Morning View:

Good Morning from the Vantage FX offices in a dreary Sydney. I hope the weather where you’re reading from is a little nicer than what we’re battling here.

We see the Japanese Monetary Policy Statement and Press Conference on the calendar today during the Asian session and as always, it’s a tentative release scheduled for after the meeting has concluded. Like the rest of Finance Twitter, you too can draw your own conclusions as to whether a longer meeting means a possible rumoured upgrade to Japan’s economic outlook which would diminish the chance of further QE and see the Yen receive a boost.

Having a look at the GBP/JPY chart ahead of the release, price is poised nicely for a move either way. One of those charts that shows how closely intertwined technicals are with the fundamentals that push the major levels.

GBP/JPY Daily:

Click on chart to see a larger view.

Price is sitting nicely at the key daily swing high resistance level from November 2014.

On this blog, I have have previously talked about how the British election result kicked the pair off it’s major trend line and after that flag resistance that price re-tested as support price hasn’t even paused on the way to the highs we sit at now.

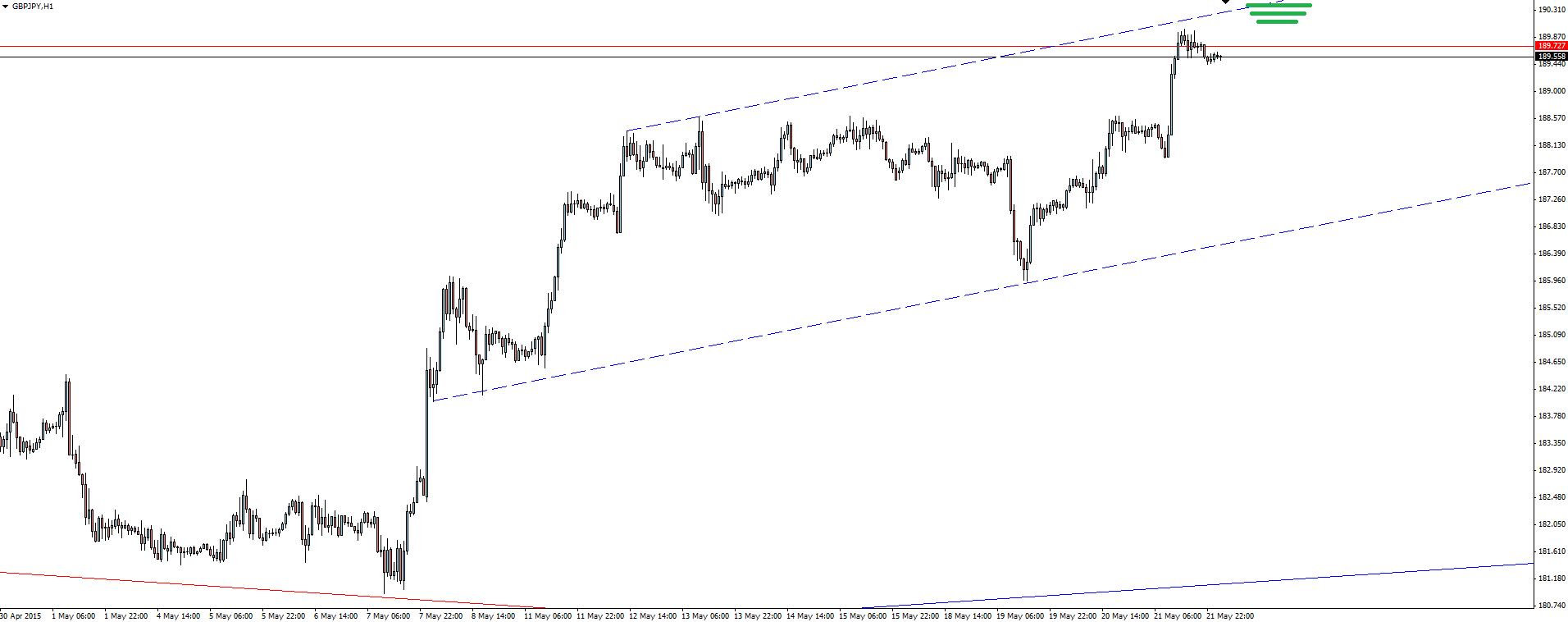

GBP/JPY Hourly:

Click on chart to see a larger view.

Zooming into the Hourly chart, price is trending up in a tight channel which it currently is sitting at the top of. Yes there is still room to push the upper bounds of the channel and have it still hold, but combined with the swing high I would rather be a seller than buyer up here.

In play if the BOJ statement reveals nothing new.

———-

On the Calendar Today:

Heading into the weekend we have a whole host of central bankers speakers in Portugal on a panel discussion at the ECB Forum on Central Banking titled “Inflation and Unemployment in Europe”. I’m not really sure what could possibly be said to move markets here, but it’s another piece of event risk heading into the weekend if you want to play it safe.

Friday:

JPY Monetary Policy Statement

JPY BOJ Press Conference

EUR ECB President Draghi Speaks

EUR German Ifo Business Climate

GBP BOE Gov Carney Speaks

CAD Core CPI m/m

CAD Core Retail Sales m/m

EUR ECB President Draghi Speaks

GBP BOE Gov Carney Speaks

JPY BOJ Gov Kuroda Speaks

USD Fed Chair Yellen Speaks

Recommended Content

Editors’ Picks

GBP/USD stays weak near 1.2400 after UK Retail Sales data

GBP/USD stays vulnerable near 1.2400 early Friday, sitting at five-month troughs. The UK Retail Sales data came in mixed and added to the weakness in the pair. Risk-aversion on the Middle East escalation keeps the pair on the back foot.

EUR/USD extends its downside below 1.0650 on hawkish Fed remarks

The EUR/USD extends its downside around 1.0640 after retreating from weekly peaks of 1.0690 on Friday. The hawkish comments from Federal Reserve officials provide some support to the US Dollar.

Gold: Middle East war fears spark fresh XAU/USD rally, will it sustain?

Gold price is trading close to $2,400 early Friday, reversing from a fresh five-day high reached at $2,418 earlier in the Asian session. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row.

Bitcoin Price Outlook: All eyes on BTC as CNN calls halving the ‘World Cup for Bitcoin’

Bitcoin price remains the focus of traders and investors ahead of the halving, which is an important event expected to kick off the next bull market. Amid conflicting forecasts from analysts, an international media site has lauded the halving and what it means for the industry.

Israel vs. Iran: Fear of escalation grips risk markets

Recent reports of an Israeli aerial bombardment targeting a key nuclear facility in central Isfahan have sparked a significant shift out of risk assets and into safe-haven investments.