Analysis for November 11th, 2013

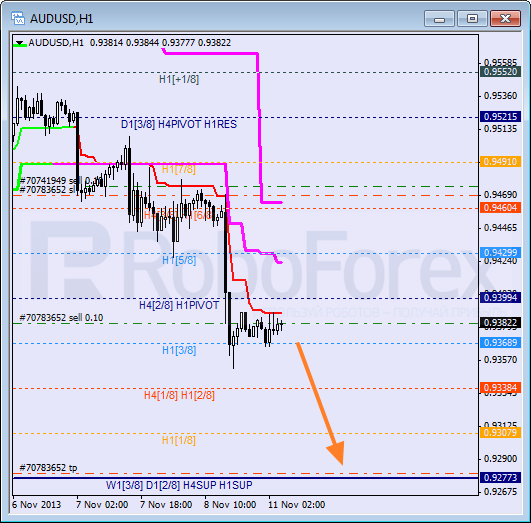

AUD/USD

After rebounding from Super Trends, Australian Dollar continued moving downwards. Right now, market is consolidating and I’ve decided to open another sell order. Main target is still at the 0/8 level.

Price is moving in the middle of H1 chart and supported by Super Trend. In the near term, pair is expected to start falling down again towards the 0/8 level.

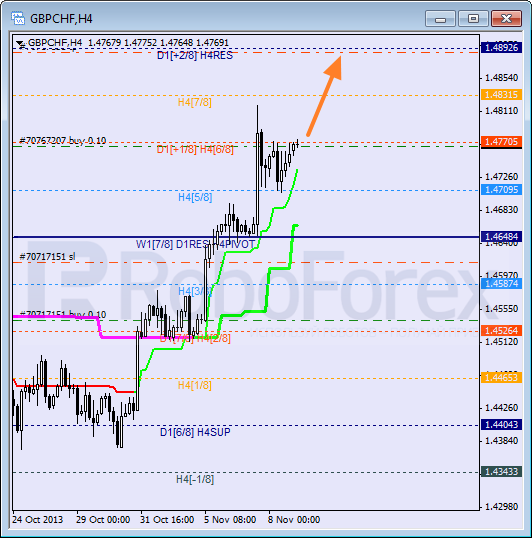

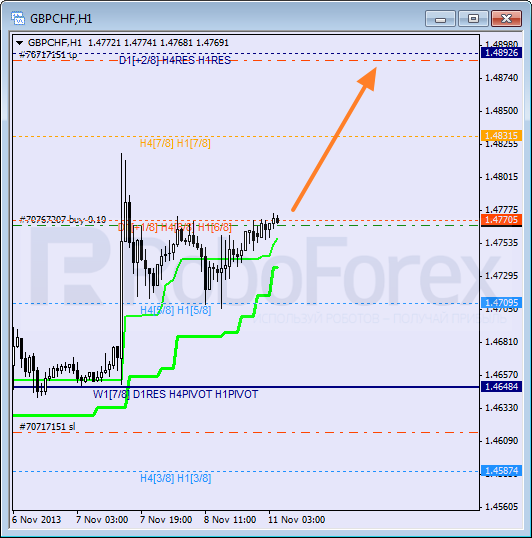

GBP/CHF

Pair is being corrected; earlier Super Trends formed “bullish cross”. Possibly, price may break maximum during Monday. Take Profits on my buy orders are placed at the 8/8 level.

Levels at H4 and H1 charts are completely the same; bulls are supported by Super Trends, from which price has already rebounded several times. I’ll move stops higher as soon as pair breaks maximum.

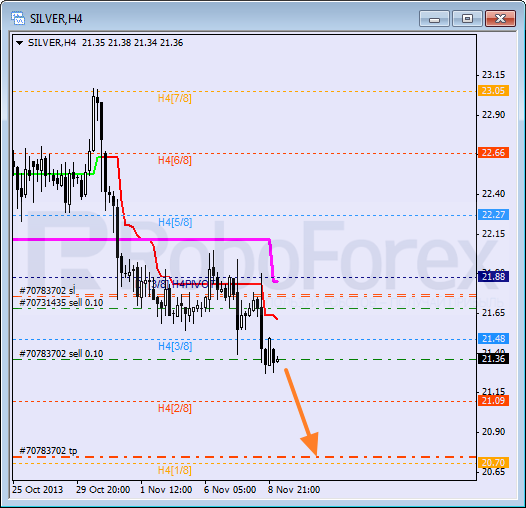

SILVER

Bear continue pushing Silver downwards. During correction, I opened on more sell order. Closest target is at the 1/8 level, which may later become starting point of new correction.

At H1 chart, market is moving inside “oversold zone”. During local correction, bulls weren’t able to keep price above Super Trends. In the future, instrument is expected to break the -2/8 level. In this case, lines at the chart will be redrawn.

Before you enter foreign exchange and stock markets, you have to remember that trading currencies and other investment products is trading in nature and always involves a considerable risk. As a result of various financial fluctuations, you may not only significantly increase your capital, but also lose it completely. Therefore, our clients have to assure RoboForex that they understand all the possible consequences of such risks, they know all the specifics, rules and regulations governing the use of investment products, including corporate events, resulting in the change of underlying assets. Client understands that there are special risks and features that affect prices, exchange rates and investment products.

Recommended Content

Editors’ Picks

AUD/USD keeps the red below 0.6400 as Middle East war fears mount

AUD/USD is keeping heavy losses below 0.6400, as risk-aversion persists following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY recovers above 154.00 despite Israel-Iran escalation

USD/JPY is recovering ground above 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price pares gains below $2,400, geopolitical risks lend support

Gold price is paring gains to trade back below $2,400 early Friday, Iran's downplaying of Israel's attack has paused the Gold price rally but the upside remains supported amid mounting fears over a potential wider Middle East regional conflict.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.