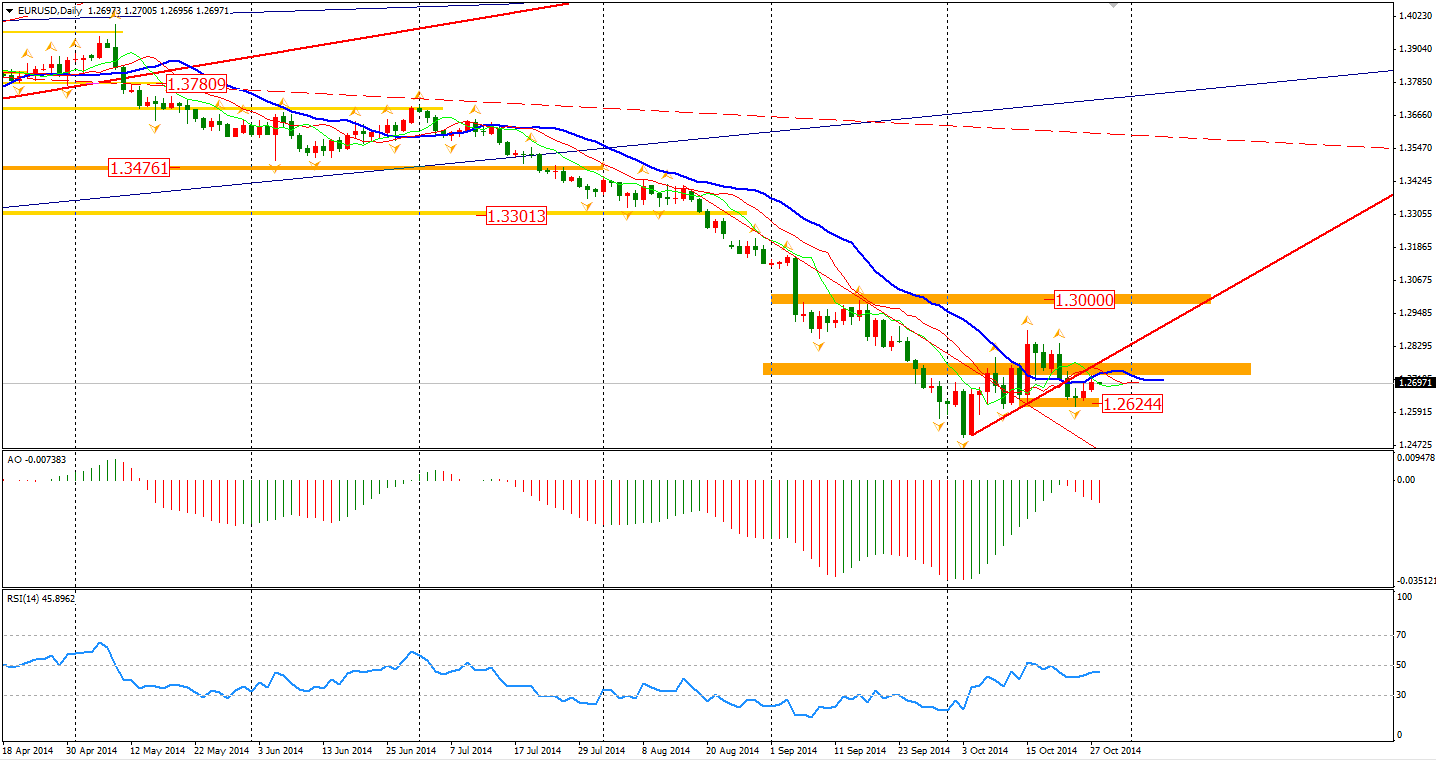

The volatility of in the FX market was fairly limited with little news leading the direction and participants quietly waiting for the result of the next FOMC meeting. Most majors continued their consolidating slow climb against Dollar.

The ECB’s test on European banks showed that 25 out of 130 banks failed and that only 10 banks were still in need of capital rising to cover shortfalls. The news inspired the Euro during the Asian trading hours, but all gains were later erased as the currency was once again hit by worrisome German data. The German Ifo Business Climate recorded a six month straight decline to 103.2, missing the expected 104.6.

