Morning Recap:

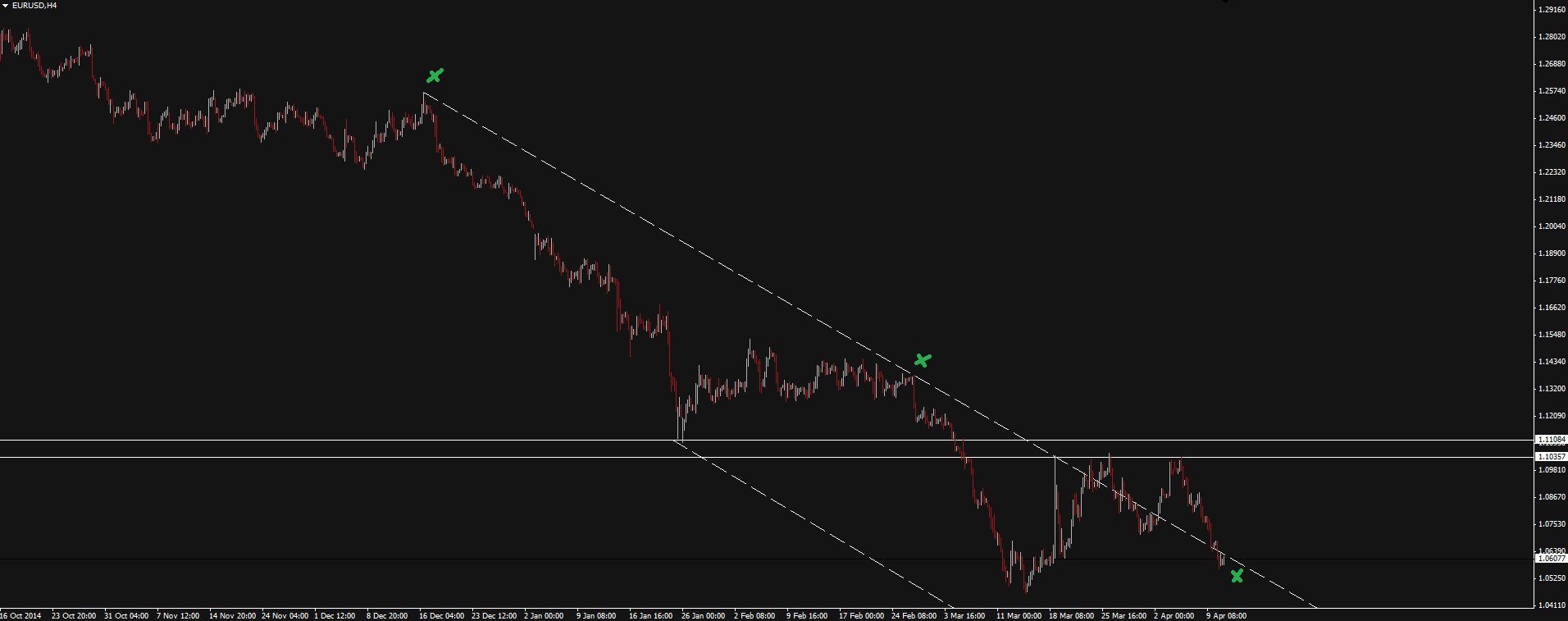

The Euro and British Pound were again the biggest losers on Friday night with the Euro getting smashed for the 5th straight session to close at a 3 week low. With the Eurozone still struggling through QE and the British in the middle of an uncertain election race, the bears are firmly in control across both EUR/USD and GBP/USD.

The Aussie and Kiwi dollars have both held up better than their counterparts from the Northern Hemisphere, but both are at the bottom of ranges and all tucking back into descending channels (as you can see on the EUR/USD chart below), meaning we could be looking at further downside across the board this week.

Click on chart to see a larger view.

Quote of the Day:

I don’t like talking politics in any of these reports, but I couldn’t help myself when I read this quote from Australian Treasurer Joe Hockey. If you aren’t familiar with Joe Hockey, picture a confident, outgoing man who is never afraid to speak his mind.

When asked a question around the tactics of major iron ore miners Rio Tinto and BHP Billiton of ramping up production in a falling market to drive out domestic and international rivals, his reply was swift:

“I’m reluctant to tell people how to run their companies. Not that it stops them from telling us how to run the country.”

Ha!

On the Calendar Today:

We start the week on a quiet note today, with the only major release being Trade Balance data coming out of China. As is the case a lot of the time with Chinese data, the release is set as tentative so keep an eye on Twitter for further release news, especially if you’re trading the Aussie.

