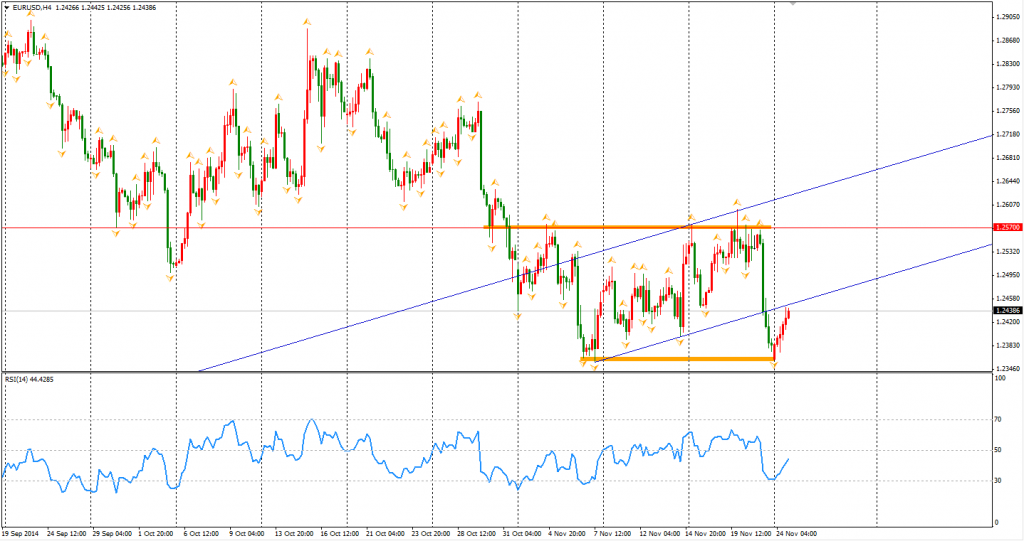

The upbeat German business confidence assisted in a Euro rebound against the dollar away from its month’s low. The business climate index rose for the first time in seven months to 104.7. It gives some hope to the Eurozone against other weak data. The Euro Dollar was around 1.2440 this morning – still weak considering the slump of last Friday. Traders can keep their bearish view on Euro as long as it remains below the lower boundary of the flag pattern.

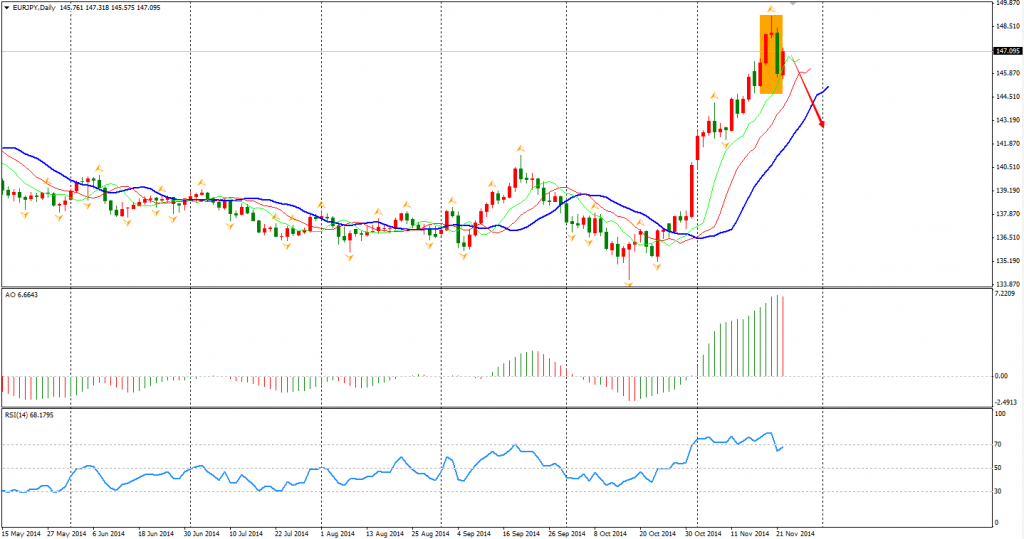

We can also see some trading opportunities in the Euro crosses. EURJPY for instance, left an evening star in the daily chart on last Friday and a doji in the weekly chart. Considering the Dollar Yen has been close to the 120 level and the Euro is expected to be under pressure from ECB’s further easing, the Euro Yen may fall in the mid-term.

