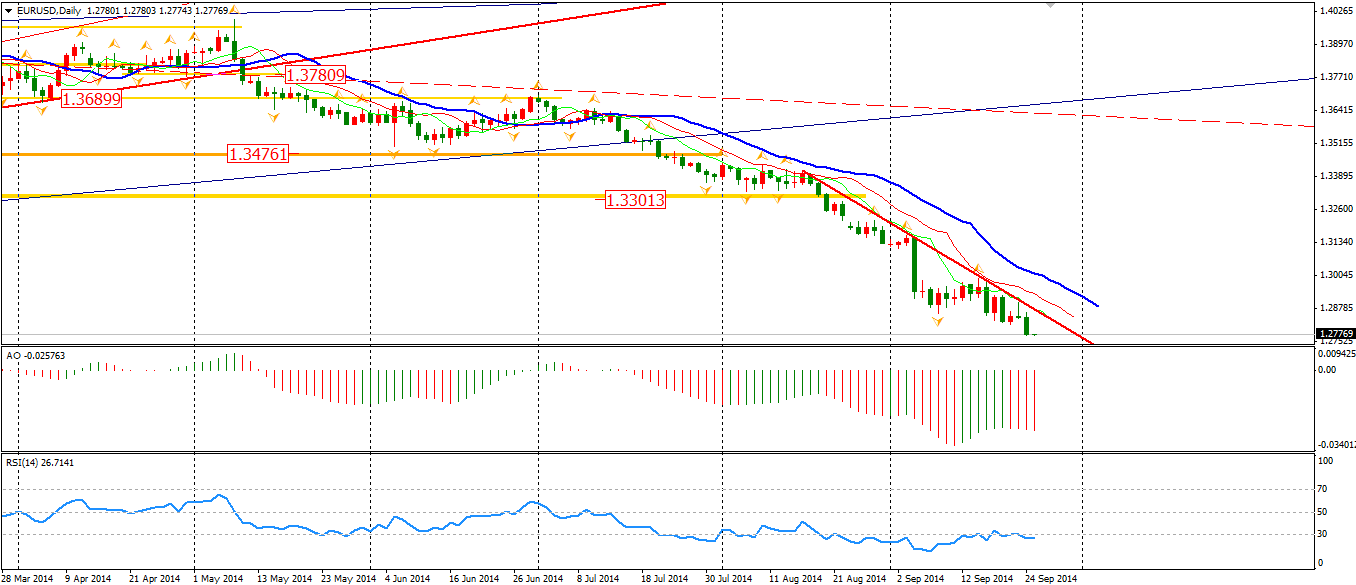

Once again the Dollar refreshed its recent high. The disappointing German IFO data further raised the expectation of new stimulus from ECB, while the stop loss orders from Euro buyers magnified the short term fluctuation. Euro Dollar slid to the day low of 1.2786, confirming our previous forecast of deeper fall from the Euro.

The US New Home Sales annual surprisingly grew by 504,000 houses in one year, which is the greatest high since 2008. The annual growth rate was 18% – a 22 year high. The strong sales number only further boosted the Dollar. The Dollar Index stands beyond the 85 level, which is another new high, not seen since June 2010. The Dollar has continued its rise to 10 consecutive weeks. It is the strongest bullishness of the Dollar in recent 30 years.

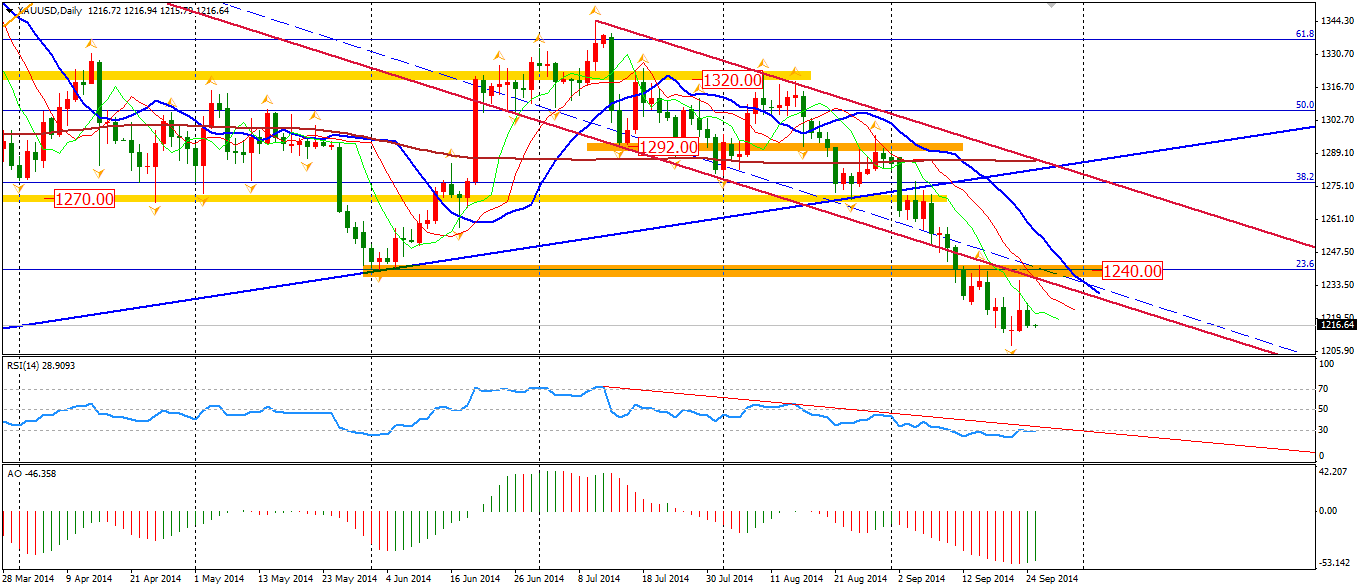

The strong Dollar also suppressed Gold prices to $1216 and erased most of Tuesday’s gain. We will maintain a bearish outlook unless gold bounces back to beyond the $1240 level.

