The Dollar is heading to its highest level in ten years as recent US jobless claims fell by 43,000 to a near-15-year low at 265,000 in the last week. The data is fairly lower than what economists had expected. Indeed, very strong evidence to show that the US job market is recovering.

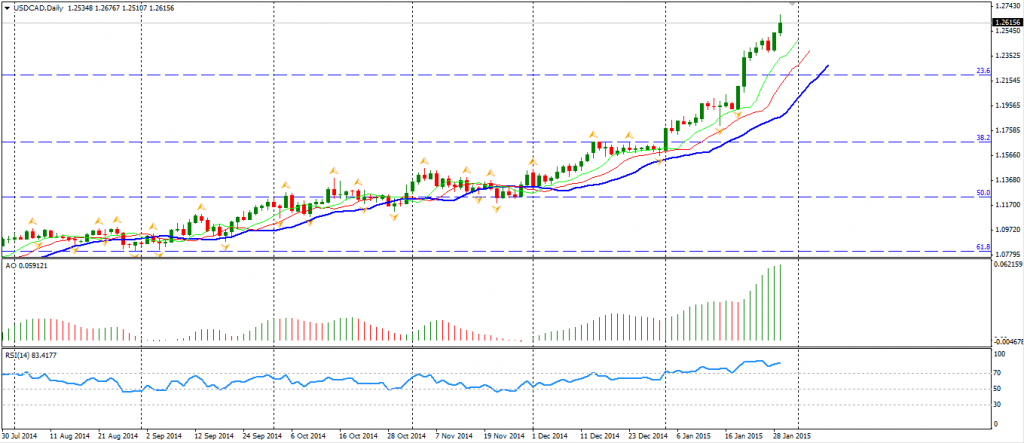

Commodity currencies refreshed their lows against the Dollar, as oil prices plunged to new lows of $43.60 per barrel. USDCAD once touched 1.2675 – the highest since April 2009. The CAD slumped right after the exchange level upwardly broke the 1.2580 level, triggering stop orders and pushing the price even higher.

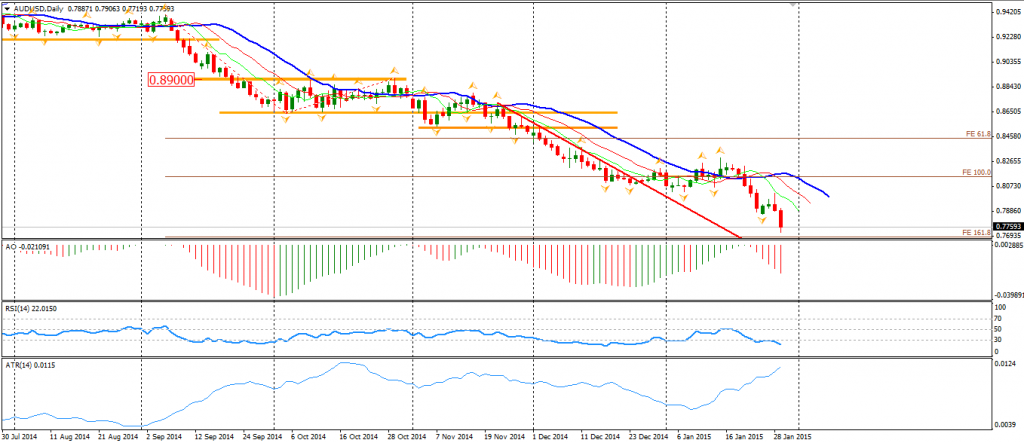

The Aussie Dollar hit a new low of 0.7720 this morning as well on heated speculation that the RBA will cut the interest rate next Tuesday. The currency was first dragged by its neighbour NZD as RBNZ stated its currency is still unsustainably high. If the RBA do cut their rate in the upcoming decision, the Aussie Dollar may soon hit the 0.75 level, which was mentioned as a favourable exchange level by RBA Governor Stevens.

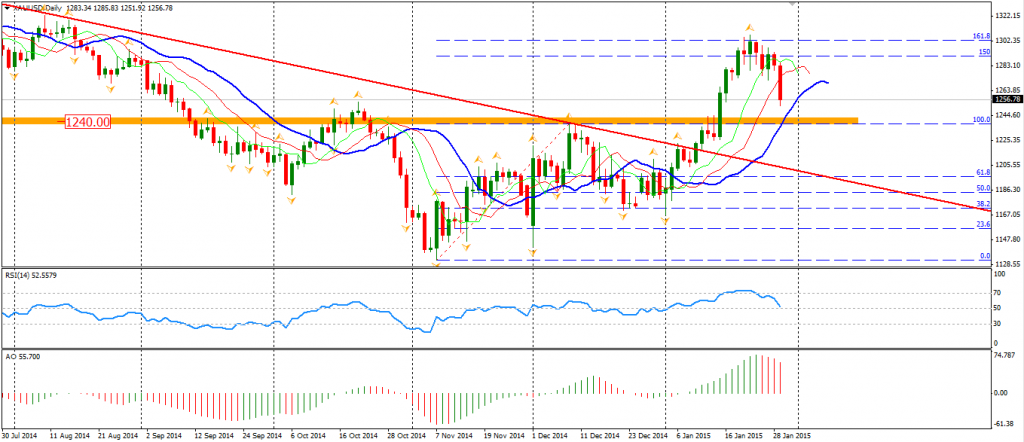

Gold fell the most since 2013 as the bright job market data reduced the attraction of safe-haven assets. The bulls in precious metals were betting on the Fed to be more dovish. However, now as the Fed kept its tone yesterday and jobless claims fell again, participants turned into bearish on yellow metal. $1240 will be the support level below.

Back to stock markets, the Shanghai Composite plunged 1.31% to 3262. The Nikkei Stock Average lost 1.06%. Australian ASX 200 rose 0.3% to 5569. In European markets, the UK FTSE was down 0.21%, the German DAX rebounded 0.25% and the French CAC Index fell 0.44%. The US market rose amid corporate earnings. The S&P 500 closed 0.46% higher to 2012. The Dow gained 0.92% to 17349, and the Nasdaq Composite Index rose 0.57% to 4664.

On the data front, Eurozone CPI will be at 21:00 AEDST. U.S. and Canada GDP will be released at 0:30 am AEDST.

Recommended Content

Editors’ Picks

EUR/USD clings to daily gains above 1.0650

EUR/USD gained traction and turned positive on the day above 1.0650. The improvement seen in risk mood following the earlier flight to safety weighs on the US Dollar ahead of the weekend and helps the pair push higher.

GBP/USD recovers toward 1.2450 after UK Retail Sales data

GBP/USD reversed its direction and advanced to the 1.2450 area after touching a fresh multi-month low below 1.2400 in the Asian session. The positive shift seen in risk mood on easing fears over a deepening Iran-Israel conflict supports the pair.

Gold holds steady at around $2,380 following earlier spike

Gold stabilized near $2,380 after spiking above $2,400 with the immediate reaction to reports of Israel striking Iran. Meanwhile, the pullback seen in the US Treasury bond yields helps XAU/USD hold its ground.

Bitcoin Weekly Forecast: BTC post-halving rally could be partially priced in Premium

Bitcoin price shows no signs of directional bias while it holds above $60,000. The fourth BTC halving is partially priced in, according to Deutsche Bank’s research.

Week ahead – US GDP and BoJ decision on top of next week’s agenda

US GDP, core PCE and PMIs the next tests for the Dollar. Investors await BoJ for guidance about next rate hike. EU and UK PMIs, as well as Australian CPIs also on tap.