The market did not get significant news from the January FOMC meeting. The committee said in its statement “it can be patient in the beginning to normalize the stance of the monetary policy”. U.S. seems to be the only advanced economy that has potential for interest rate hike within 2015. However, as the deflation risk is spreading around the globe and other major economies are struggling in the growth, the policymakers are still careful of using this option.

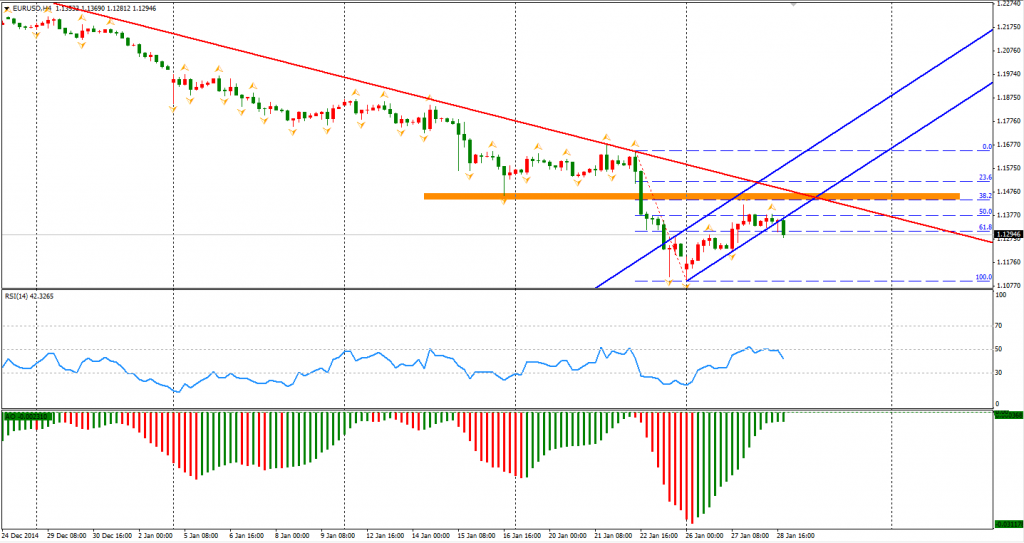

The market did not find the direction right after the statement was released, but the bullishness of USD managed to prevail in the later part of the day. Euro Dollar fell below the 1.13 mark again, implying that the rebound may be over. We can see in the H4 chart that the retracement stopped at 50% of the fall since QE program announcement. A new round of decline has just begun.

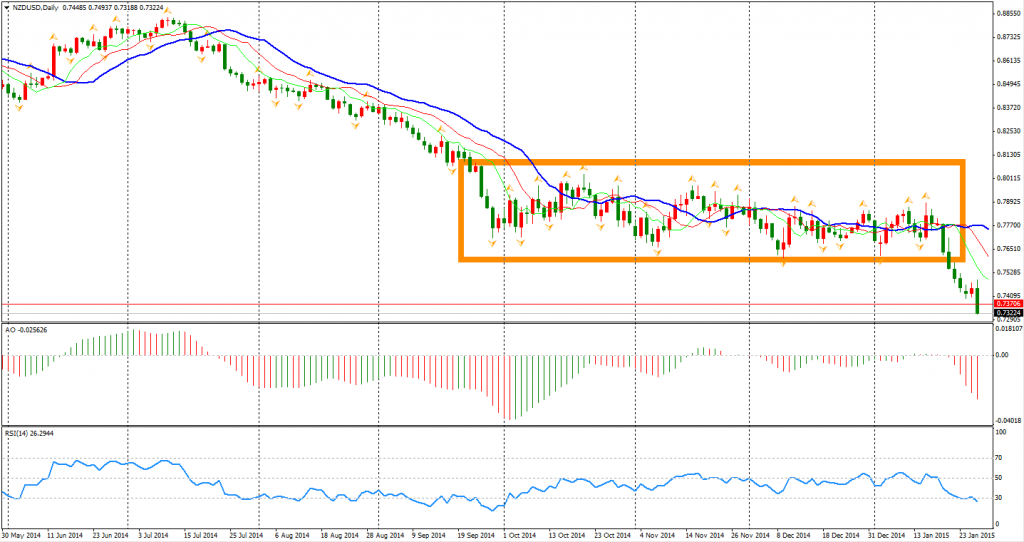

Reserve Bank of New Zealand disclosed its statement one hour after. NZDUSD slumped about 2% as the central bank’s rate remained but said that its currency is still unjustifiably and unsustainably high. Kiwi Dollar has refreshed its 3-year low to 0.7320 by the time of this report. As the speculations increases that RBNZ may cut the rate like Bank of Canada did, the next target below 0.7120, which is the low of 2011, may soon be reached.

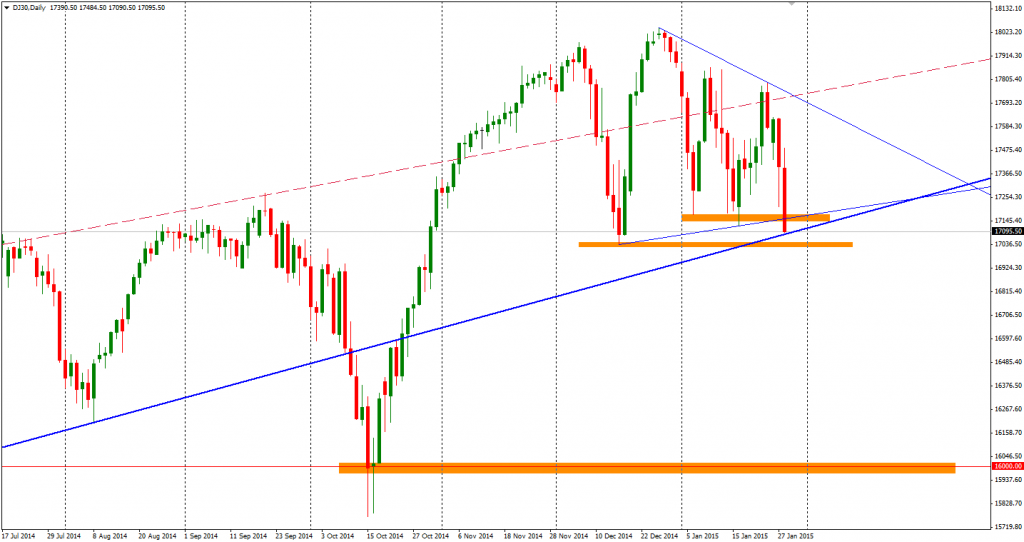

Back to stock markets, the Shanghai Composite fell 1.41% to 3306. The Nikkei Stock Average gained 0.15%. Australian ASX 200 rose 0.1% to 5552. In European markets, the UK FTSE was up 0.21%, the German DAX rebounded 0.78% and the French CAC Index fell 0.29%. The US market mostly fell. The S&P 500 closed 1.35% lower to 2002. The Dow lost 1.12% to 17387, and the Nasdaq Composite Index fell 0.93% to 4638.

The strong Dollar has affected the profits of US listed company and participants see no sign of rate hike delay. The daily chart of Dow future tells us a potential medium run top is forming. If the 17000 integer level is broken, the index may fall to 16000.

On the data front, German Unemployment Change will be at 19:55 AEDST. US weekly Unemployment Claims and Pending Home Sales will be released at midnight.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.