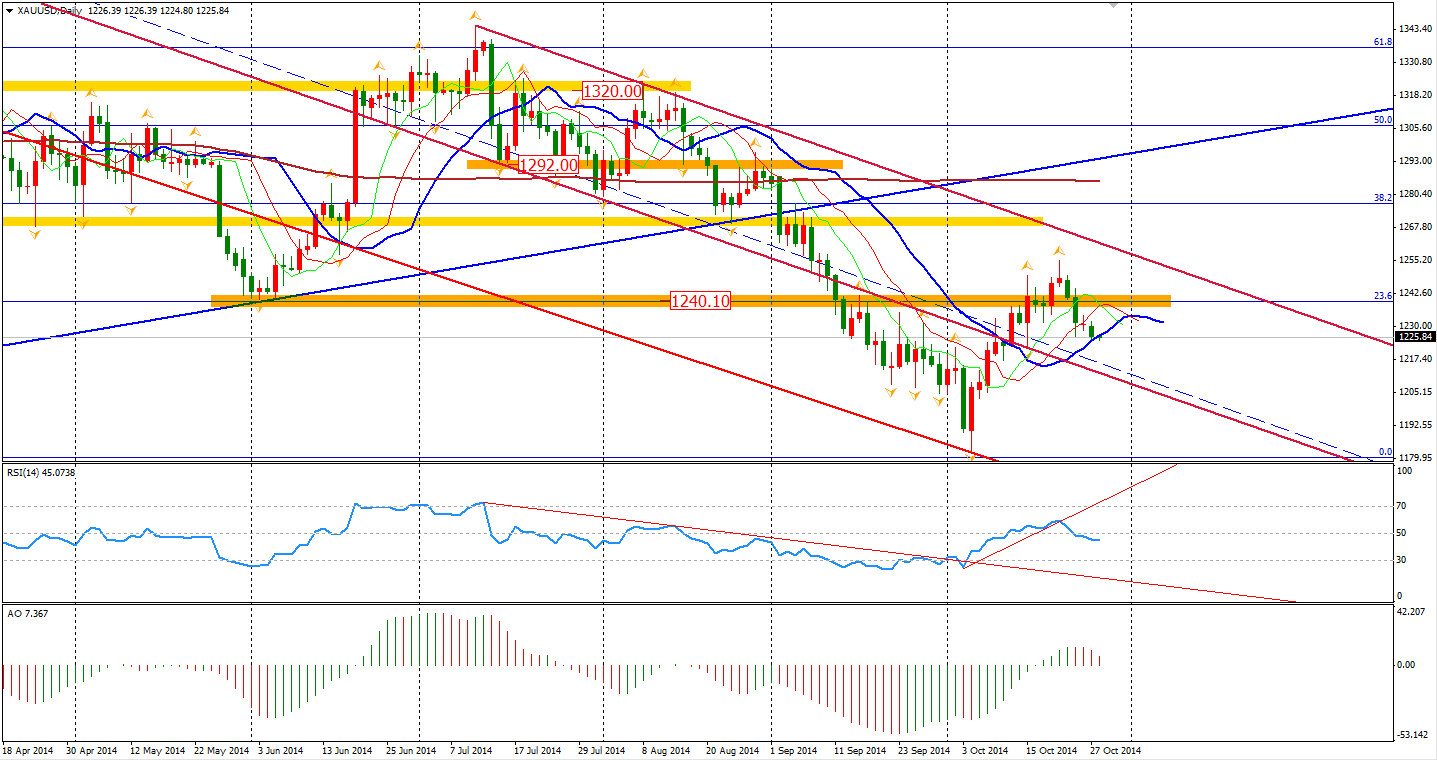

The US pending home sales grew by only 0.3% last month versus the forecasted 1.1%, pushing the Dollar decline against the majors in the American session. The gold price however still fell during that period as it had lost its upward momentum, falling from its month high of $1255 per ounce to its current levels of below $1230. The technical indicators like alligator and RSI are turning bearish right now, despite the fact that speculators in futures and options market have increased their net long position.

Asian stock markets were up on the US lead, with Australian stocks hitting a six-week high. The ASX 200 gained 0.86% to 5458. The Nikkei Stock Average gained 0.63% to 15389, whilst Chinese stocks remained weak as the Hong Kong-Shanghai trading link stalled. The Shanghai Composite fell 0.51% to 2290. In European stock markets, the UK FTSE was down 0.4%, the German DAX lost 0.95% on the Ifo data and the French CAC Index slid 0.78%. The US market opened low on the downbeat housing data, but recovered the loss at the close. The S&P 500 fell 0.15% to 1962. The Dow once gained 0.07% to 16818, while the Nasdaq Composite Index edge up 0.05% to 4486.

On the data front, only the US data is noteworthy. The Durable Goods Orders will be out at 23:00 AEST and CB Consumer Confidence 90 minutes later.

Recommended Content

Editors’ Picks

AUD/USD failed just ahead of the 200-day SMA

Finally, AUD/USD managed to break above the 0.6500 barrier on Wednesday, extending the weekly recovery, although its advance faltered just ahead of the 0.6530 region, where the key 200-day SMA sits.

EUR/USD met some decent resistance above 1.0700

EUR/USD remained unable to gather extra upside traction and surpass the 1.0700 hurdle in a convincing fashion on Wednesday, instead giving away part of the weekly gains against the backdrop of a decent bounce in the Dollar.

Gold keeps consolidating ahead of US first-tier figures

Gold finds it difficult to stage a rebound midweek following Monday's sharp decline but manages to hold above $2,300. The benchmark 10-year US Treasury bond yield stays in the green above 4.6% after US data, not allowing the pair to turn north.

Bitcoin price could be primed for correction as bearish activity grows near $66K area

Bitcoin (BTC) price managed to maintain a northbound trajectory after the April 20 halving, despite bold assertions by analysts that the event would be a “sell the news” situation. However, after four days of strength, the tables could be turning as a dark cloud now hovers above BTC price.

Bank of Japan's predicament: The BOJ is trapped

In this special edition of TradeGATEHub Live Trading, we're joined by guest speaker Tavi @TaviCosta, who shares his insights on the Bank of Japan's current predicament, stating, 'The BOJ is Trapped.'