Jobless Claims:

Overnight’s Unemployment Claims number out of the US smashed expectation. The 255K print beat the 279K expectation, meaning the number came in at its lowest level since 1973! What were you doing in 1973?

“USD Unemployment Claims 255K v 279K expected.”

This means that since March, unemployment claims have been well below the 300K magic number that is seen as par for an improving labour market. We all know how much human beings, and especially the special types who trade, love round numbers.

Back in early July, Janet Yellen made the following comment on the labour market, highlighting what she saw as remaining slack:

“It is my judgment that the lower level of the unemployment rate today probably does not fully capture the extent of slack remaining in the labour market – in other words, how far away we are from a full-employment economy,”

This number can be viewed as a tightening of that slack. Picture the job market as a loose, coiled up piece of rope and this print meaning employers are pulling it tighter with each month.

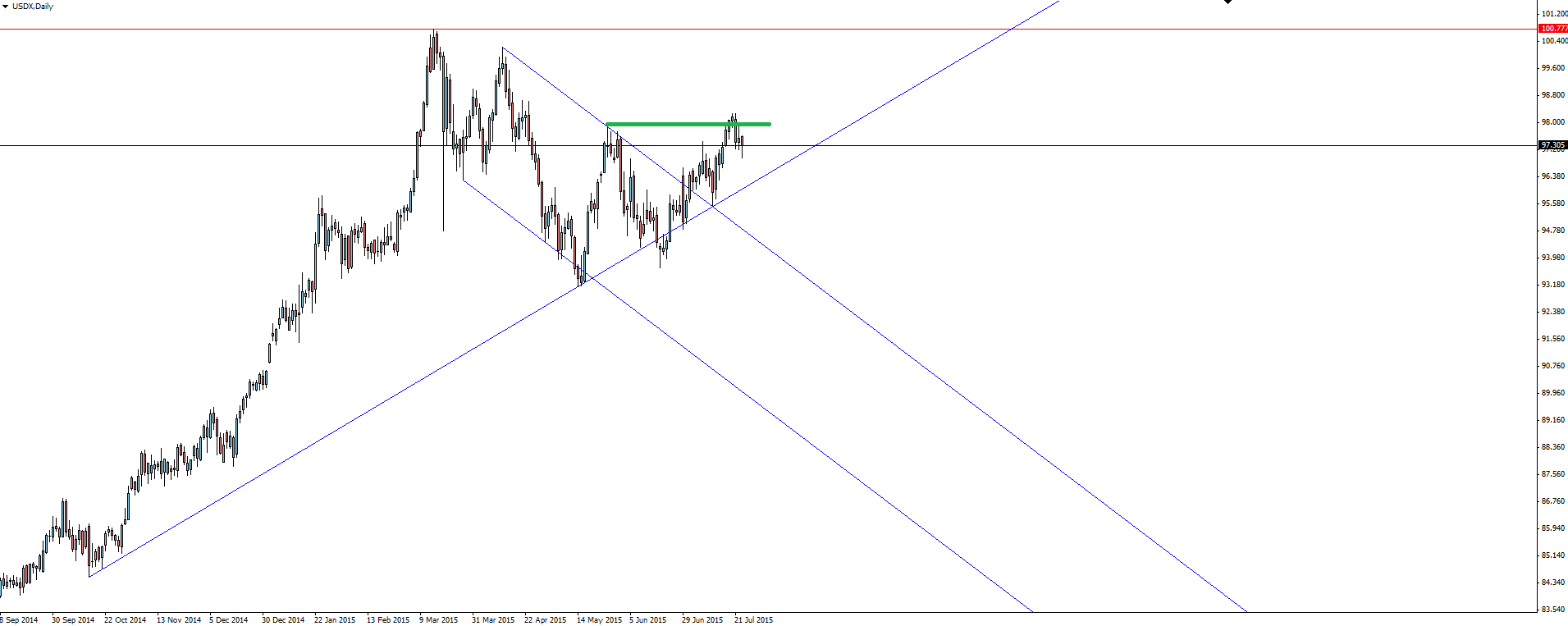

USDX Daily:

Click on chart to see a larger view.

With this excellent print, I have to say that I expected more from the USDX. But the fact that the daily candle left that long wick into previous resistance now being tested as support tells me that the buyers are still in charge of this market.

Next week we have FOMC and US GDP which will he HUGE catalysts for the Fed to possibly pull the trigger on a rate hike in September. Let’s just say that I’d much rather be long USD going into these releases than short anyway.

———-

On the Calendar Friday:

NZD Trade Balance (-60M v +100M expected)

CNY Markit Flash Manufacturing PMI

EUR French Flash Manufacturing PMI

EUR German Flash Manufacturing PMI

EUR Flash Manufacturing PMI

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.