It was another quiet Monday for the FX markets with traders sitting still. Russia and the Ukraine, in a meeting mediated by Germany and France, have appeared to have made some progress. Neither side intends to escalate the situation and all have sought to play down the importance of the Friday’s incident. We will have to see if the recent updates on the “dozen civilians dead” said to have been attacked in an aid convoy by pro-Russian rebels will escalate tensions.

The FX maybe still but stocks have surged suggesting those markets’ fears are easing. European stock markets rebounded, the FTSE gained 0.78%, the German DAX surged 1.68%, and the French CAC Index advanced 1.35%. U.S. stocks also showed relief. The Dows closed 1.06% higher at 16838. The S&P 500 edged 0.85% higher to 1971, and the Nasdaq Composite Index was up 0.97% to 4508.

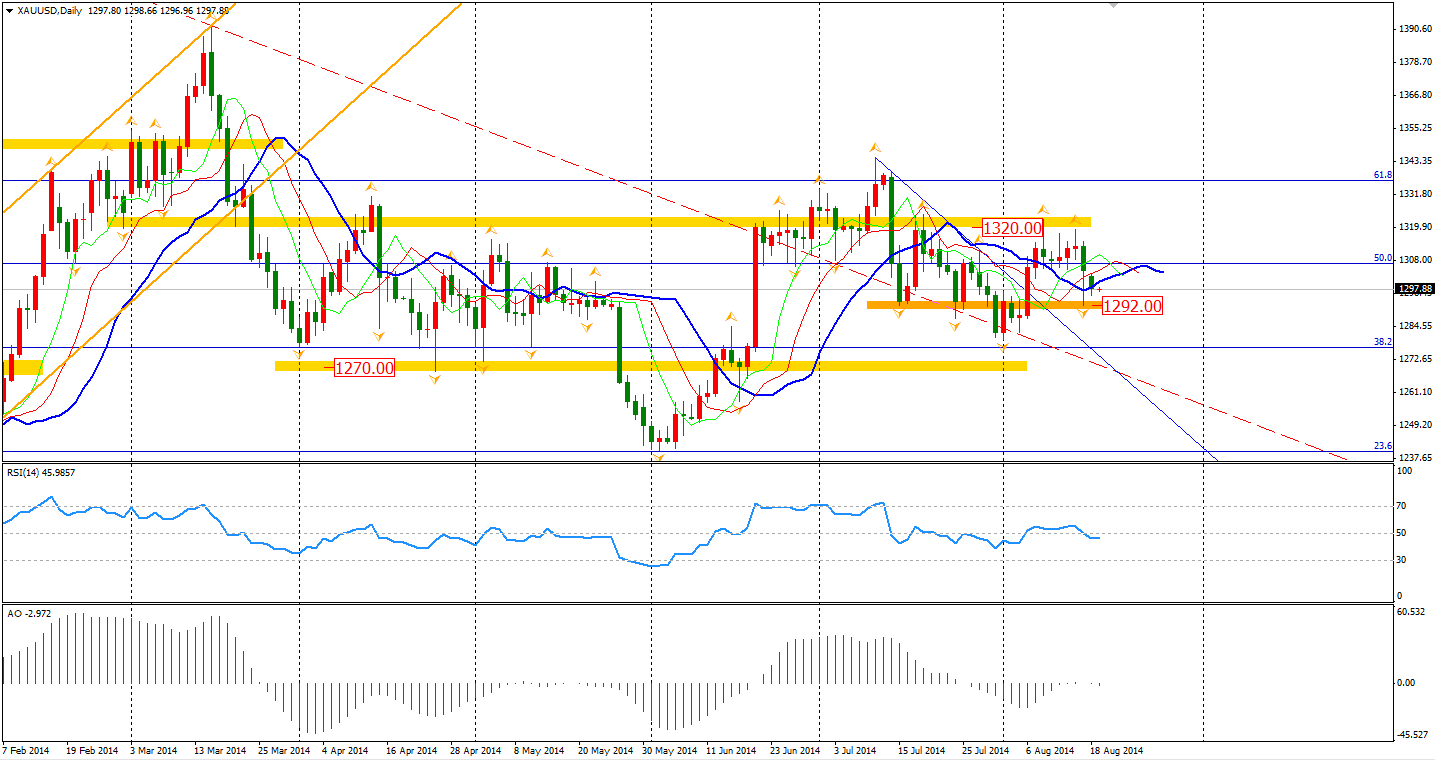

Friday’s incident may have made investors rush to safe haven assets, yet this run has seemed to ease yesterday. Gold, slightly fell to $1297 per ounce remaining in the sideway from $1292 to $1320.