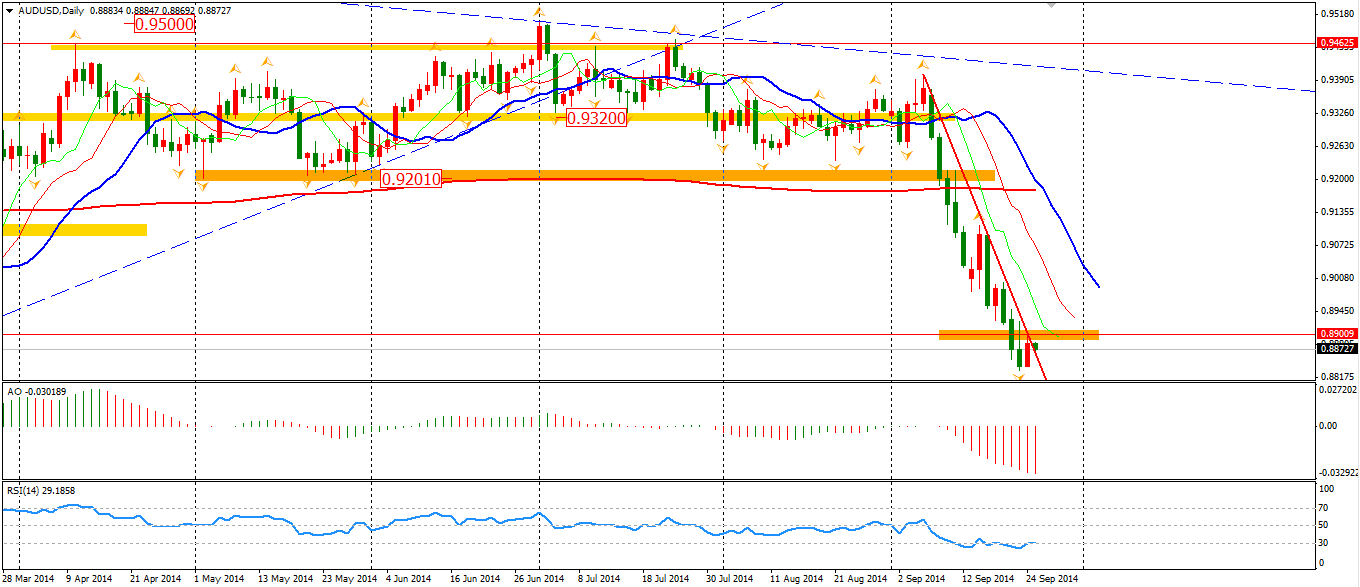

The Aussie Dollar climbed to an area around 0.89. It is a critical level which may help traders decide whether the Aussie may start a significant rebound in the short run. As previously discussed, even though we expect that the Aussie may be heading to the ![]() 0.8650-0.8500 range, but carry trade buyers may pop out any time and support the high-interest-rate currencies.

0.8650-0.8500 range, but carry trade buyers may pop out any time and support the high-interest-rate currencies.

Asian stocks performed weakly yesterday with only the Chinese Stock market leading a rise. Shanghai Composite rebounded by 1.47% to 2344. The Nikkei Stock Average fell 0.24%. The Australian ASX 200 bounced 0.74% to 5376. European stock markets fell on a weak report on Europe’s economy, the UK FTSE was up 0.45%, the German DAX gained 0.70% and the French CAC Index rebounded 1.25%. U.S. stocks were boosted by the bright Housing data. The S&P 500 rose 0.78% to 1998. The Dow edged up 0.90% to 17210, while the Nasdaq Composite Index surged 1.03% to 4555.

On the data front, local traders should keep an eye on RBA Governor Stevens’ speech at 12:30 AEST. US Durable Goods Orders and Unemployment Claims will be released at 22:30.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0650 after US data

EUR/USD retreats from session highs but manages to hold above 1.0650 in the early American session. Upbeat macroeconomic data releases from the US helps the US Dollar find a foothold and limits the pair's upside.

GBP/USD retreats toward 1.2450 on modest USD rebound

GBP/USD edges lower in the second half of the day and trades at around 1.2450. Better-than-expected Jobless Claims and Philadelphia Fed Manufacturing Index data from the US provides a support to the USD and forces the pair to stay on the back foot.

Gold clings to strong daily gains above $2,380

Gold trades in positive territory above $2,380 on Thursday. Although the benchmark 10-year US Treasury bond yield holds steady following upbeat US data, XAU/USD continues to stretch higher on growing fears over a deepening conflict in the Middle East.

Ripple faces significant correction as former SEC litigator says lawsuit could make it to Supreme Court

Ripple (XRP) price hovers below the key $0.50 level on Thursday after failing at another attempt to break and close above the resistance for the fourth day in a row.

Have we seen the extent of the Fed rate repricing?

Markets have been mostly consolidating recent moves into Thursday. We’ve seen some profit taking on Dollar longs and renewed demand for US equities into the dip. Whether or not this holds up is a completely different story.