Without further ado and without surprise, the largest scale monetary stimulus in human history is ending. The Fed has decided to stop its asset purchasing program which has swelled its balance sheet by $1.66 trillion. The board of committee believe that the “labour market conditions improved somewhat further, with solid job gains and a lower unemployment rate” disregarding earlier language that referred to a “significant underutilization” of labour resources. Even though the Fed is trying to minimize the effects of QE quitting on the market, even pledging that they will not raise the interest rate until inflation is back to 2%, the Dollar surged across the board and US stocks fell after the release.

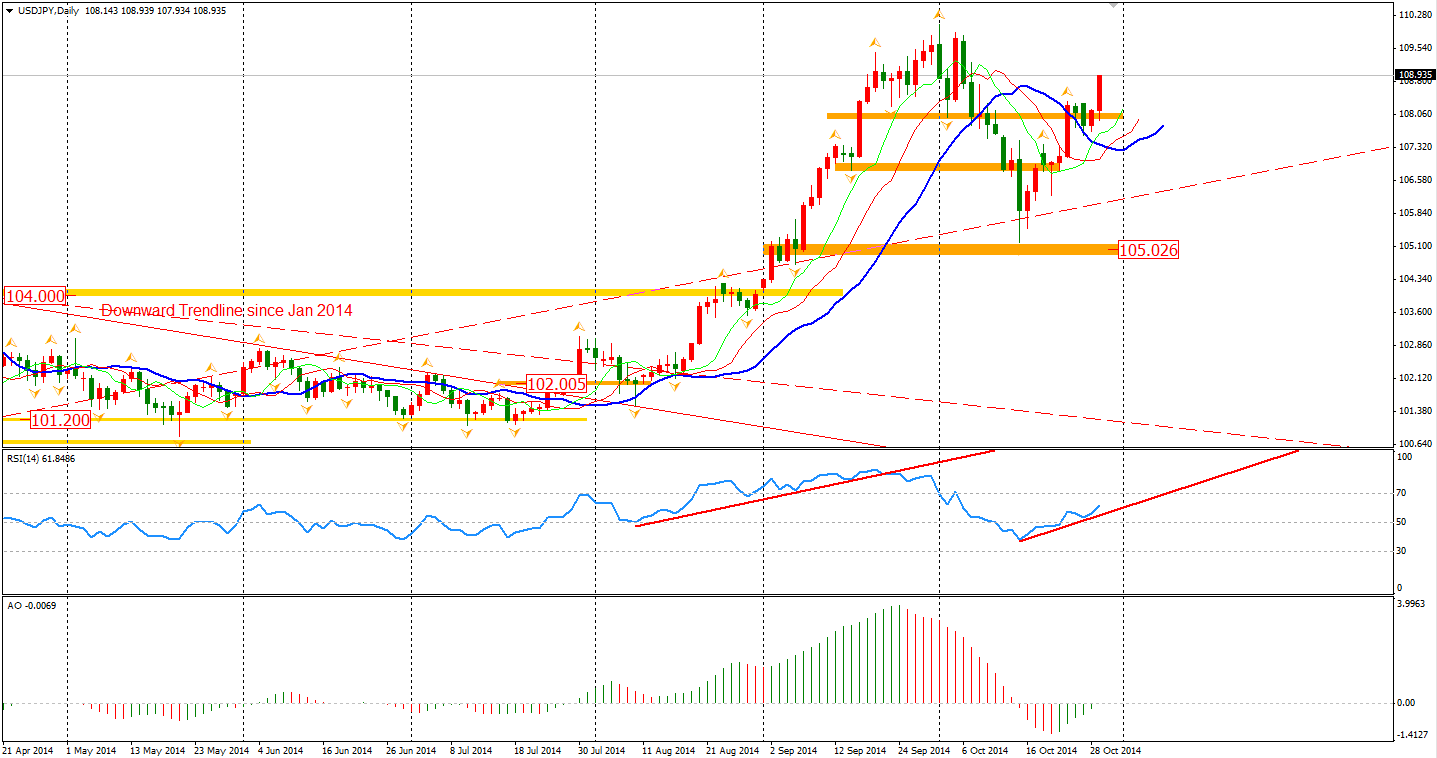

Most major pairs fell by over 100 pips against the Dollar erasing all gains of the last two days when the market was speculating on the possibility of a dovish FOMC statement. Dollar Yen rose by 0.7% nearing the 109 Yen level. A new resurgence appears to be on the way and the former high of 110 will be challenged soon.

