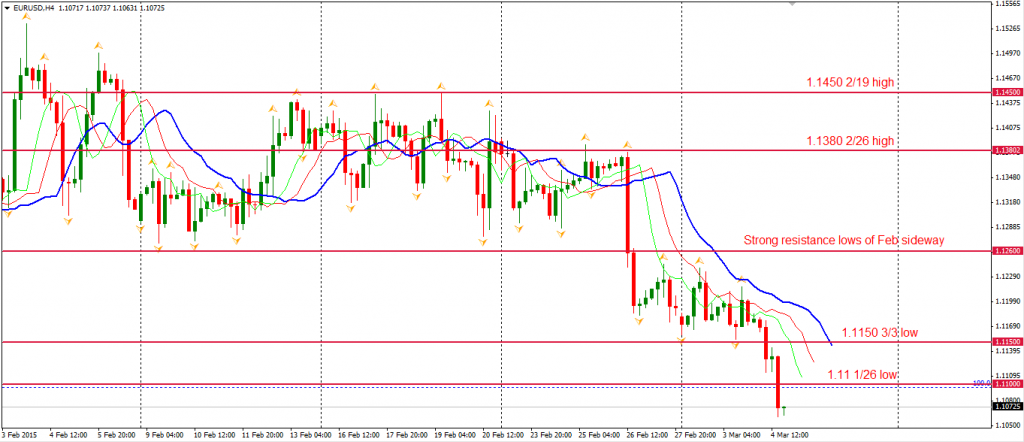

No matter how pleasant the recent improving data in the Euro area is looking, it cannot seem to stop the falling Euro. The Eurozone retail sales rose for the fourth month in a row with the expansion speed at a 9-year high. Data shows how the tumbled oil prices have supported consumption and economic recovery. However, the CPI still fell by 0.3% in February, increasing speculations that ECB may be forced to purchase more assets. The EURUSD yesterday refreshed recent lows to 1.1060, breaking two support levels and former lows nearing 1.11. The alligator is in bearish order, implying the short term trend may continue.

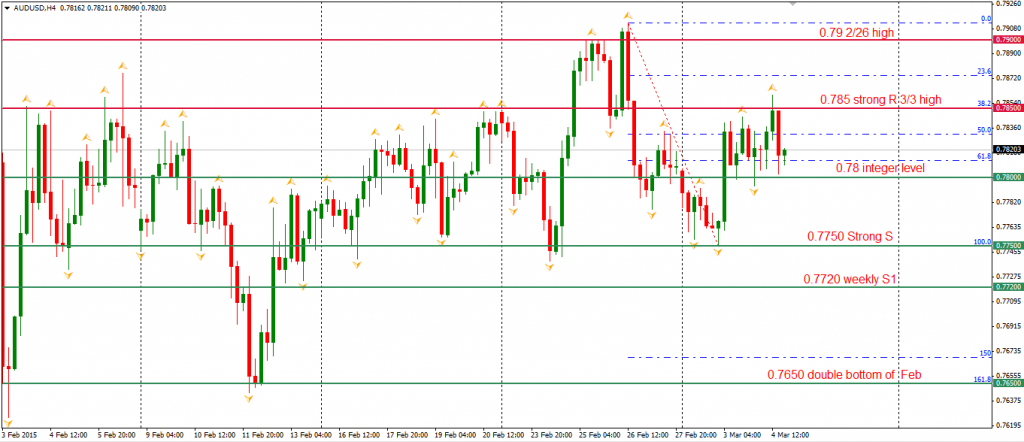

Australian Q4 GDP rose by 0.5% and expanded by 2.5% in 2014, mostly in line with forecasts. Aussie Dollar maintains its consolidation within the range between 0.78-0.7850. The currency is supported by real money but the offers at 0.7850 are still very strong. The larger sideway range will be 0.7750-0.79.

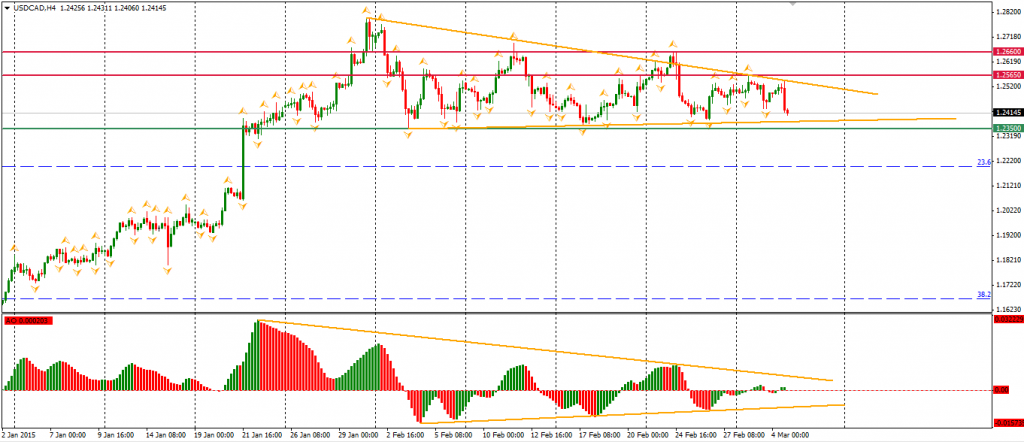

The Canadian Dollar jumped after Bank of Canada held its interest rate at 0.75%, the result disappointed some traders who were betting on an upward breakout of a recent USDCAD triangular pattern. The rebound of oil prices also supports the strength of CAD. Although, it seems unlikely the BOC will cut the rate in the near future, the lessened oil exports still put heavy pressure on CAD. The bottom of the triangle pattern is at 1.2350.

Looking to the stock markets, the Shanghai Composite rebounded by 0.51% to 3280. The Nikkei Stock Average slid by 0.6%. The Australian ASX 200 lost 0.54% to 5902. In European markets, the UK FTSE was up 0.44%, the German DAX gained 0.73% and the French CAC Index rose by 1%. The US stock indices’ retracements continued. The S&P 500 closed 0.44% lower at 2098. The Dow slid by 0.58% to 18097, and the Nasdaq Composite Index fell 0.26% to 4967.

On the data front, Australia retail sales and trade balance will be released at 11:30 AEDST. Bank of England and ECB will disclose their March decision tonight. US weekly Unemployment Claims will be out at 0:30 AEDST after midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.