Chinese Stock Woes:

After what seemed like a settled week, Chinese stocks were back in the news overnight with some massive falls ripping through markets. The Shanghai Composite Index capitulated, suffering an 8.5% loss on the day, its worst performance since February 2007!

This drop was on the back of concerns that the Chinese government is faltering on its measures to artificially prop up the market.

“Investors are not confident that the bull market will return any time soon.”

Confidence in the market is completely shot and we are going to see a few more wild swings yet to come. The manipulation of the market that the Chinese government is undertaking as well as the ever unreliable data releases described by some traders on social media as the government ‘spinning the random number generator’ has done nothing to ease concerns.

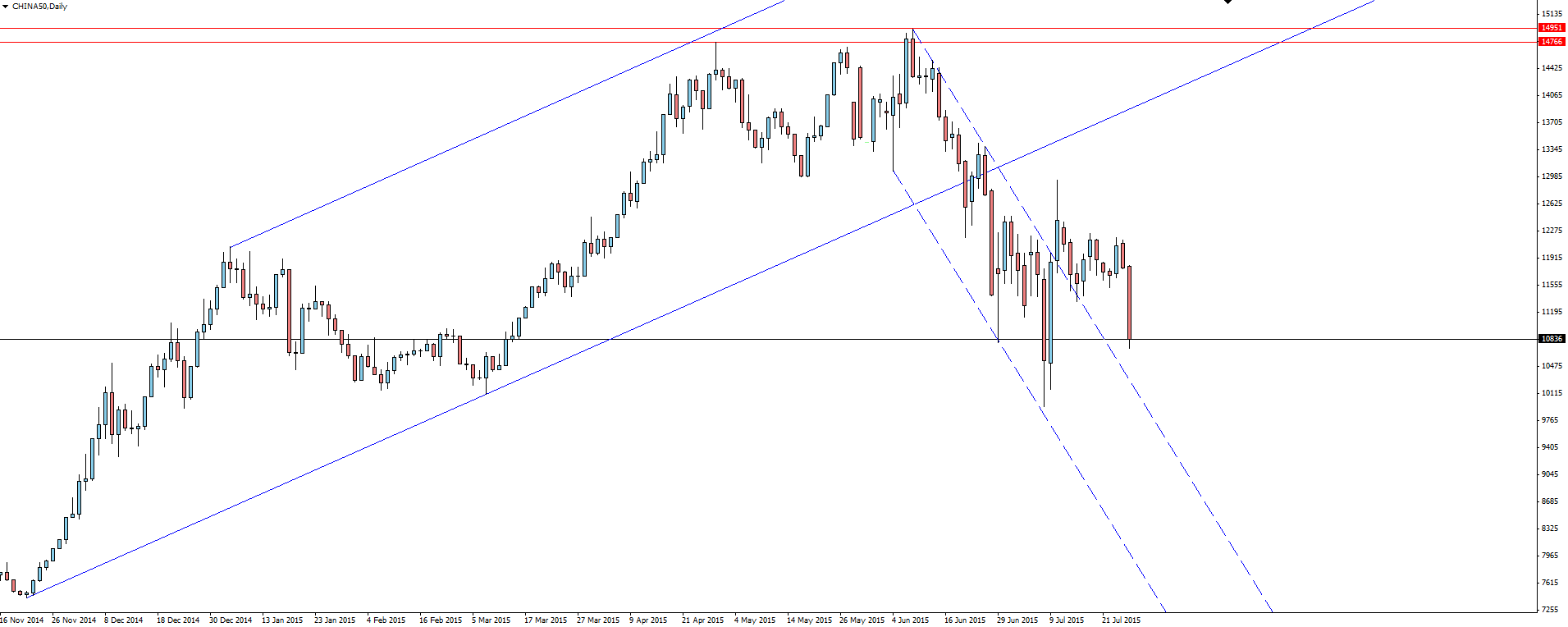

CHINA50 Daily:

Click on chart to see a larger view.

