Morning View:

Good Morning Traders.

I hope you enjoyed your Bank Holiday Monday. Whether you actually observed it or not, the markets definitely did, putting in a lackluster day of sideways trading in a tight range. Holiday trading is a bit of a coin flip in terms of whether you get what happened yesterday where price doesn’t really move, or you can get crazy whipsawing price action if something spooks the already thin market.

As always though, Greece is never far from the news, and Finance Minister Varoufakis gave us this article which for me adds a bit of a human element to the austerity issue.

“The problem is simple: Greece’s creditors insist on even greater austerity for this year and beyond – an approach that would impede recovery, obstruct growth, worsen the debt-deflationary cycle, and, in the end, erode Greeks’ willingness and ability to see through the reform agenda that the country so desperately needs. Our government cannot – and will not – accept a cure that has proven itself over five long years to be worse than the disease.”

As a trader, it is easy to detach yourself from what the word ‘austerity’ actually means for the people of Greece. The question of how can Greece expect the ever get out of this mess if it is never allowed to spur economic growth has always been for me why they will be forced to leave the Eurozone. ‘Monetary asphyxiation’ as Varoufakis so vividly describes policy being forced upon his government is not and never will be the answer.

———-

On the Calendar Today:

Already got a trade balance beat out of New Zealand early in Asia which saw the Kiwi spike up but has given almost all of it’s gains back as I sit down to my desk now. The market is primarily USD driven at the moment and USD is king.

No market moving tier 1 data until we hit the US session tonight with Durable Goods and Consumer Confidence.

Tuesday:

NZD Trade Balance (123M v expected 105M)

USD Core Durable Goods Orders

USD CB Consumer Confidence

———-

Chart of the Day:

NZD/USD Daily:

Click on chart to see a larger view.

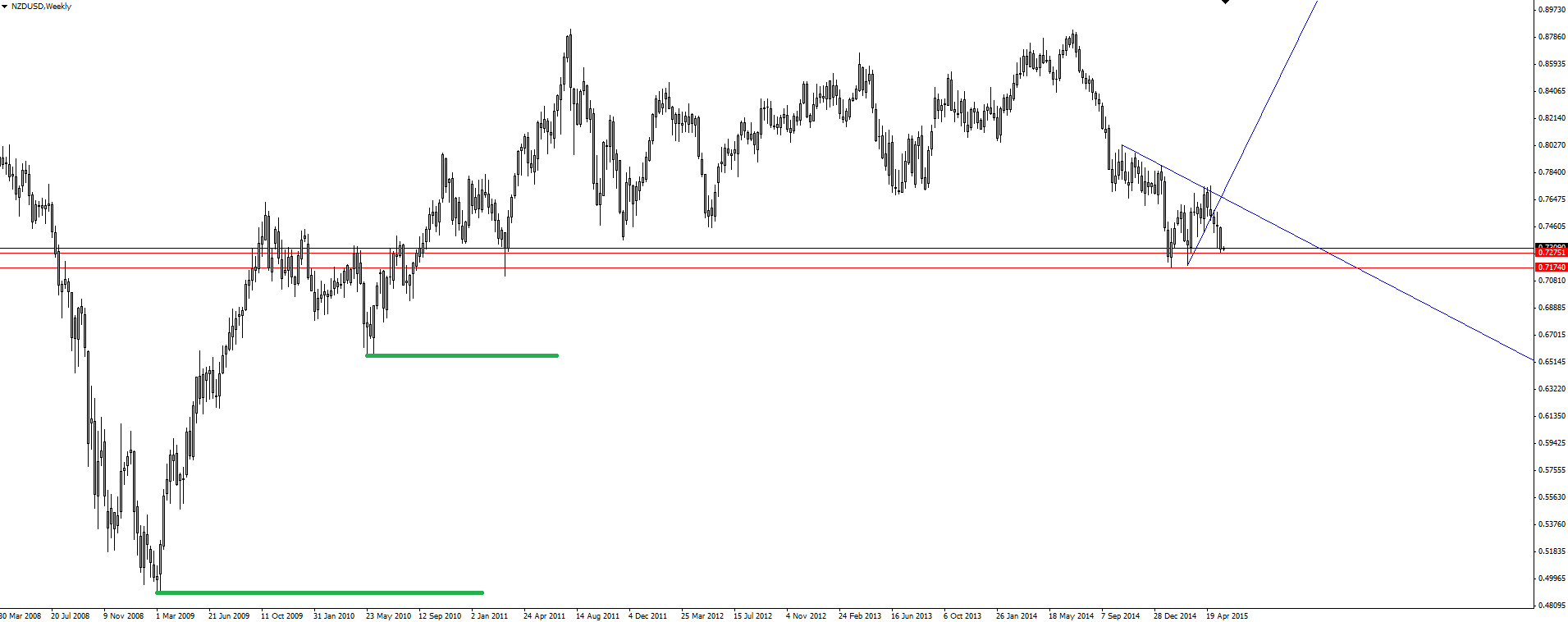

With further RBNZ rate cuts on the cards, as the Fed driven USD theme kicks back in, the Kiwi could be one of the pairs that has the most to lose. The pair gave back almost all it’s 600 pip fall after the RBNZ successfully gave it a good jawboning. The fact that it was back above those levels before this USD driven fall tells me that if/when the RBNZ make their move, then the pair will look for new lows.

I am happy selling any sort of rally and possibly looking to get in early and playing for a break of the marked support level. Take a look at the Weekly chart and you can see that there’s not much left in terms of support below that level and things could possibly get ugly quite quickly.

NZD/USD Weekly:

Click on chart to see a larger view.

Position yourself for these big moves before they actually happen.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.