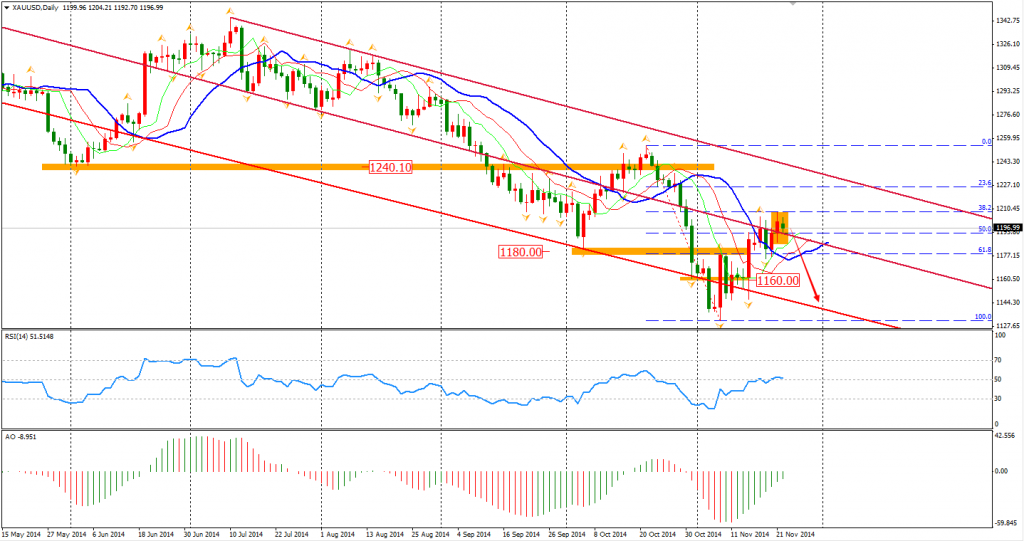

Traders maintain their doubts for the next move of gold price as gold closed as a harami in the daily chart. Some hedge funds added their wagers on a bullishness after China joined Japan and Eurozone in the team of monetary easing. However, other participants are still keeping their bearish bets as the Fed is heading to rate hike and demands from China and India are weak compared with last year. The Harami pattern may imply that the rebound is over.

Most Asian stock markets closed higher after the China rate cut. The Shanghai Composite surged 1.85% to a 3-year high of 2533. The ASX 200 also advanced 1.08% to 5362. In the European stock markets, the UK FTSE was down 0.31%, the German DAX rose 0.54% and the French CAC Index gained 0.49%. The US market kept climbing. The S&P 500 gained 0.29% to 2069. The Dow rose 0.05% to 17818, and the Nasdaq Composite Index rose 0.88% to 4754.

On the data front, BOJ Governor Kuroda will speak at 12:00 AEDST. Canada Retail Sales and US Prelim GDP will be released at 0:30 AEDST.

Recommended Content

Editors’ Picks

EUR/USD retreats below 1.0700 after US GDP data

EUR/USD came under modest bearish pressure and retreated below 1.0700. Although the US data showed that the economy grew at a softer pace than expected in Q1, strong inflation-related details provided a boost to the USD.

GBP/USD declines below 1.2500 as USD rebounds

GBP/USD declined below 1.2500 and erased the majority of its daily gains with the immediate reaction to the US GDP report. The US economy expanded at a softer pace than expected in Q1 but the price deflator jumped to 3.4% from 1.8%.

Gold drops below $2,320 as US yields shoot higher

Gold lost its traction and turned negative on the day below $2,320 in the American session on Thursday. The benchmark 10-year US Treasury bond yield is up more than 1% on the day above 4.7% after US GDP report, weighing on XAU/USD.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.