NFP Good Friday:

With Good Friday not actually a federal holiday in the US, today sees the March NFP jobs report released as scheduled.

Although it may feel strange for some of us logging into our trading platforms on a public holiday, it is actually not that uncommon for NFP to fall on Good Friday. The last time we got a Good Friday NFP number was in 2012 with 10 others before that dating back 35 years!

The expected NFP print sits at 247,000 and as I mentioned in yesterday’s morning view, the risk is for a weaker number. On the back of this risk, the USD slipped against most major currencies with traders taking profits heading into the number.

Click on chart to see a larger view.

I’ve been speaking about looking at opportunities to get into trades heading into the number, and these profit taking rallies can be seen as this opportunity if you are bullish USD. Historically, there isn’t too much to fear from low holiday liquidity affecting how the number trades as it’s released, but in the lead up during Asia and London I definitely recommend using some caution. Could get some spiky price action.

UK Election Uncertainty:

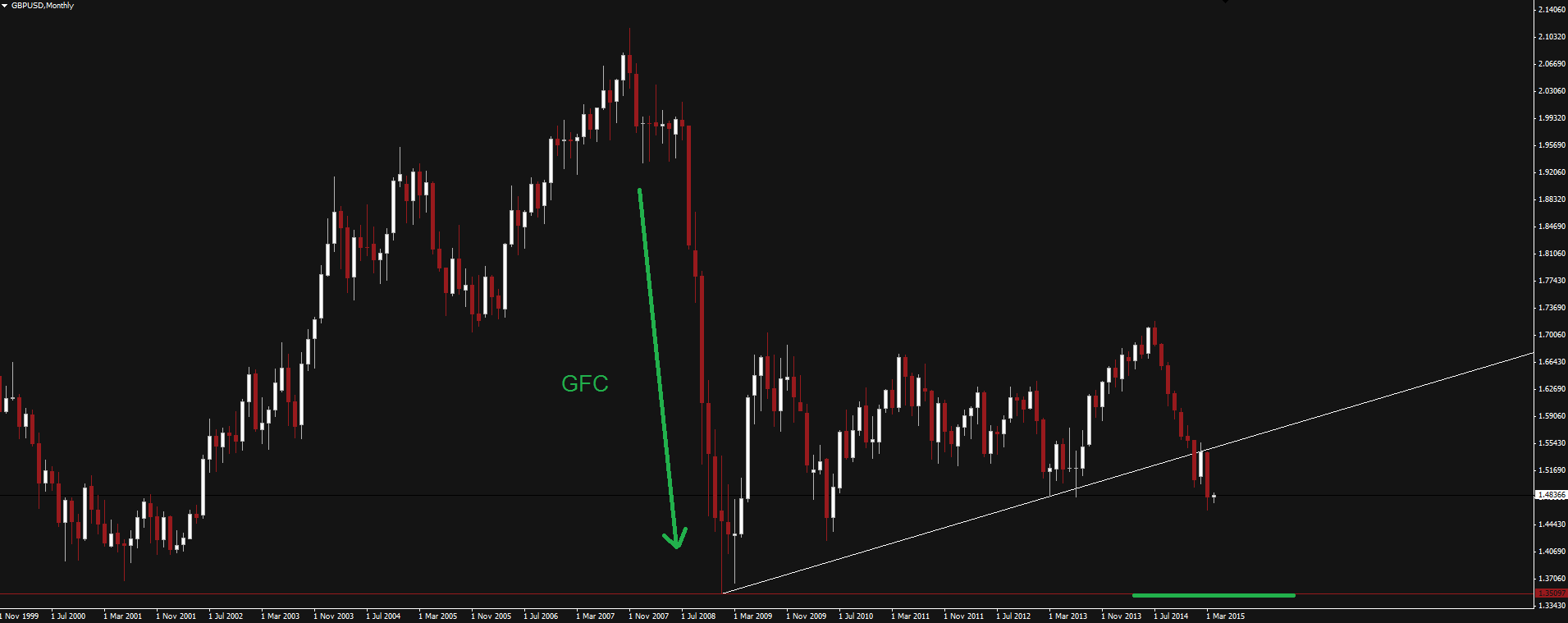

The run in to the UK elections are in full swing and the risk of a hung parliament is real. Markets can’t deal with uncertainty and this will put further pressure on GBP/USD with a history of dysfunctional coalitions falling apart.

On the matter of a possible hung parliament, I even came across a headline that read: “This could be the UK’s Lehman’s moment” which to me is just a little bit exaggerated… Yes it’s interesting that in the current economic climate, GBP/USD price could take a look at testing it’s GFC swing lows on the Monthly chart, but that’s definitely not the right way of wording it.

Click on chart to see a larger view.

So long as there is uncertainty, we are looking at further falls in GBP/USD.

On the Calendar Today:

Most major centres are on holiday for Good Friday, but put a big red circle around NFP come the US session.

Friday:

AUD Bank Holiday

CHF Bank Holiday

EUR German Bank Holiday

GBP Bank Holiday

CAD Bank Holiday

USD Non-Farm Employment Change

USD Unemployment Rate

Chart of the Day:

AUD/NZD 4 hour:

Click on chart to see a larger view.

The AUD/NZD set a fresh all time low overnight, dropping below 1.0100 which was touched back in 1996. That big fat red line at parity on the chart above is getting mighty close isn’t it! It’s such a big one that I just can’t see the market not trying to push it down to at least have a go at testing the level.

So often this happens with huge psychological levels like this and heading into the RBA decision next week where a cut is expected, I like the idea of selling into any rallies.

Recommended Content

Editors’ Picks

EUR/USD holds steady near 1.0650 amid risk reset

EUR/USD is holding onto its recovery mode near 1.0650 in European trading on Friday. A recovery in risk sentiment is helping the pair, as the safe-haven US Dollar pares gains. Earlier today, reports of an Israeli strike inside Iran spooked markets.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD is rebounding toward 1.2450 in early Europe on Friday, having tested 1.2400 after the UK Retail Sales volumes stagnated again in March, The pair recovers in tandem with risk sentiment, as traders take account of the likely Israel's missile strikes on Iran.

Gold price defends gains below $2,400 as geopolitical risks linger

Gold price is trading below $2,400 in European trading on Friday, holding its retreat from a fresh five-day high of $2,418. Despite the pullback, Gold price remains on track to book the fifth weekly gain in a row, supported by lingering Middle East geopolitical risks.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Geopolitics once again take centre stage, as UK Retail Sales wither

Nearly a week to the day when Iran sent drones and missiles into Israel, Israel has retaliated and sent a missile into Iran. The initial reports caused a large uptick in the oil price.