Morning View:

Media whispering is what I saw the RBA’s ‘tactic’ described as today, so lets go with that.

Peter Martin, the Economics Editor at the Age/Sydney Morning Herald published an article last night titled “Reserve Bank to cut interest rates in May in face of weak economy”. Now I don’t have a problem with opinion pieces. Everyone online has an opinion on absolutely everything, and monetary policy is no different.

What I do have a problem with, is major newspapers publishing opinions as if they are fact to a mainstream audience.

Well, is it just an opinion?

It doesn’t even matter if it is or it isn’t. It’s done the job that Stevens wanted and dumped the Aussie over 100 pips from the time the article was released (while the USDX was dumped alongside it mind you, showing the merit the Aussie move had).

If Stevens actually is giving under the table ‘whispers’ on monetary policy to the odd journalist who asks nicely, it’s not right. Trust is already completely gone from the RBA after multiple obvious leaks before the official release.

This is just the Terry McCrann circus re-branded and not the right way to conduct monetary policy decisions.

———-

On the Calendar Today:

A whole raft of bank holidays across Asia and Europe today in observance of Labor Day. There is still tier 1 Manufacturing PMI data out of China and of course the Greek headlines wont stop once the European session rolls around.

We end the week with ISM Manufacturing PMI out of the US and of course as always, watch out for any end of week/month flows.

Friday:

CNY Bank Holiday

CNY Manufacturing PMI

AUD PPI

EUR Bank Holidays

GBP Manufacturing PMI

USD ISM Manufacturing PMI

———-

Chart of the Day:

I spoke yesterday on Twitter about NZD/USD being in play following dovish comments out of the RBNZ. I never got a chance to post any charts to Twitter so I explain what I’m looking at below.

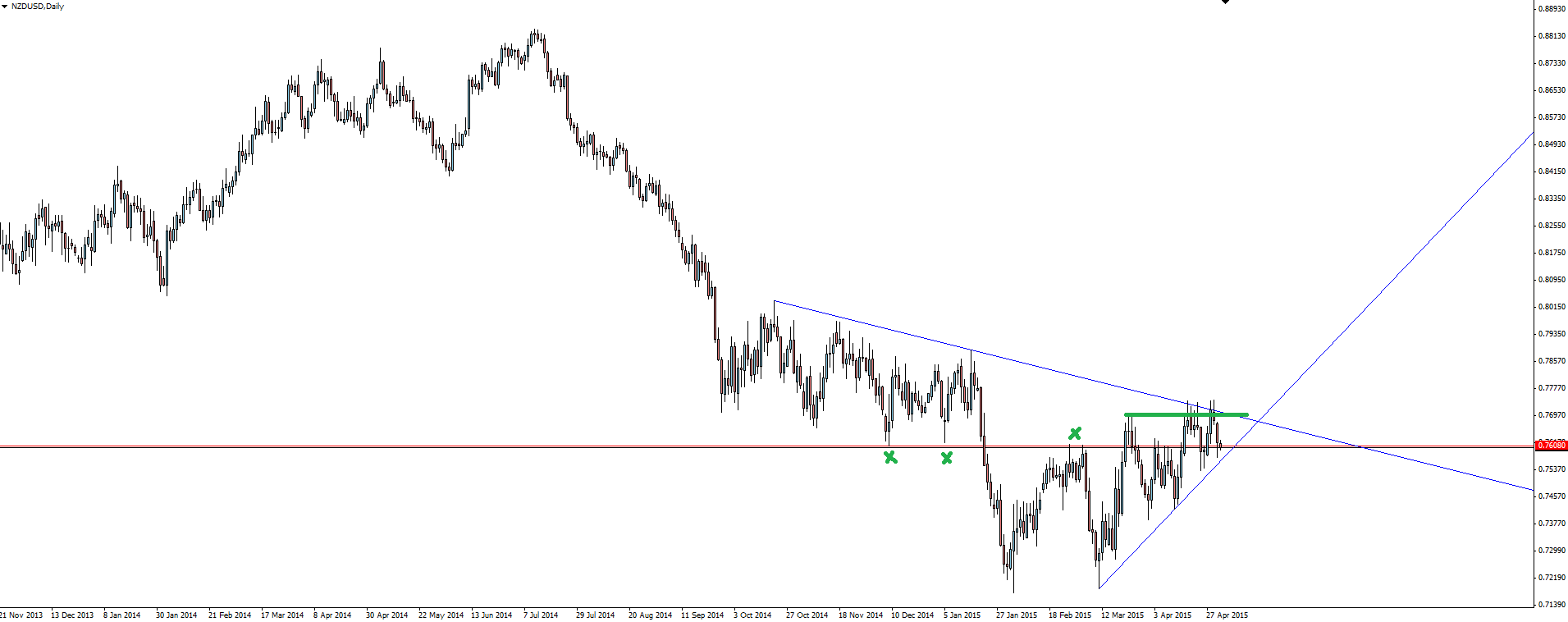

NZD/USD Daily:

Click on chart to see a larger view.