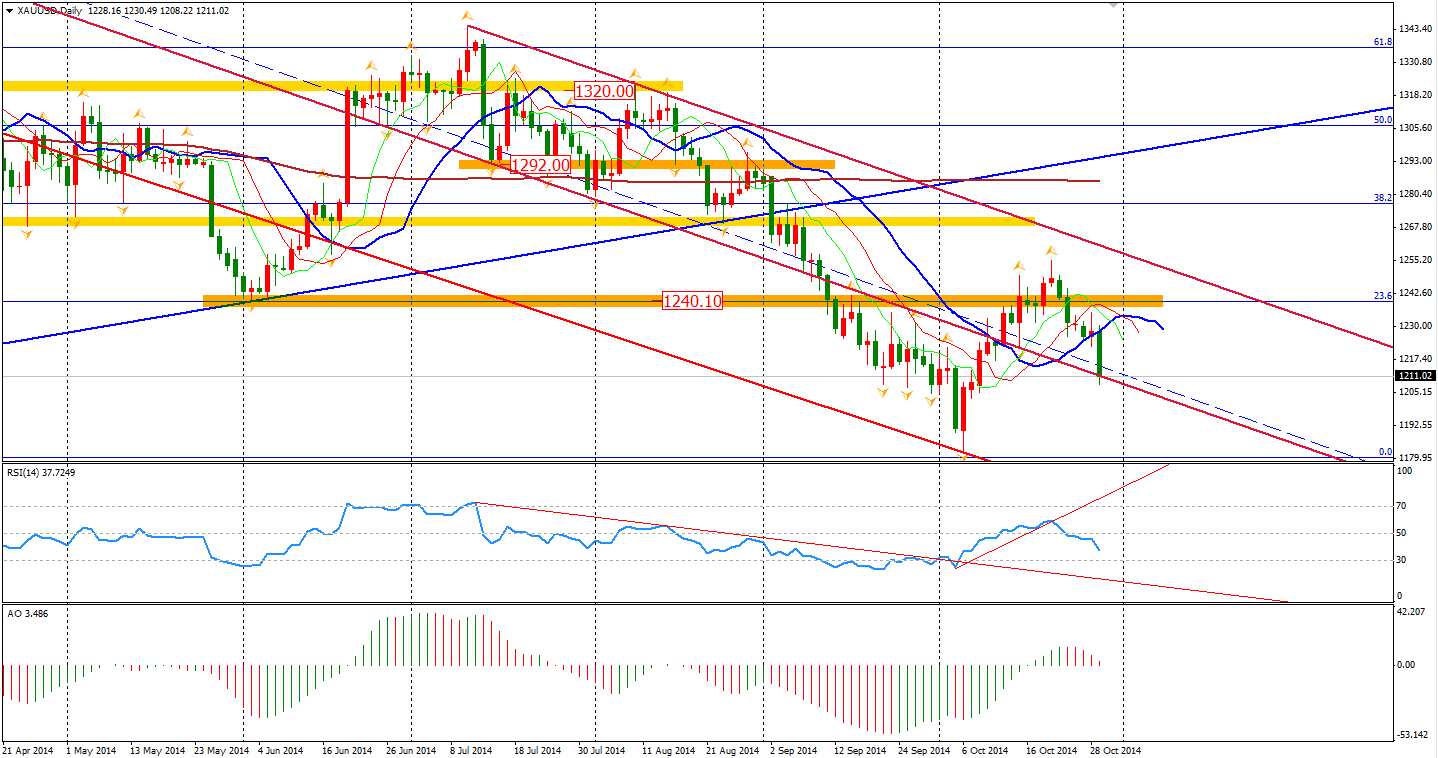

The Gold price plummeted once by 1.6% to $1208 per ounce this morning as the non-interest-return assets lost its attraction. The price now is temporarily supported by the middle line of the bearish channel.

Asian stock markets rose yesterday led by the Chinese market. The Shanghai Composite rocketed by 1.5% to 2373 as the Hong Kong authority said the preparation of Shanghai-HK market link has been complete. ASX 200 lost 0.09% to 5448. The Nikkei Stock Average also rose 1.46% to 15553. In European stock markets, the UK FTSE was up 0.81%, the German DAX edged up by 0.16% and the French CAC Index closed flat. The US market once fell on the statement but recovered most of the loss later. The S&P 500 slid 0.14% to 1982. The Dow slid 0.18% to 16974, while the Nasdaq Composite Index lost 0.33% to 4549.

On the data front, German CPI and Unemployment Change will be released today. US Advance GDP and Unemployment Claims will be out at 23:30 AEST and Yellen’s speech will begin at midnight.

Recommended Content

Editors’ Picks

AUD/USD remained bid above 0.6500

AUD/USD extended further its bullish performance, advancing for the fourth session in a row on Thursday, although a sustainable breakout of the key 200-day SMA at 0.6526 still remain elusive.

EUR/USD faces a minor resistance near at 1.0750

EUR/USD quickly left behind Wednesday’s small downtick and resumed its uptrend north of 1.0700 the figure, always on the back of the persistent sell-off in the US Dollar ahead of key PCE data on Friday.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

Bitcoin price continues to get rejected from $65K resistance as SEC delays decision on spot BTC ETF options

Bitcoin (BTC) price has markets in disarray, provoking a broader market crash as it slumped to the $62,000 range on Thursday. Meanwhile, reverberations from spot BTC exchange-traded funds (ETFs) continue to influence the market.

US economy: slower growth with stronger inflation

The dollar strengthened, and stocks fell after statistical data from the US. The focus was on the preliminary estimate of GDP for the first quarter. Annualised quarterly growth came in at just 1.6%, down from the 2.5% and 3.4% previously forecast.