Monday:

CNY Trade Balance

Chart of the Day:

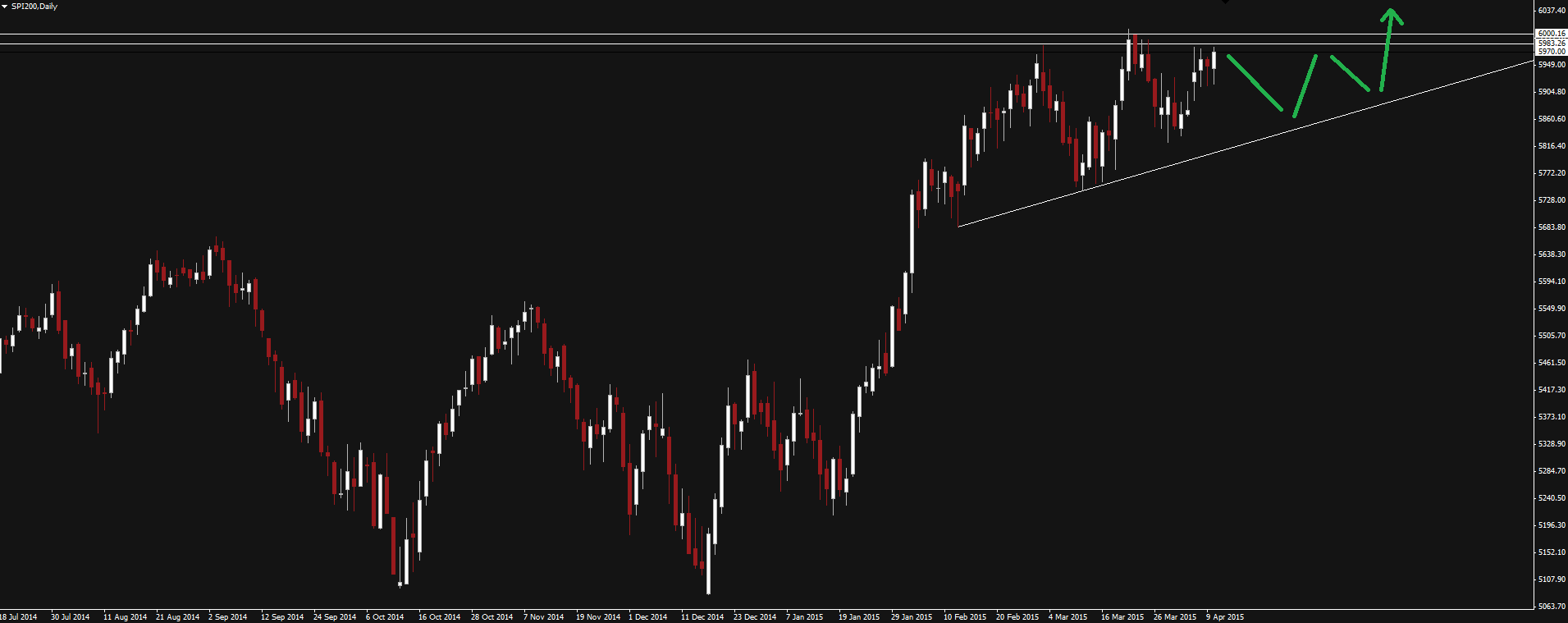

Something a little different to start the week with the Australian SPI200 market at the front of local trader’s minds as price approaches a major psychological. The SPI goes into this week just over 30 points short of the magic 6000 mark.

SPI200 Daily:

Click on chart to see a larger view.

Markets tested the level a few weeks back pushing through intra-day, but were unable to close and sellers stepped in. The SPI has then made another higher low to form a bit of an ascending triangle that looks very bullish.

Any weaker than expected Australian data that points of an already almost certain interest rate cut and subsequent cheap money, should be the catalyst for a push through the 6000 level.

Recommended Content

Editors’ Picks

AUD/USD jumps above 0.6500 after hot Australian CPI data

AUD/USD extended gains and recaptured 0.6500 in Asian trading, following the release of hotter-than-expected Australian inflation data. The Australian CPI rose 1% in QoQ in Q1 against 0.8% forecast, providing extra legs to the Australian Dollar upside.

USD/JPY hangs near 34-year high at 154.88 as intervention risks loom

USD/JPY is sitting at a multi-decade high of 154.88 reached on Tuesday. Traders refrain from placing fresh bets on the pair as Japan's FX intervention risks loom. Broad US Dollar weakness also caps the upside in the major. US Durable Goods data are next on tap.

Gold price cautious despite weaker US Dollar and falling US yields

Gold retreats modestly after failing to sustain gains despite fall in US Treasury yields, weaker US Dollar. XAU/USD struggles to capitalize following release of weaker-than-expected S&P Global PMIs, fueling speculation about potential Fed rate cuts.

Crypto community reacts as BRICS considers launching stablecoin for international trade settlement

BRICS is intensifying efforts to reduce its reliance on the US dollar after plans for its stablecoin effort surfaced online on Tuesday. Most people expect the stablecoin to be backed by gold, considering BRICS nations have been accumulating large holdings of the commodity.

US versus the Eurozone: Inflation divergence causes monetary desynchronization

Historically there is a very close correlation between changes in US Treasury yields and German Bund yields. This is relevant at the current juncture, considering that the recent hawkish twist in the tone of the Fed might continue to push US long-term interest rates higher and put upward pressure on bond yields in the Eurozone.