Price is trapped in a triangle pattern while consolidating around the key 0.7608 weekly level. I really like how price re-tested the highs, taking some stops above them while still trapped inside the triangle, before getting smashed down on the RBNZ comments.

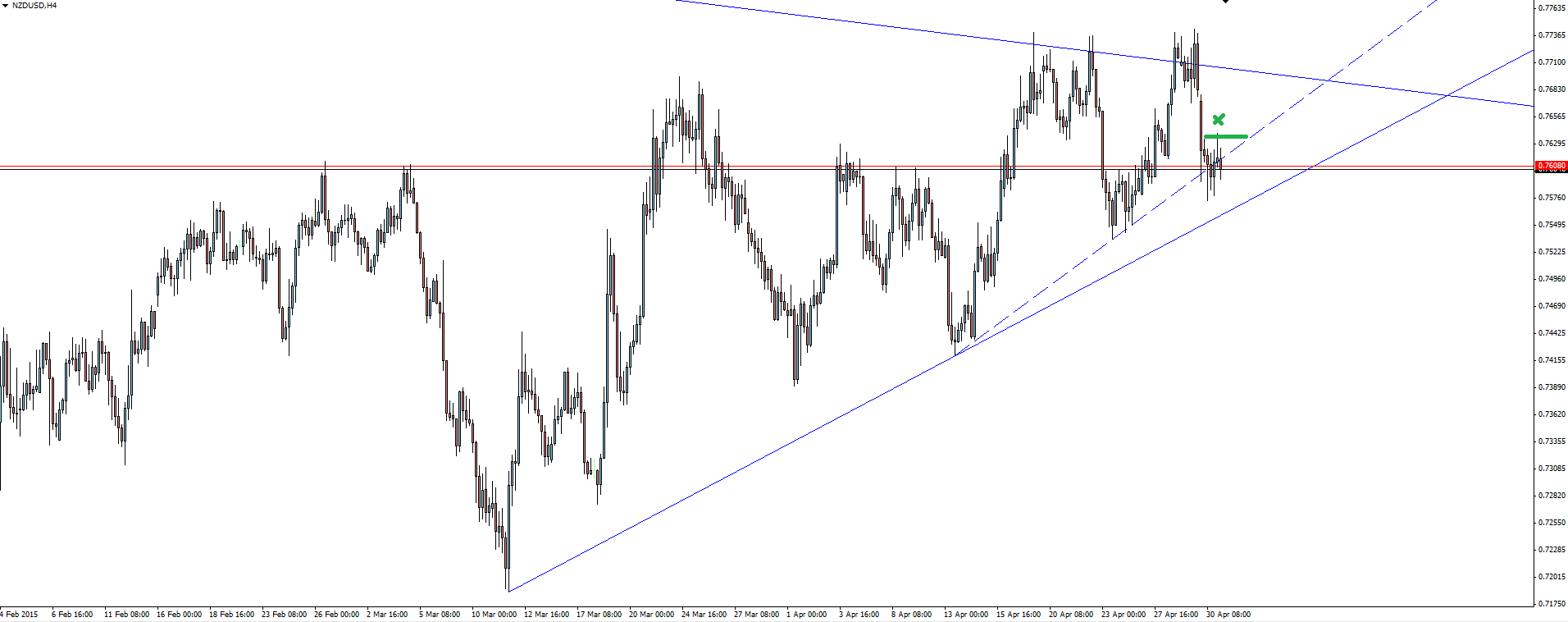

NZD/USD 4 Hourly:

Click on chart to see a larger view.

Price has now come to short term trend line support, pushing through it yesterday before retesting the previous days but again being sold off them.

This is a good place to look to get short as the demand is absorbed, playing for a proper break down through the bottom of the triangle either tonight or next week.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.