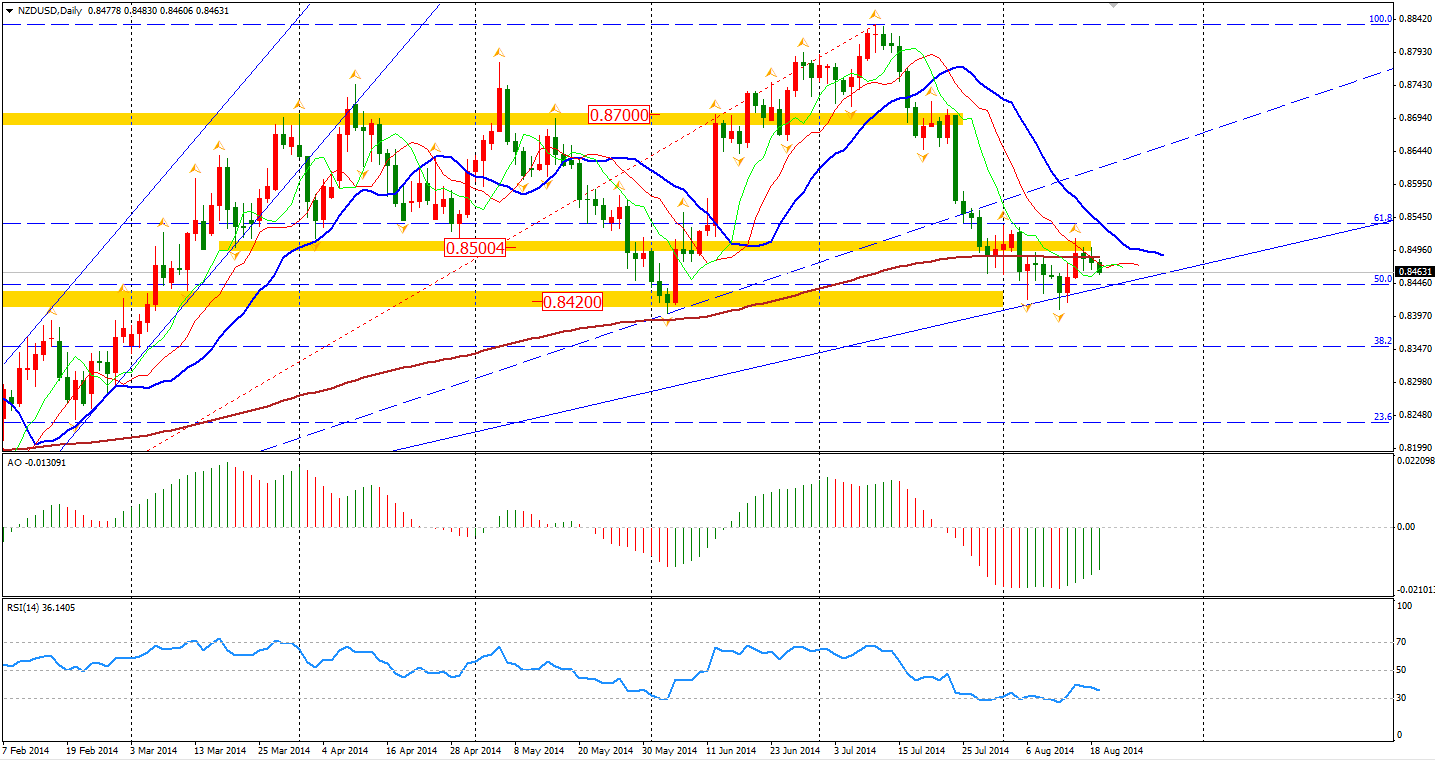

In the Southern hemisphere, the Kiwi Dollar continued its weakness against the background of geopolitical fears. The Reserve Bank of New Zealand has fulfilled half of its 2% interest rate raising plan, but in the most recent month, its currency has erased half of the gains against the Dollar since this year began. Carry trade may not be a good strategy during this unstable geopolitical environment. This may also explain why the Euro refuses to fall below 1.33 and why the NZD can hardly rebound. The NZDUSD is currently suppressed by a 200-day MA and 0.85 integer level, but supported by a bullish trendline formed from last July. Upward breakout may have more chances and it will be an entry sign of bulls.

Asian stock markets also edged slightly higher yesterday, led by the Mainland China market. The Shanghai Composite gained 0.57% to 2239, the Nikkei Stock Average closed flat and the Australian ASX 200 rebounded 0.37% to 5587.

On the data front, Australia Monetary Policy Meeting Minutes will be out at 11:30 AEST. UK inflation data will be at 18:30 AEST. Investors will also watch U.S. Building Permits and CPI are at 22:30 AEST.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold climbs above $2,340 following earlier drop

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.