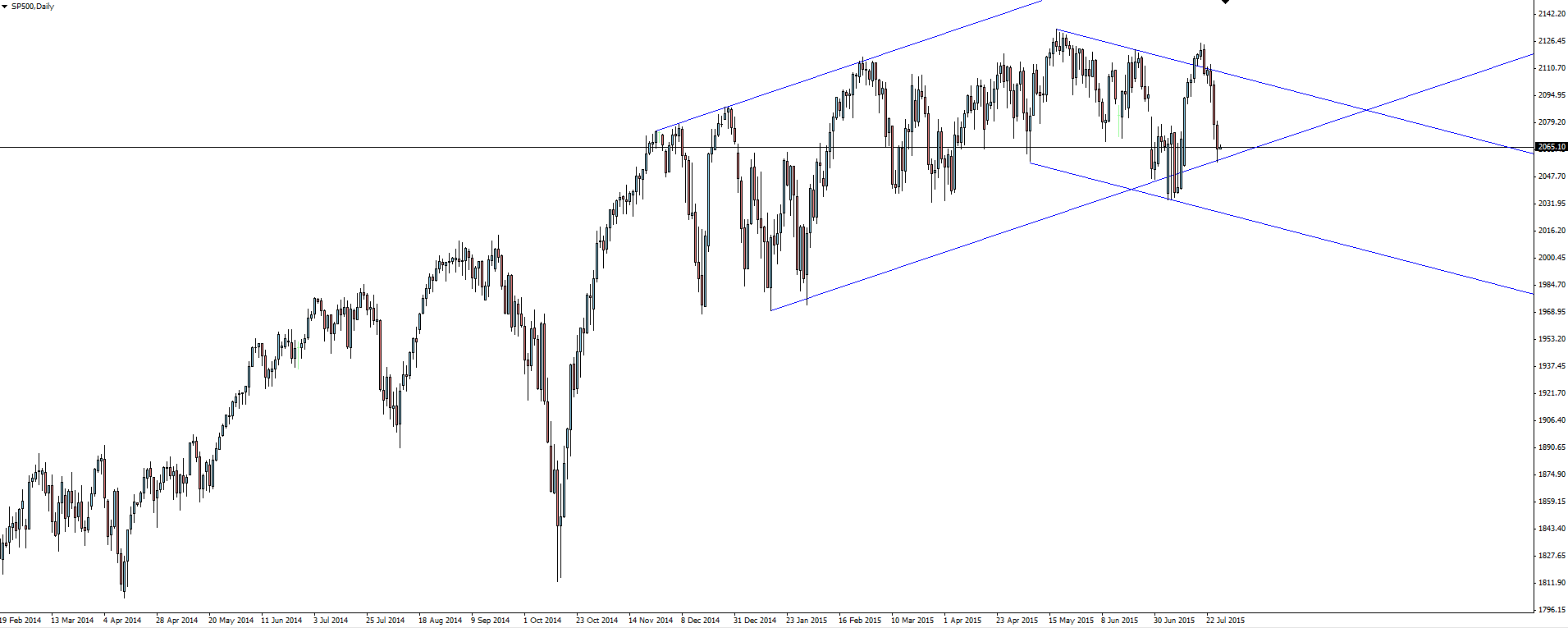

These sharp moves in China are also felt across the globe with US markets feeling the pinch. With FOMC jitters and corporate earnings spurring on the declines, a loss of confidence in China has not helped matters, sending the SP500 well off its highs down to significant channel support.

SP500 Daily:

Click on chart to see a larger view.

———-

On the Calendar Tuesday:

GBP Prelim GDP

USD CB Consumer Confidence

———-

Chart of the Day:

As its FOMC week, we have been looking at the majors heading into Wednesday’s meeting. Its AUD/USD’s turn today as we take a look at the weekly and daily charts below.

AUD/USD Weekly:

Click on chart to see a larger view.

What a fall from grace the Aussie has suffered. The good old days for Aussie tourists getting $1.10 in the US are certainly long forgotten.

More recently, price had a bit of a pause between 75 and 80c but that was short lived as yet another major support level crumbled to get where we currently sit.

This marked level that price is approaching is massively important, being both major weekly trend line support dating back 14 years to 2001, while also lining up with (relatively) short term channel support dating back to the change of trend when price came off its highs in 2012.

AUD/USD Daily:

Click on chart to see a larger view.

Zooming into the daily, price is currently in a bit of a ‘no mans land’, sitting between trend line support and the marked horizontal support/resistance level that could be used to manage your risk from the short side.

If the Fed rhetoric isn’t as hawkish as expected and it looks like more delays on interest rate hikes, price will bounce and the horizontal resistance zone around the 75c level will come into play. If you’re still a USDX bull then this is a nice area to manage your risk around and possibly short into it.

However, if hikes are as imminent as many economists are predicting, then the major weekly support level could be in danger. I can’t stress enough just how significant this confluence of weekly support is and even on the back of a hawkish Fed, we could see a bit of sell the rumour, buy the news come into play on AUD/USD.

Recommended Content

Editors’ Picks

AUD/USD tumbles toward 0.6350 as Middle East war fears mount

AUD/USD has come under intense selling pressure and slides toward 0.6350, as risk-aversion intensifies following the news that Israel retaliated with missile strikes on a site in Iran. Fears of the Israel-Iran strife translating into a wider regional conflict are weighing on the higher-yielding Aussie Dollar.

USD/JPY breaches 154.00 as sell-off intensifies on Israel-Iran escalation

USD/JPY is trading below 154.00 after falling hard on confirmation of reports of an Israeli missile strike on Iran, implying that an open conflict is underway and could only spread into a wider Middle East war. Safe-haven Japanese Yen jumped, helped by BoJ Governor Ueda's comments.

Gold price jumps above $2,400 as MidEast escalation sparks flight to safety

Gold price has caught a fresh bid wave, jumping beyond $2,400 after Israel's retaliatory strikes on Iran sparked a global flight to safety mode and rushed flows into the ultimate safe-haven Gold. Risk assets are taking a big hit, as risk-aversion creeps into Asian trading on Friday.

WTI surges to $85.00 amid Israel-Iran tensions

Western Texas Intermediate, the US crude oil benchmark, is trading around $85.00 on Friday. The black gold gains traction on the day amid the escalating tension between Israel and Iran after a US official confirmed that Israeli missiles had hit a site in Iran.

Dogwifhat price pumps 5% ahead of possible Coinbase effect

Dogwifhat price recorded an uptick on Thursday, going as far as to outperform its peers in the meme coins space. Second only to Bonk Inu, WIF token’s show of strength was not just influenced by Bitcoin price reclaiming above $63,000.