A big week ahead as the central banks of advanced economies will disclose their March decisions and plenty of important economic data will be released this week. Before starting this week’s trading, you should take note that over the weekend, the Chinese central bank PBOC just cut its interest rate. It is the second move by the central bank towards easing in February after it reduced the required reserve ratio and first rate cut last November.

The annual National People’s Congress meeting will be held this week, during which Chinese lawmakers will approve the budget and announce their growth goals for China’s economy. The goal for 2015 is expected to be below 7% against a backdrop of weak domestic and foreign needs. The fast pace of easing infers that these policymakers of the second largest economy may publish more stimulus confronting economic weakness and deflation risk.

Back to Friday’s market, the USD retreated slightly against most major peers except the Euro and JPY. Commodity currencies are relatively stronger, but still under their resistance levels.

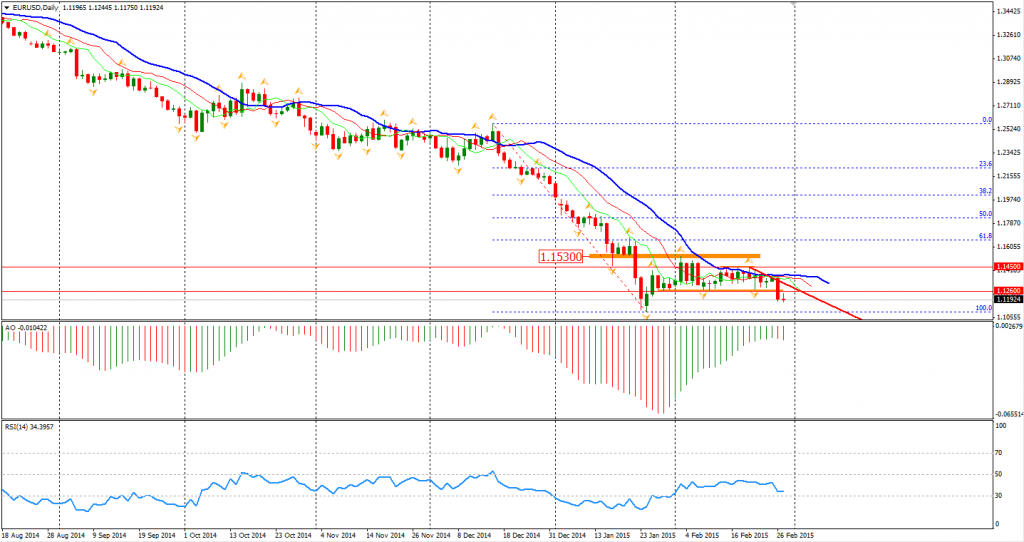

The Euro weakened before the ECB has started its new assets purchasing program. There has been $1.9 Trillion Euro regions’ government securities with negative yields but still more may be purchased by the central bank. This extraordinary market condition may make European institutions allocate more investments around the world instead of providing loans to local business due to lack of confidence. A new round of depreciation is on the front.

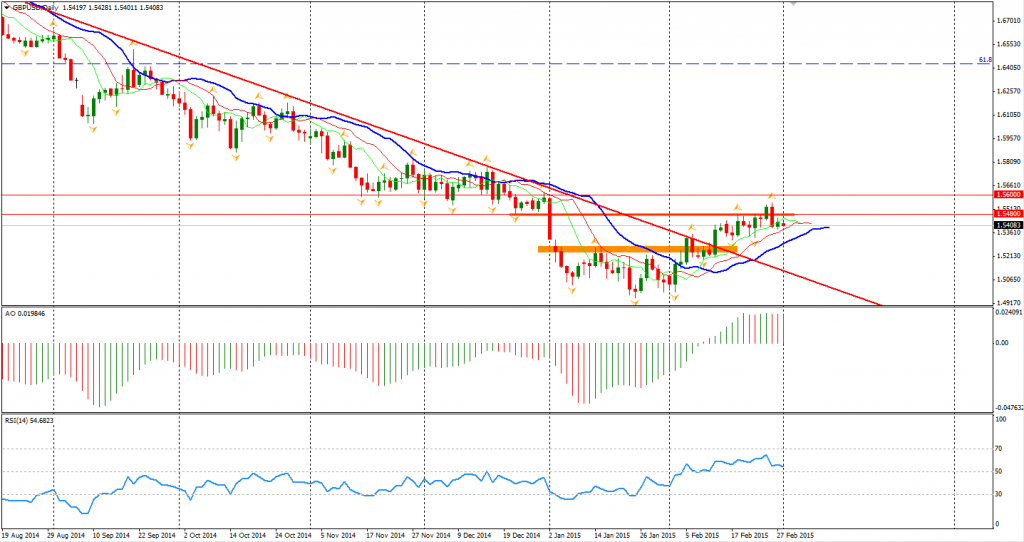

As there is no negative news yet for US, traders are reluctant to sell USD, keeping the strength of USD even many has warned the potential retracement. Sterling performed well in February. However, I am still waiting for the breakout of 1.5480 to confirm the intermediate-term trend of GBPUSD. The break may happen this week among the heating speculation of rate hike within this year as the Bank of England reiterated that UK was on the road towards higher interest rate.

As to the stock markets, Shanghai Composite rose by 0.36%. The Nikkei Stock Average gained 0.1%. Australian ASX 200 rebounded by 0.34% to 5929. In European markets, the UK FTSE was down 0.1%, the German DAX climbed 0.66% and the French CAC Index gained 0.83%. The US stock indices were dragged by technology stocks. The S&P 500 closed 0.3% lower at 2102. The Dow slid 0.45% to 18133, and the Nasdaq Composite Index fell touching the historical 5000 points and lost 0.49% to 4964 at close.

On the data front, China HSBC Final Manufacturing PMI will be released at 12:45 AEDST. UK and Euro-area Manufacturing PMI will be out tonight. US ISM Manufacturing PMI will be at 2 am AEDST after midnight.

Recommended Content

Editors’ Picks

GBP/USD stays below 1.2450 after UK employment data

GBP/USD trades marginally lower on the day below 1.2450 in the early European session on Tuesday. The data from the UK showed that the ILO Unemployment Rate in February rose to 4.2% from 4%, weighing on Pound Sterling.

EUR/USD steadies above 1.0600, awaits German ZEW and Powell speech

EUR/USD is holding above 1.0600 in the European morning on Tuesday, having hit fresh five-month lows. The pair draws support from sluggish US Treasury bond yields but the rebound appears capped amid a stronger US Dollar and risk-aversion. Germany's ZEW survey and Powell awaited.

Gold price holds steady below $2,400 mark, bullish potential seems intact

Gold price oscillates in a narrow band on Tuesday and remains close to the all-time peak. The worsening Middle East crisis weighs on investors’ sentiment and benefits the metal. Reduced Fed rate cut bets lift the USD to a fresh YTD top and cap gains for the XAU/USD.

SOL primed for a breakout as it completes a rounding bottom pattern

Solana price has conformed to the broader market crash, following in the steps of Bitcoin price that remains in the red below the $65,000 threshold. For SOL, however, the sensational altcoin could have a big move in store.

Key economic and earnings releases to watch

The market’s focus may be on geopolitical issues at the start of this week, but there is a large amount of economic data and more earnings releases to digest in the coming days.