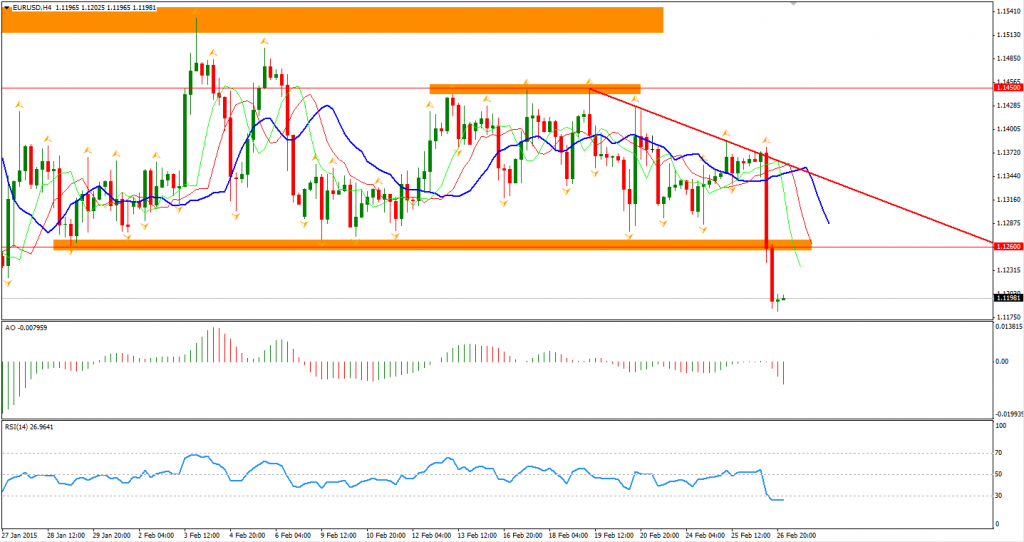

It was a quite big surprise that the Euro Dollar slumped by more than 1.5% below 1.12 after it hit the day high of 1.1240. I was personally expecting at least some resistance would hurdle the falling around the 1.1260 level, where there was the lower boundary of one-month-length sideway. The bottom has supported EURUSD eight times now in the last four weeks. The breakthrough triggered stop-loss sell orders at multiple levels below 1.1260 and suppressed the exchange level to a further low. The next two targets of bears are 1.1150 and 1.1098, which was 26th January’s low.

The surge of the Dollar last night was first boosted by the economic data. The recent CPI data implied US inflation is close to recovery, fuelling the speculation of a rate hike. Although the lower oil prices pushed the January CPI to a negative 0.7%, the lowest record since December 2008, the core CPI (excluding food and energy) rose 0.2% higher than market expectation. Furthermore, the US durable goods orders data is partially attributed to the rally of USD as it unexpectedly expanded by 2.8%.

The shift of the market direction did not happen and the USD is still heading to its decade high. The AUD and GBP which made their upward breakout against the Dollar fell back to their previous trading ranges. It seems to be a universal rule of trading that we shall trade with the trend not against it as we may not be able to survive before the true reversals. Now, as all major peers are technically bearish against the Dollar, betting on a stronger USD somewhat seems to be the only safe option before the reverse truly comes.

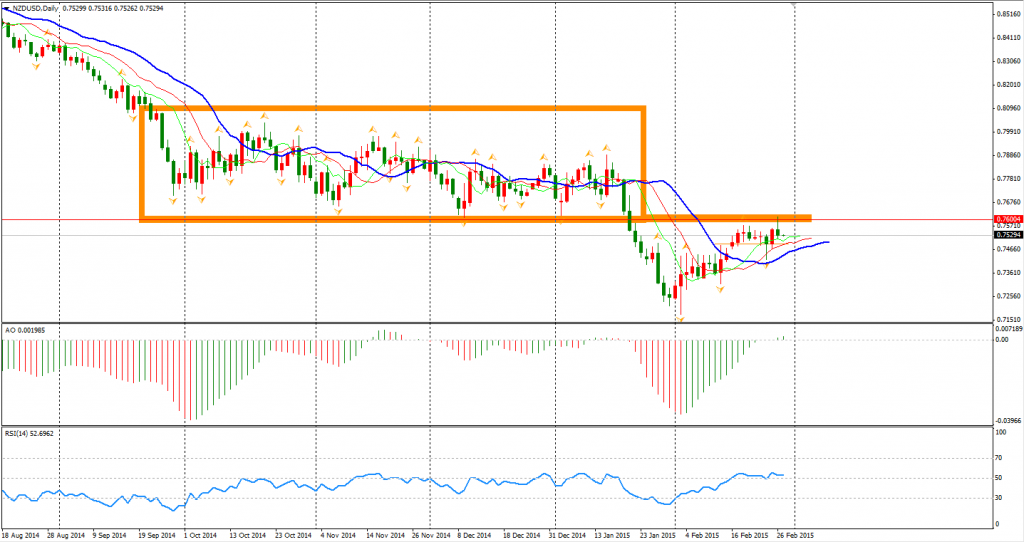

The Kiwi Dollar failed to stand above the resistance of 0.76 as mentioned before. The carry-trade strategy supported its rally in the last month, but the trend may stop at this level. Traders should be aware of the downward risk of NZDUSD.

Looking to the stock markets, Shanghai Composite surged 2.15% as the market is betting on further easing. The Nikkei Stock Average gained 1.08% to 18786. Australian ASX 200 lost 0.6% to 5909. In European markets, the UK FTSE was up 0.21%, the German DAX climbed 1% and the French CAC Index gained 0.58%. The US stock indices remained mostly unchanged. The S&P 500 closed 0.15% lower at 2111. The Dow slid 0.1% to 18215, and the Nasdaq Composite Index climbed 0.42% to 4988.

On the data front, New Zealand ANZ Business Confidence will be released at 11:00 AEDST. US Prelim GDP will be out at 0:30 AEDST; Chicago PMI and Pending Home Sales will be an hour later.

Recommended Content

Editors’ Picks

EUR/USD holds gains above 1.0700, as key US data loom

EUR/USD holds gains above 1.0700 in the European session on Thursday. Renewed US Dollar weakness offsets the risk-off market environment, supporting the pair ahead of the key US GDP and PCE inflation data.

GBP/USD extends recovery above 1.2500, awaits US GDP data

GBP/USD is catching a fresh bid wave, rising above 1.2500 in European trading on Thursday. The US Dollar resumes its corrective downside, as traders resort to repositioning ahead of the high-impact US advance GDP data for the first quarter.

Gold price edges higher amid weaker USD and softer risk tone, focus remains on US GDP

Gold price (XAU/USD) attracts some dip-buying in the vicinity of the $2,300 mark on Thursday and for now, seems to have snapped a three-day losing streak, though the upside potential seems limited.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

US Q1 GDP Preview: Economic growth set to remain firm in, albeit easing from Q4

The United States Gross Domestic Product (GDP) is seen expanding at an annualized rate of 2.5% in Q1. The current resilience of the US economy bolsters the case for a soft landing.