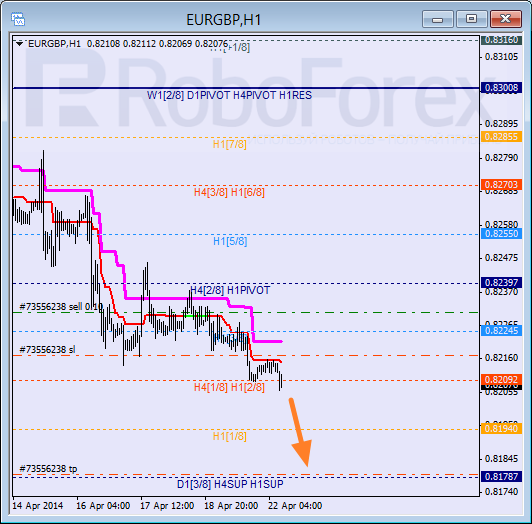

EUR GBP, “Euro vs Great Britain Pound”

Pair reached new minimum. Earlier price rebounded from H4 Super Trend and I opened sell order; stop is already in the black. If market is able to stay below the 1/8 level, price will continue falling down towards the 0/8 one.

At H1 chart, after slight consolidation, price started moving downwards; bears are supported by Super Trends. If later pair rebounds from the 0/8 level, market will start new correction.

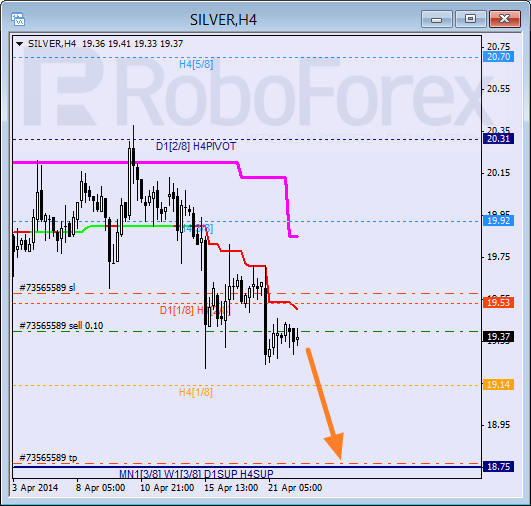

XAG USD, “Silver vs US Dollar”

Silver is still being corrected. Earlier price rebounded from H4 Super Trends several times. In the near term, instrument is expected to break local minimum and continue moving downwards to reach the 0/8 level.

As we can see at H1 chart, Silver may try to test Super Trend and the 4/8 level. If Silver rebounds from these levels and then is able to stay below the 3/8 level, instrument may start new descending movement towards the 0/8 one.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0700, awaits key US data

EUR/USD clings to gains near the 1.0700 level in early Europe on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

USD/JPY keeps pushing higher, eyes 156.00 ahead of US GDP data

USD/JPY keeps breaking into its highest chart territory since June of 1990 early Thursday, recapturing 155.50 for the first time in 34 years as the Japanese Yen remains vulnerable, despite looming intervention risks. The focus shifts to Thursday's US GDP report and the BoJ decision on Friday.

Gold closes below key $2,318 support, US GDP holds the key

Gold price is breathing a sigh of relief early Thursday after testing offers near $2,315 once again. Broad risk-aversion seems to be helping Gold find a floor, as traders refrain from placing any fresh directional bets on the bright metal ahead of the preliminary reading of the US first-quarter GDP due later on Thursday.

Injective price weakness persists despite over 5.9 million INJ tokens burned

Injective price is trading with a bearish bias, stuck in the lower section of the market range. The bearish outlook abounds despite the network's deflationary efforts to pump the price.

Meta takes a guidance slide amidst the battle between yields and earnings

Meta's disappointing outlook cast doubt on whether the market's enthusiasm for artificial intelligence. Investors now brace for significant macroeconomic challenges ahead, particularly with the release of first-quarter GDP data.